Bitcoin’s market share went sideways, with BTC dominance flat at 58.47%, while the Altcoin Index stayed high at 69, showing rotation is alive even without breakout energy.

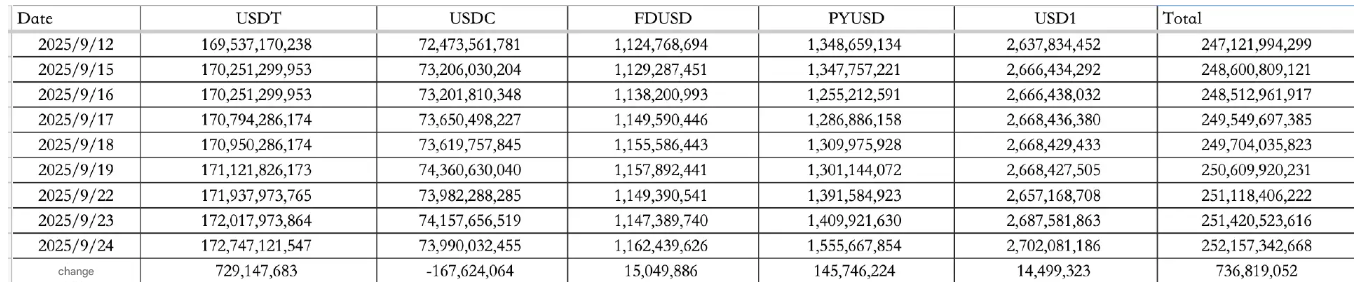

Stablecoins added fuel. On September 24, inflows reached $736.82M, almost entirely from $729.15M into USDT, offset slightly by a $167.62M USDC outflow. That lifted the total stablecoin supply to $252.16B, a fresh record.

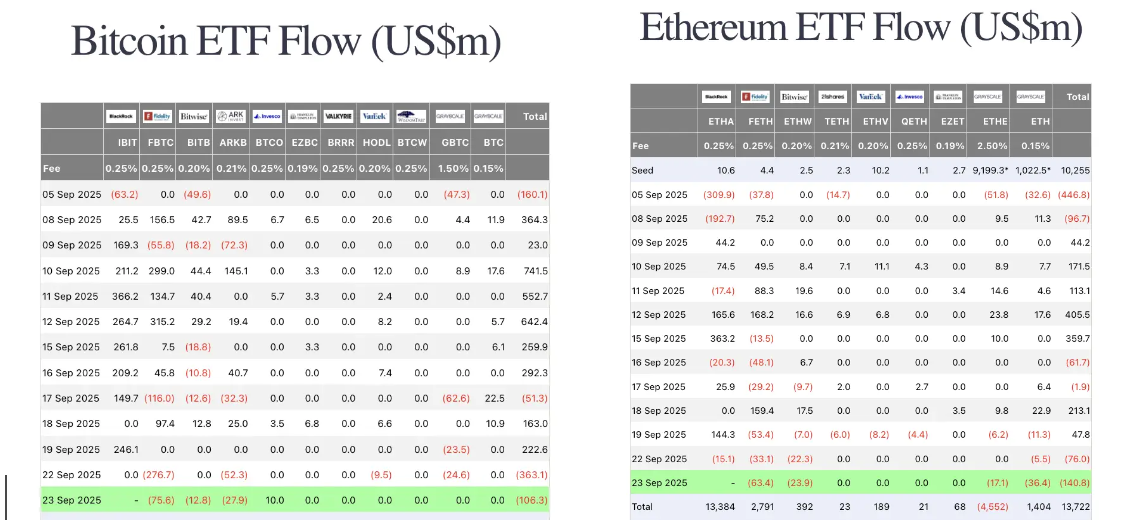

ETF flows told a different story. On September 23, excluding BlackRock prints, BTC ETFs lost $106M and ETH ETFs shed $141M, underscoring caution from institutions.

Macro and policy

U.S. equities slipped, with the Dow down 0.19%, Nasdaq off 0.95%, and S&P 500 down 0.55%. Treasuries and the dollar eased, with the 10-year yield down 0.99% to 4.106% and the DXY at 97.334. Gold inched up 0.43% to $3,762.48.

The big policy headline came from the SEC, which floated an “innovation exemption” that would let crypto companies launch products in the U.S. without meeting full legacy compliance upfront. Chair Paul Atkins said the goal is to encourage DeFi experimentation while keeping it under the umbrella of securities law. If approved by year-end, the move could be a watershed moment for DeFi spot, margin, and perpetual markets.

Meanwhile, the CFTC announced a tokenized collateral program, allowing derivatives traders to post stablecoins and other assets instead of cash. It builds on pilots run earlier this year and invites industry feedback through October 20.

Market movers and institutions

Fitell Corporation secured $100M in financing, earmarked for a Solana-based treasury strategy.

Tether is in early talks with investors to raise $15–20B via private placement, which would value the company as one of the world’s largest private firms. The raise would be for around 3% of equity, marking a major liquidity event if closed.

How to start trading Bitcoin

Bitcoin’s the OG—still king of the hill, still moving markets. Whether you're stacking sats or going full degen with leverage, Toobit gives you everything you need. Spot, Futures, and all the bells and whistles.

Industry highlights

The aster boom continues. Daily trading volumes crossed $21.12B, with revenues hitting $7.04M in 24 hours, an all-time high. That eclipsed Hyperliquid ($2.79M) and put aster second only to Tether and Circle in fee generation.

Traders flagged that manual hedging on lighter nets $2.56 per $10,000 of notional at current volumes, but margins compress once daily turnover passes $28.4B and disappear past $38.8B without point farming.

Elsewhere, the BNB Chain meme scene exploded, with over 5,700 tokens issued in 24 hours on Four.Meme, alongside 17,401 on Pump.fun and smaller bursts on LaunchLab and Believe.

Alpha watch

-

Plasma’s next Launchpad sale opens September 25, pricing XPL at $0.35 with a 3M cap, payable in GUSD. Traders expect oversubscription.

-

Aster’s third phase ended, but airdrops will likely follow the fourth phase, not immediately. Point farmers are urged to lower expectations, with likely returns just 1–2x fees, essentially farming rebates that funnel back into lighter and edgeX liquidity.

-

Stable ecosystem strategies are back in play, with KOLs outlining how to farm DC roles via social campaigns.

-

Polymarket U.S. is rumored to go live on September 25 with aggressive referral and deposit incentives aimed at capturing U.S. users.