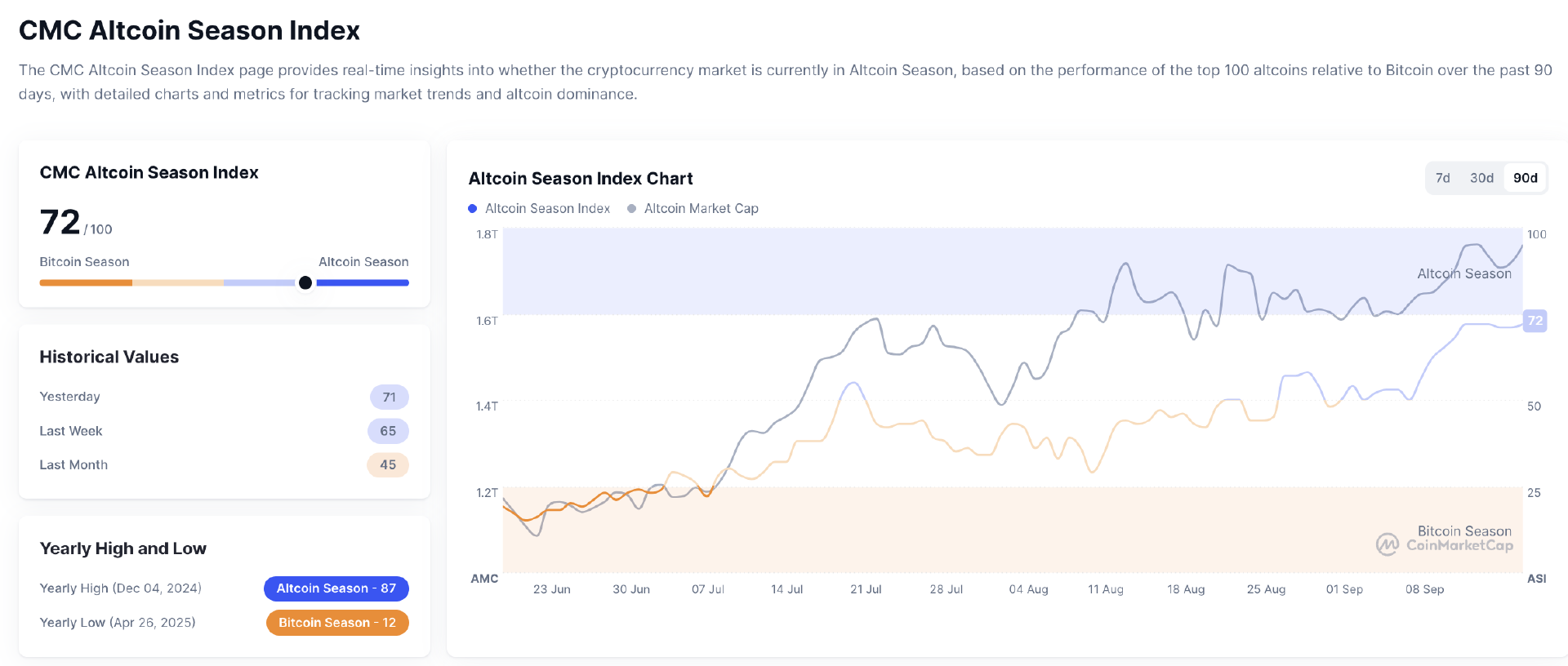

Bitcoin lost ground, with BTC dominance down 1.02% to 57.67%, while the Altcoin Index climbed to a high of 72, suggesting rotation into alts is gaining traction.

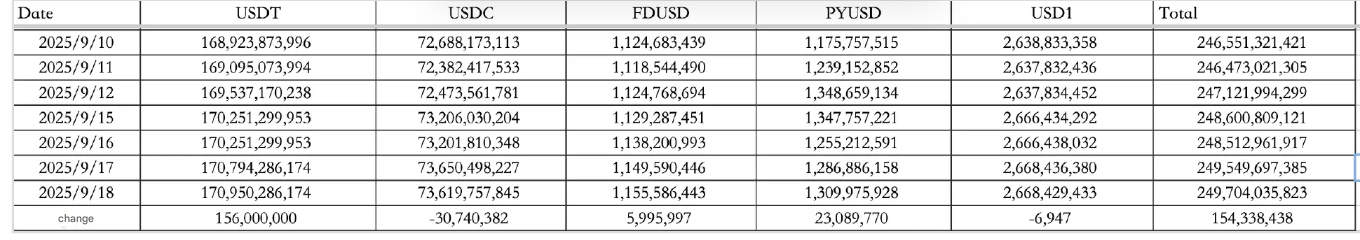

Stablecoins supported the move. On September 18, inflows totaled $154.34M, with $156M into USDT and a $30.74M USDC outflow, bringing the total supply to $249.704B.

