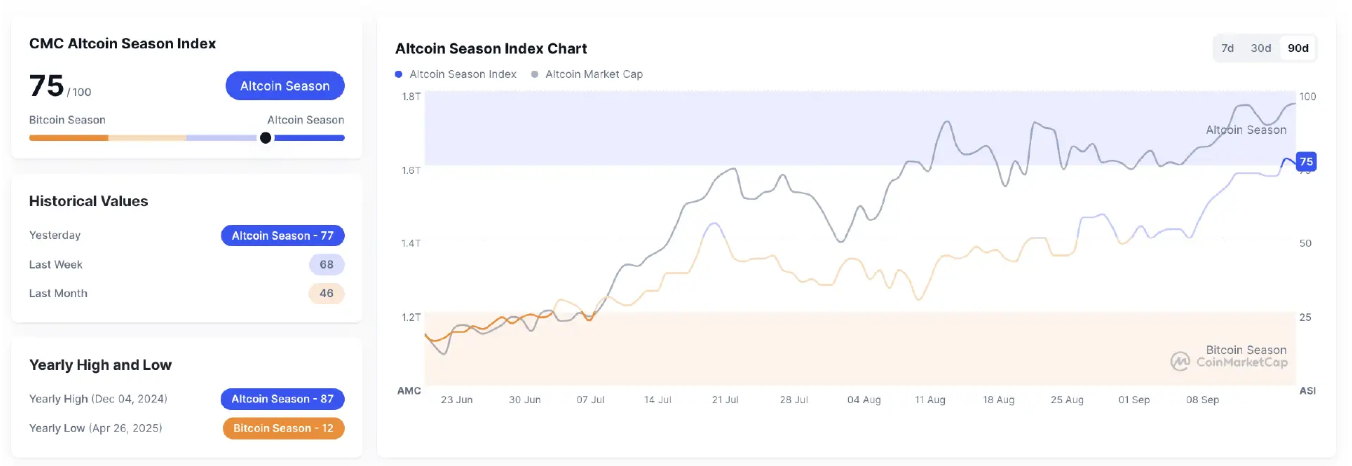

Bitcoin’s dominance ticked up 0.11% to 57.74%, while the Altcoin Index climbed to 75, approaching the danger zone.

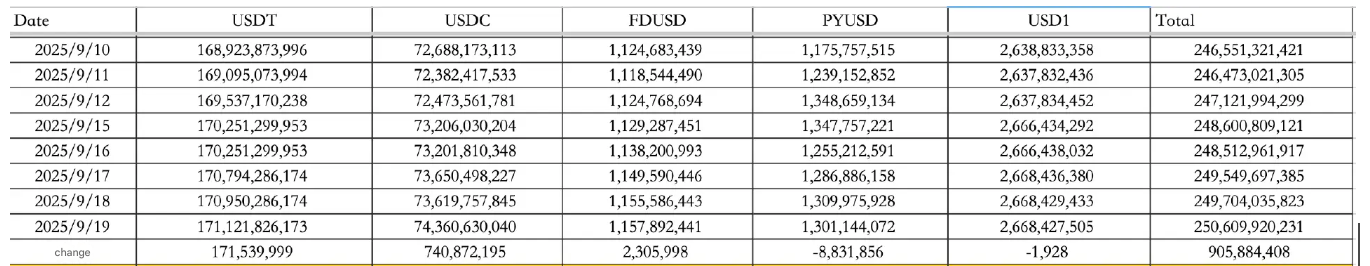

Stablecoin inflows surged to $905.88M on September 19, with USDT adding $171.54M and USDC contributing $740.87M, bringing the total stablecoin supply to $250.61B.

Stablecoin inflows surged to $905.88M on September 19, with USDT adding $171.54M and USDC contributing $740.87M, bringing the total stablecoin supply to $250.61B.

