Bitcoin dominance slipped 0.25% to 58.43% while the Altcoin Index held steady at 52, underscoring a market where capital is rotating but not rushing.

Stablecoins saw $427M in net inflows between September 5 to September 8, with USDT pulling in $558M and USDC losing $69M, bringing the total stablecoin market cap to $246.31B.

Macro and policy

Global headlines continue to shape risk appetite. In Japan, Prime Minister Shigeru Ishiba announced his resignation, a move seen as supportive for risk assets given his hawkish reputation.

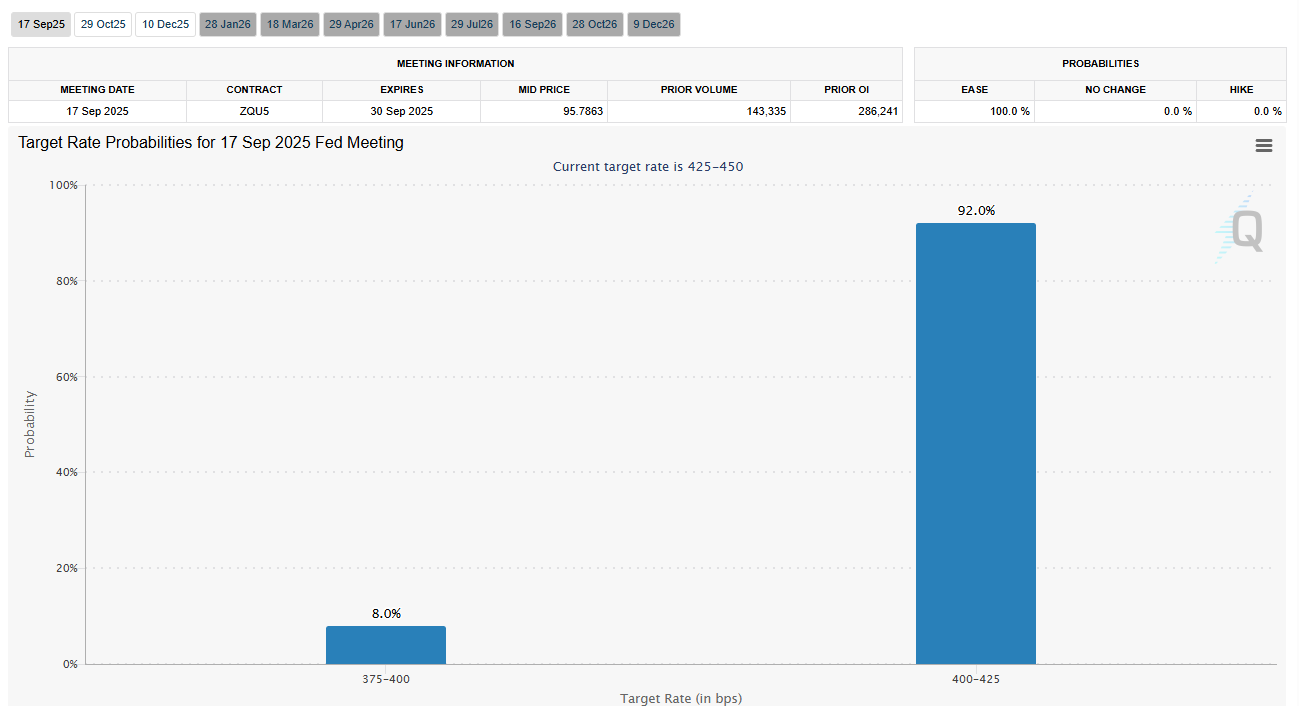

Meanwhile in the U.S., CME FedWatch data points to a 100% probability of a rate cut on September 25. The numbers spread across a 92% bet on a 25-basis-point move and 8% lean for a deeper 50% cut.

On regulation, a draft bill in the U.S. Senate is pushing for an SEC–CFTC joint committee to settle long-running turf wars in crypto oversight.

The proposal also seeks to clarify treatment for airdrops, exempt DePIN networks from securities rules, and protect DeFi developers. Both regulators are set to co-host a public roundtable on September 29 to align priorities.

The SEC also announced a cross-border task force to crack down on fraud tied to foreign companies entering U.S. markets, including potential manipulation through pump-and-dump schemes.

ETH treasuries climb as MicroStrategy misses S&P 500 cut

MicroStrategy failed to secure a spot in the S&P 500 this round, with lower-cap firms like Robinhood making the cut instead. That puts its bid for mainstream index inclusion on hold until at least December.

Paradigm’s Matt Huang took to social media to explain why their new stablecoin payments project, Tempo, is launching on L1 rather than an Ethereum L2, citing decentralization, neutrality, and payment performance.

From Nasdaq to L1s, institutions reshape crypto

Sol Strategies made headlines as the first Solana-based financial firm approved for a Nasdaq listing, signaling broader institutional interest in the ecosystem.

Meanwhile, ETH accumulation continues at pace among treasury firms. Bitmine Immersion Tech now holds 1.87M ETH worth $8B, up 124.1% in the past 30 days. SharpLink Gaming follows with 837,000 ETH ($3.59B), and The Ether Machine with 495,000 ETH ($2.12B).

How to start trading Ethereum

Ethereum’s more than just a coin, it’s an entire ecosystem. If you're ready to trade ETH like a pro (or at least fake it till you make it), Toobit makes trading altcoins easy. From Spot to Futures, we’ve got the whole toolkit.

On-chain and industry highlights

Liquidity across the altcoin landscape remains strained, with capital concentrating around select names. JLP’s total value locked (TVL) has broken $2B, delivering an annualized yield of 17.58%.

Another token, M, has seen its fully diluted valuation climb past $19B with a circulating cap nearing $2B, reflecting concentrated speculative momentum.

Linea also confirmed that it will distribute 160M LINEA tokens next week under its Ignition Incentive Program, up from the initially planned 150M. Of this, 80% will go to lending pool liquidity providers on Aave and Euler, while 20% is reserved for trading incentives on Etherex.