Bitcoin’s share of the market ticked up, with BTC dominance rising 0.17% to 58.3 percent, while the Altcoin Index held at 46. It is not breakout mode, but alts are holding steady in rotation territory.

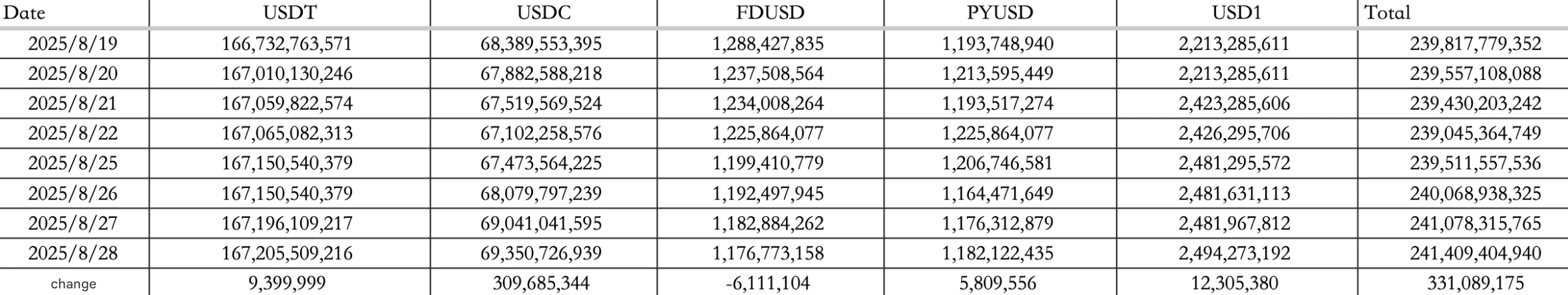

Stablecoins provided support. On August 28, the basket added $331M in inflows, with $9M into USDT and a larger $310M into USDC.

That pushed the total stablecoin supply to $241.409B, another notch higher for onchain liquidity.

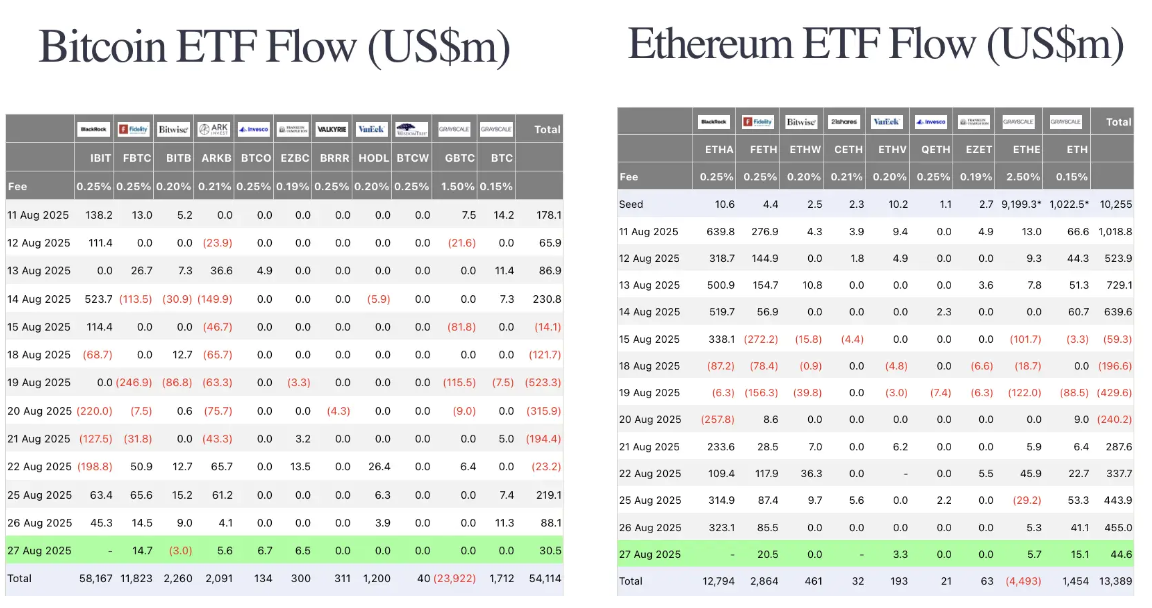

ETF flows stayed positive. On August 27, excluding BlackRock, BTC ETFs added $31M and ETH ETFs pulled in $45M.

Earlier in the week, ETH ETFs recorded $899M of inflows across Monday and Tuesday, underlining heavy institutional appetite.

Macro and policy

U.S. equities inched higher: the Dow rose 0.32%, Nasdaq added 0.21%, and the S&P 500 climbed 0.24%. Treasuries rallied, with the 10-year yield dropping 0.63% to 4.23%, while the dollar index slipped 0.03% to 98.10. Gold continued near highs at $3,391.94.

Nvidia reported Q2 revenue of $46.7B, beating expectations of $46.0B, and approved an additional $60B in stock buybacks.

Guidance for Q3 came in at $54B ± 2%, slightly above the $53.46B consensus, but commentary on AI spending deceleration knocked the stock down 5% after hours.

On the policy side, Treasury Secretary Bessent said there are 11 Fed chair candidates, with interviews set to begin after Labor Day (September 1) before presenting a shortlist to President Trump.

Meanwhile, the CFTC confirmed it will adopt Nasdaq’s monitoring system for expanded crypto oversight, offering real-time alerts and cross-market analysis to flag abuse.

Ethereum: treasuries pile in, targets climb

Treasuries continue to bulk up on ETH. BMNR leads with 1.70M ETH, worth about $7.95B, a 202.4% increase over the past 30 days. SBET follows with 797,700 ETH, valued at $3.7B, up 121.1% over 30 days.

Analysts are turning more bullish. Tom Lee forecast ETH at $5,500 in the coming weeks, with a possible seasonal dip in September but a push to $10,000–$12,000 before year-end.

Trend Research raised its long-term ETH target, arguing that with friendlier regulation and Wall Street consensus, “the scramble for ETH has only just begun,” and ETH market cap could surpass BTC within 1–2 full cycles.

Solana: finality upgrade and AI benchmark

The Solana community is now voting on SIMD-0326 Alpenglow, billed as one of the network’s most important upgrades. The proposal aims to deliver block finality in 150 milliseconds, with votes scheduled for epochs 840–842.

If passed, it would mark a significant step toward Solana’s goal of sub-second settlement.

Separately, Solana released an open benchmark for testing AI execution on-chain, giving developers a common framework to measure and push the chain’s AI integration capabilities.

How to start trading Solana

Solana isn’t just fast, it’s lightning. From meme launches to serious DeFi, SOL is where the action lives. If you’re ready to ride the high-speed rails, Toobit makes trading Solana simple. Spot, Futures, and the full pro toolkit are all at your fingertips.

Industry and alpha

Metaplanet announced plans to raise $881M in September–October to expand its BTC holdings, targeting deeper reserves.

In memecoins, a popular launchpad confirmed a new points system is live, with today’s launch recommended for early participation.

Over the past week, one project spent $10.65M buying back its own tokens, equal to 99.32% of its revenues for the period, and has now reduced circulating supply by 4.26%.

Other highlights:

-

Arthur Hayes said the 2028 market top will align with U.S. political cycles and explosive AI growth.

-

MetaMask is rolling out mUSD, a new stablecoin product, expanding the wallet’s role in payments.

-

Analysts shared a stablecoin yield strategy averaging $500K per month in profits, with a 78% annualized return but warned it requires size, discipline, and constant monitoring.