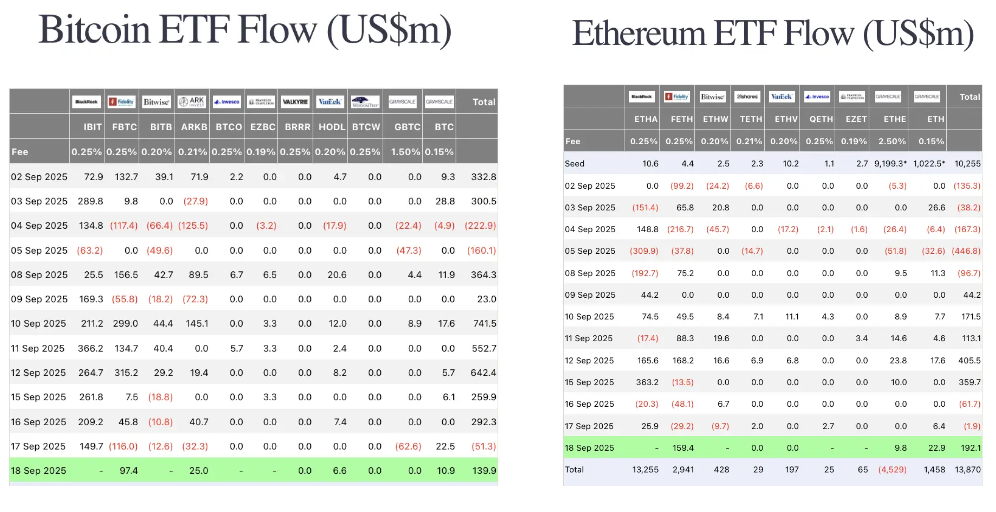

ETF activity also pointed to renewed confidence. Bitcoin ETFs recorded $139.9M in inflows on September 18, while Ethereum ETFs pulled in $192.1M, excluding data from BlackRock.

Macro and policy

U.S. equities advanced, with the Dow up 0.27%, the Nasdaq climbing 0.94%, and the S&P 500 rising 0.48%. Nvidia jumped 3.49%, while Intel surged 22.77% on news of a $5B investment from Nvidia and a joint development plan spanning AI infrastructure and personal computing.

Meanwhile, the 10-year Treasury yield ticked up 0.56% to 4.112% and the dollar index gained 0.36% to 97.36. Gold held firm at $3,640.44.

Policy shifts are adding fuel to market speculation. The SEC has approved new ETF listing standards, trimming review periods from 240 days to around 75. Assets with at least six months of regulated futures trading now qualify. This move clears a more direct path for spot crypto ETFs.

Trump’s $17 Trillion claim sparks skepticism

President Trump asked the U.S. Supreme Court to allow the president to dismiss Federal Reserve Governor Cook. At the same time, Trump claimed in a press conference with the U.K. Prime Minister that the U.S. will attract over $17T in investment this year. Economists like Peter Schiff dismissed the comment as unrealistic, noting it would imply GDP growth surging 50% and a skyrocketing dollar.

Institutional moves

Pantera Capital flagged that institutional exposure to Solana remains under 1% of circulating supply, compared with 16% for Bitcoin and 7% for Ethereum. The firm expects Solana’s “institutional moment” by late 2025, potentially timed with Solana ETF approvals.

Momentum is already building: Nasdaq-listed Brera Holdings rebranded as Solmate and raised $300M to seed a Solana treasury, backed by Pulsar Group, the Solana Foundation, RockawayX, and ARK Invest. Former Kraken legal chief Marco Santori will serve as CEO.

Grayscale Ethereum Mini Trust ETF also made headlines by moving 214,400 ETH, valued at roughly $967M, to 67 new wallets. Each address received 3,200 ETH, signaling preparations for potential staking. The SEC has not yet approved staking-enabled Ethereum ETFs, but the reshuffling suggests readiness.

How to start trading Ethereum

Ethereum’s more than just a coin, it’s an entire ecosystem. If you're ready to trade ETH like a pro (or at least fake it till you make it), Toobit makes trading altcoins easy. From Spot to Futures, we’ve got the whole toolkit.

Industry highlights

Across projects, Aster announced early withdrawals and a listing on Binance Alpha, while MetaMask hinted at an upcoming token. Plasma confirmed its mainnet launch for September 25, with TGE and allocations for verified contributors set the same day. Polymarket continues to hint at a token drop, while mUSD went live on Linea with subsidies.

Coinbase integrated with Morpho to enable direct on-chain USDC lending, offering yields up to 10.8% with instant withdrawals when liquidity allows.

Other Alpha updates include BuildKey events launching RIVER on September 19 and BuildPad also revealed a pivot into structured finance.