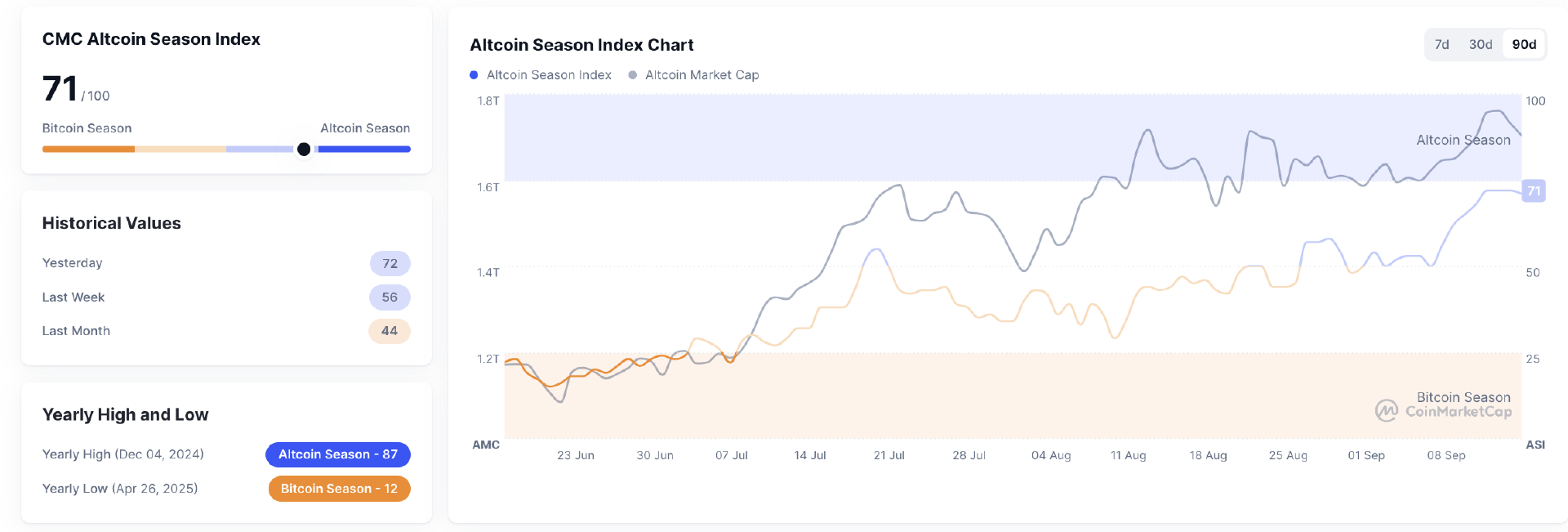

Bitcoin’s dominance in total market capitalization rose to 58.15%, signaling a firmer grip on overall crypto momentum. The Altcoin Index cooled to 71, a retreat from its overheated levels last week.

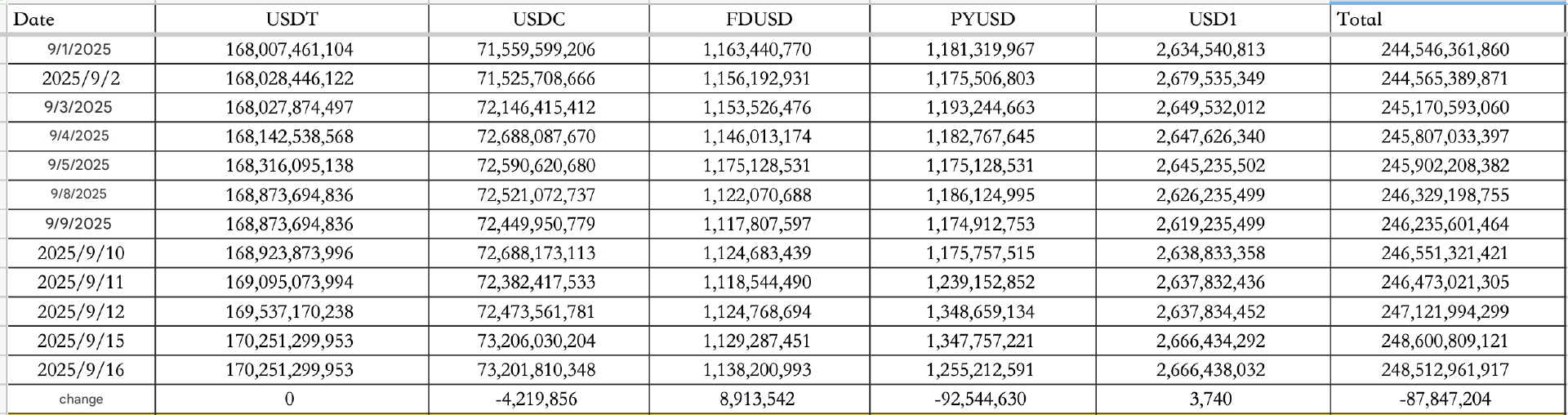

On September 16, Stablecoin outflows totaled $87.85M while USDC slipped $4.22M. The total stablecoin supply now sits at $248.51B.

