Bitcoin’s market share eased further, with BTC dominance down 0.3% to 58.15%, while the Altcoin Index rose to 56. Rotation chatter is picking up again as alts continue to resist Bitcoin’s drag.

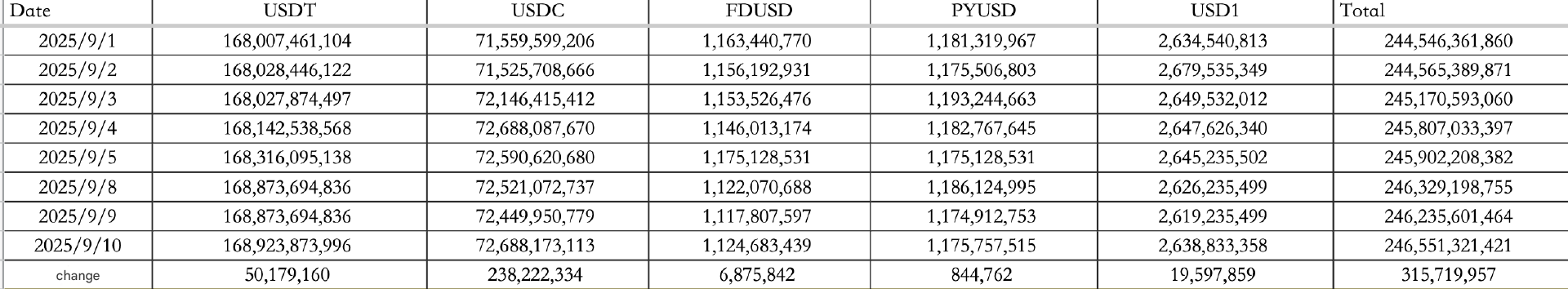

Stablecoins added fresh liquidity. On September 10, inflows totaled $315.72M, with $50.18M into USDT and $238.22M into USDC, pushing the total supply to $246.55B.