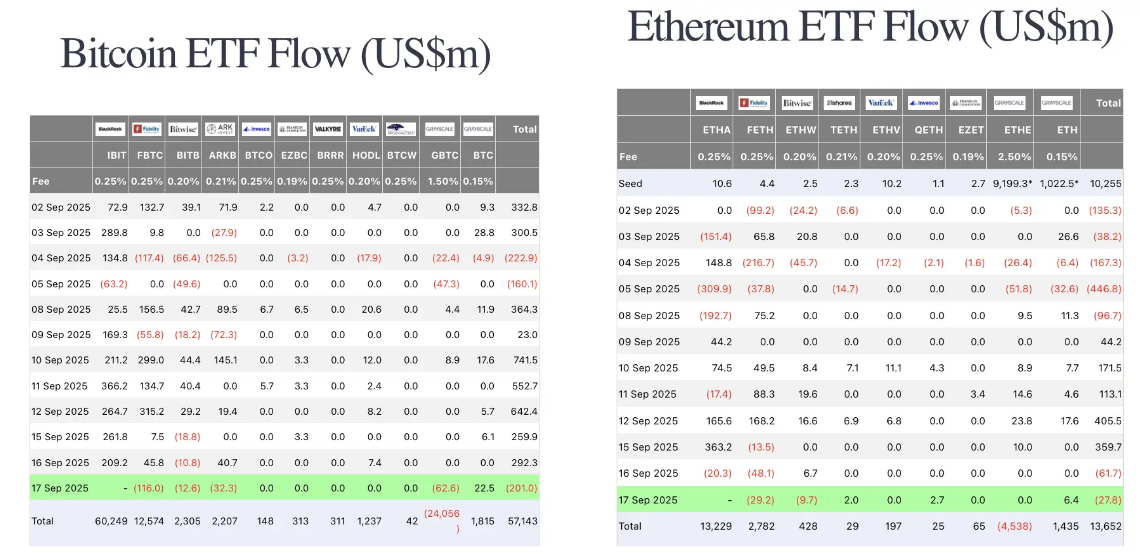

ETF flows weakened. On September 17, excluding BlackRock data, BTC ETFs lost $201M and ETH ETFs shed $27.8M.

Macro and policy

The Fed’s latest dot plot leaned dovish. Nine officials see three cuts in 2025 (75 bps total), with one governor even pushing for 150 bps of easing. Fed Chair Powell called Wednesday’s cut a “risk management decision,” pointing to cooling labor markets and slowing inflation as justification.

In Congress, the House narrowly approved a procedural step toward a temporary spending bill to avert a partial government shutdown. The measure funds agencies until November 21, giving lawmakers time to negotiate a full-year deal.

Equities diverged: the Dow rose 0.57%, Nasdaq fell 0.33%, and S&P 500 slipped 0.10%. Yields and the dollar firmed, with the 10-year up 1.13% to 4.076% and the DXY up 0.32% to 97.007. Gold eased 0.83% to $3,659.67.

Solana: CME options incoming

Forward Industries announced a $4B stock sale to power its Solana strategy. At the same time, CME Group confirmed it plans to launch Solana and XRP futures options on October 13, pending regulatory approval.

Since March, Solana futures have cleared 540,000 contracts worth $22.3B, underlining institutional demand.

The listing, if approved, would make Solana one of the few altcoins with both futures and listed options in the U.S., positioning it alongside BTC and ETH in the derivatives playbook.

How to start trading Solana

Solana isn’t just fast, it’s lightning. From meme launches to serious DeFi, SOL is where the action lives. If you’re ready to ride the high-speed rails, Toobit makes trading Solana simple. Spot, Futures, and the full pro toolkit are all at your fingertips.

Industry highlights

-

Aster token launched and spiked 10x on day one, fueling onchain perp activity. Yields topped 100% APR, with fee revenues showing more than 10x ROI.

-

Buyback data shows $HYPE has repurchased 28M tokens ($1.4B) since launch, with price climbing from $3 to $50. $PUMP has bought back $100M, equal to one-fifth of its float, with daily buybacks now near $3M.

-

Bio Protocol closed a $6.9M seed round led by Arthur Hayes’ Maelstrom Fund, with Animoca, Mechanism, and others participating. The project is building a decentralized AI-driven biotech funding platform.

-

A Q3 asset allocation report flagged institutional rotation from stables into Solana, XRP, and other alts. BTC and ETH remain portfolio cores, but alt allocations are climbing, with SOL holdings at yearly highs and XRP the third-largest non-stable asset.

Alpha watch

Prediction platform Kalshi launched an ecosystem hub with Solana and Base, including grants for builders. Its volumes hit $875M in August, nearly matching Polymarket’s $1B.

New phygitals plays are gaining traction, with Pokémon card RWA projects offering airdrop campaigns, blending collectibles with onchain financing.

Community chatter flagged Binance Wallet’s BuildKey TGE model, where deposits mint tradable allocation vouchers. The first project using this model launches September 18.