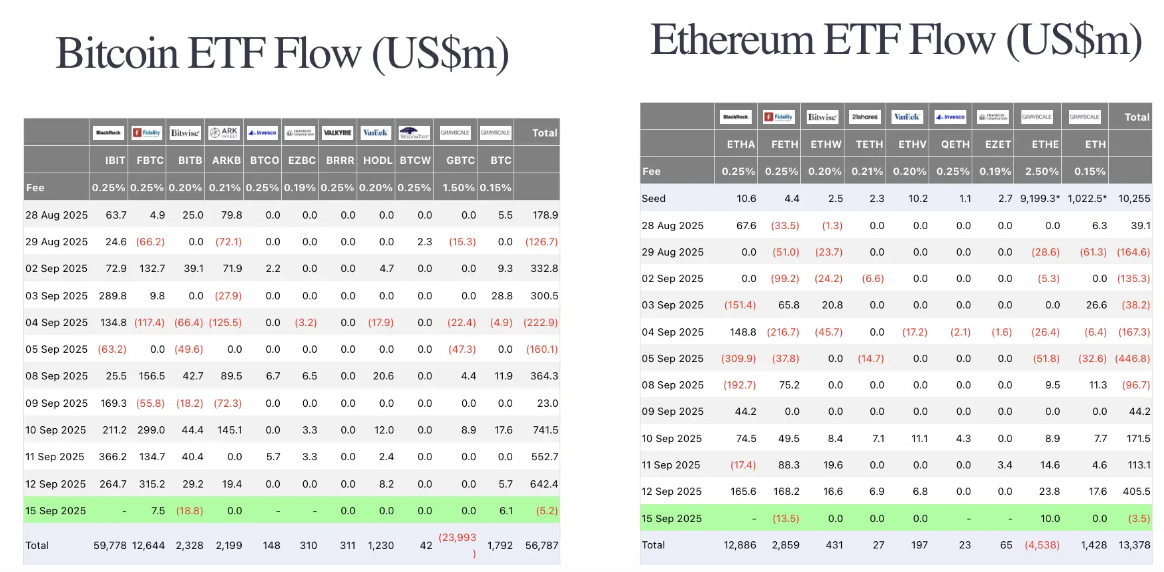

On September 15, excluding BlackRock data, Bitcoin ETFs recorded net outflows of $5.2M and Ethereum ETFs saw $3.5M in outflows. This marks a reversal from the steady inflows seen earlier in the month and reflects a pause in institutional conviction. The upcoming Federal Reserve decision looms large as a potential driver of renewed flows either way.

Macro and policy

U.S. stocks closed higher, with the Dow up 0.11%, the Nasdaq gaining 0.94%, and the S&P 500 rising 0.47%. Tesla climbed 3.56% after CEO Elon Musk purchased more than 2.5M shares on September 12, at prices ranging from $372.37 to $396.54 per share, for a total value of about $1B.

The yield on the 10-year U.S. Treasury fell 0.74% to 4.04, while the U.S. Dollar Index slipped 0.28% to 97.35. Gold advanced 0.98% to $3,679.51.

Traders remain locked on the Fed, where rate-cut odds of 25 basis points now sit at 95.9%.

Meanwhile, the U.S. has reduced tariffs on Japanese cars and auto parts from 27.5% to 15%, effective September 16.

In addition, US Treasury Secretary Bessent said the next round of U.S.-China trade talks could lead to another 90-day tariff pause.

Regulatory developments

Court filings reveal that the U.S. Securities and Exchange Commission (SEC) and crypto trading platform Gemini have reached a settlement in principle to resolve a years-long lawsuit. The agreement will fully settle the case but remains subject to SEC review and approval. Both parties have also requested that all pending dates in the case be suspended.

According to a filing with the U.S. SEC, Polymarket included “Other Warrants” in its latest funding round. This term is often used as a reference to tokens, suggesting that Polymarket may be paving the way for a potential token issuance.

Institutional moves

The Solana ecosystem took center stage. HSDT unveiled a sweeping $500M private placement to reposition itself as a Solana treasury company. If all warrants are exercised, the raise could top $1.25B, marking one of the largest capital pivots of the year.

Meanwhile, Forward Industries (NASDAQ: FORD) completed its first major liquidity acquisition of Solana, scooping up 6,822,000 SOL at an average price of $232. The purchase totaled $1.58B and highlights the rapid institutionalization of Solana balance sheet strategies.

How to start trading Solana

Solana isn’t just fast, it’s lightning. From meme launches to serious DeFi, SOL is where the action lives. If you’re ready to ride the high-speed rails, Toobit makes trading Solana simple. Spot, Futures, and the full pro toolkit are all at your fingertips.

Industry developments

MetaMask officially rolled out its own stablecoin, mUSD, aimed at embedding deeper functionality into its ecosystem. At the same time, Ethereum Foundation revealed plans to launch a new “DAI” team tasked with driving on-chain AI development, positioning Ethereum as a key settlement layer for machine economies.

Elsewhere, the frenzy around meme coin infrastructure continued as influencer Alex Becker’s livestream on pump.fun overwhelmed servers due to surging traffic. Pump.fun itself posted $3.12M in daily revenue, eclipsing Hyperliquid’s $2.48M and reaching its highest levels since mid-February. Weekly revenue hit $16.4M, a seven-month high, underscoring just how hot the space remains.