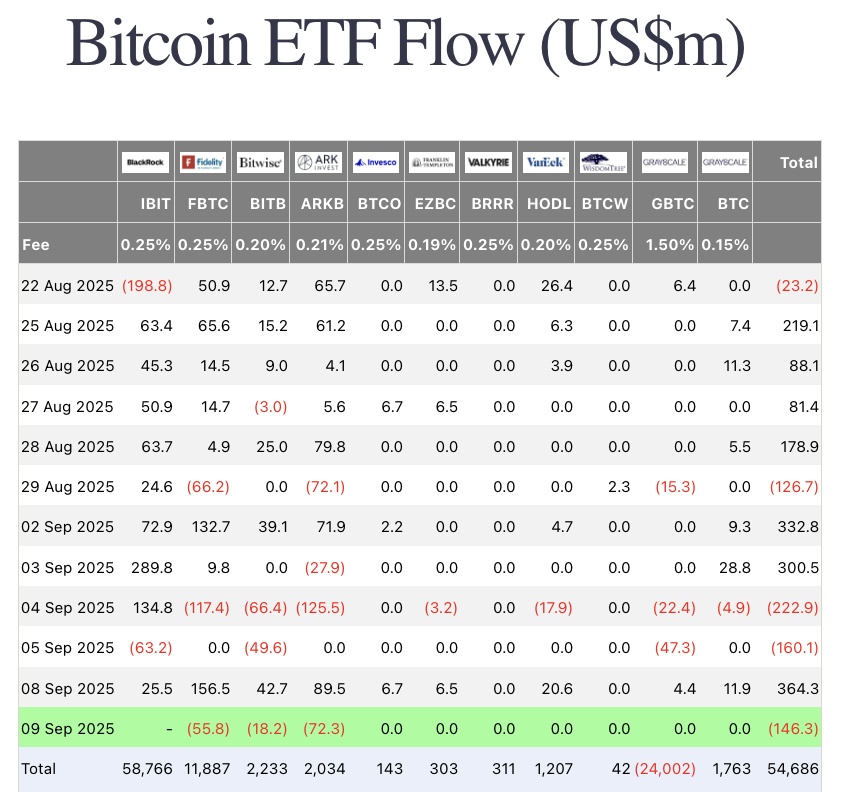

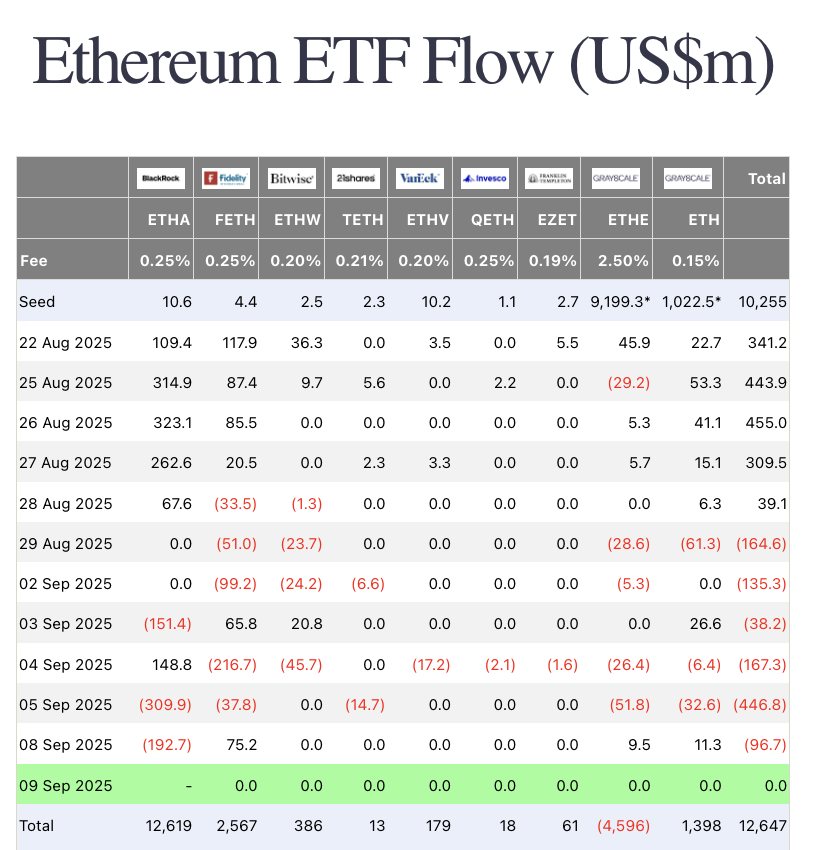

ETF flows stayed weak. On September 9, excluding BlackRock’s prints, BTC ETFs lost $146M, while ETH ETFs recorded no inflows.

Macro and policy

U.S. equities closed higher, with the Dow up 0.43%, Nasdaq up 0.37%, and S&P 500 up 0.27%. The 10-year Treasury yield climbed 1.09% to 4.089%, while the dollar index strengthened 0.31% to 97.83. Gold hovered near its record at $3,625.38.

Policy signals turned hawkish. JPMorgan strategist David Kelly warned that rate cuts could backfire, reducing retirement income, discouraging lending, and raising economic uncertainty.

The CFTC’s acting chair Caroline Pham also floated plans to bring offshore but compliant platforms into U.S. cross-border oversight.

Trump’s new crypto advisor, Patrick Witt, outlined three priorities: pushing Senate market-structure legislation, fast-tracking a national stablecoin framework, and creating a federal crypto reserve.

Market movers and institutions

SharpLink kicked off its $1.5B share repurchase program, buying back around 1M SBET shares. Charts show its ETH treasury expanding alongside BMNR’s holdings.

In Solana, four newly created wallets received 222,644 SOL (≈$48.2M) from Coinbase Prime, split evenly at 55,661 SOL each. Analysts say the synchronized moves suggest accumulation by a single entity.

At the same time, Solana CME futures open interest hit $1.49B, a new all-time high, extending the August surge that followed the launch of the first U.S. Solana staking ETF.

How to start trading Solana

Solana isn’t just fast, it’s lightning. From meme launches to serious DeFi, SOL is where the action lives. If you’re ready to ride the high-speed rails, Toobit makes trading Solana simple. Spot, Futures, and the full pro toolkit are all at your fingertips.

Industry highlights

-

Institutions are competing for rights to issue a Hyperliquid stablecoin, a sign of growing appetite for native infra tokens.

-

Tether launched USDT0, a cross-chain stablecoin live on X Layer and OKX Wallet.

-

HashKey’s custody arm broke HK$20B ($2.56B) in assets, ranking 15th globally.

-

Gate’s BTC mining pool crossed 2,528 BTC staked, offering wrapped GTBTC with yields up to 10% APR. Assets are fully reserved and auditable, with GTBTC now live on Ethereum, BNB Smart Chain, Base, and Solana.

Alpha watch

Traders say MYX is setting the playbook for altcoin perpetuals, with perp DEX tokens expected to trend next.

Yield products are hot: Bitget Wallet’s USDC earn program offers 18% APY on the first $10K for a week, then 10% ongoing, powered by Aave pools on Base with $300M of risk coverage. Kamino also launched new PYUSD subsidies, while FDUSD flexible deposits now pay up to 11.8% on the first 5,000 tokens.

Meanwhile, HYPE revenue crossed $10M, with reports digging into Hyperliquid’s economics and trader incentives.