Market tone stayed cautious. BTC dominance held firm at 59.42% while sentiment stayed stuck in fear, with the Fear and Greed Index printing 20 and the Altcoin Index holding firm at 25.

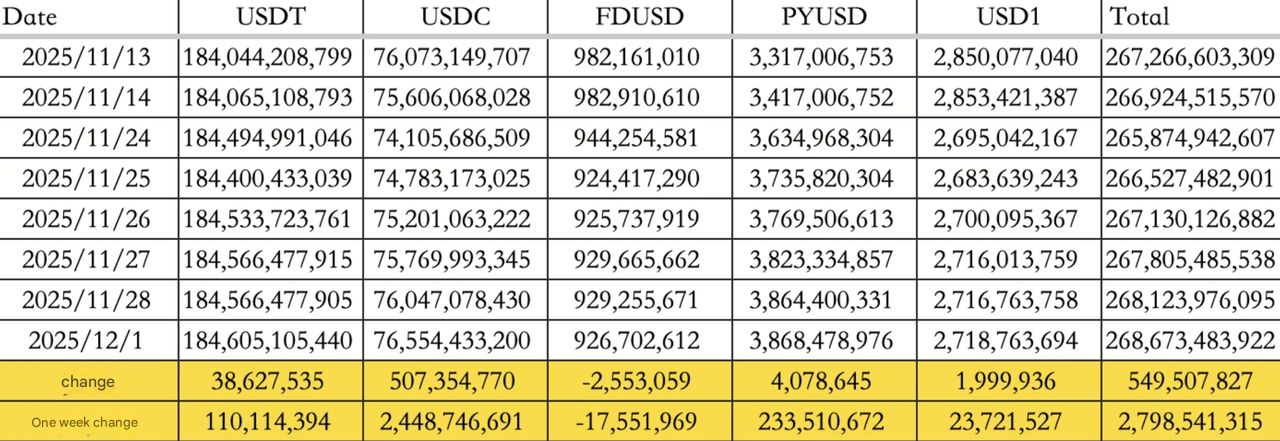

Stablecoin flows continued to anchor liquidity. From Nov 24 to Dec 1, aggregate inflows reached $2.80B, with USDTadding $1.10M and USDC accelerating with $2.45B. Total circulating supply now stands at $268.67B.

Although the market has been searching for a catalyst, the tone across commentary remained defensive. With several indicators now aligning, sentiment leans toward the early stages of a bear phase, reinforcing the need to scale down activity and watch for the next narrative shift.

Traditional markets

Wall Street drifted without clear conviction as major indices traded in narrow ranges.

Gold saw modest support from safe haven flows, while Treasury yields stayed rangebound following a quiet session.

Macro policy updates

Overnight chatter attempted to claim that Federal Reserve Chair Jerome Powell would resign at an emergency meeting. No official source, major outlet, or institutional channel confirmed this, and the rumor remains unsupported by evidence.

Looking ahead, Powell is scheduled to speak later in the day, though details on the topic remain undisclosed. Political signals grew louder after President Trump stated that he had already chosen his preferred nominee for the next Federal Reserve Chair, with Kevin Hassett seen as a leading contender.

Internationally, Kazakhstan's central bank signaled interest in allocating up to $300M into digital assets. Final size may range between $50M and $250M as the country advances plans to build a national crypto reserve fund targeted at $500M to $1B using repatriated offshore assets.

Industry highlights

Tether's CEO reiterated that the company maintains multibillion-dollar excess reserves, with group equity nearing $30B. As of Q3 2025, Tether reported around $7B in excess equity and $23B in retained earnings. Total assets stood at $215B against $184.5B in liabilities, strengthened by roughly $500M in monthly Treasury income alone.

Elsewhere, several interconnected market-making accounts tied to mid-cap ecosystems faced forced unwinds after abnormal price behavior was detected. Once their activities were restricted, correlated positions across multiple tokens unraveled rapidly, accelerating the sharp decline in SAHARA.

Security headlines intensified after Yearn Finance's yETH product was exploited through a minting vulnerability that drained liquidity. Early estimates place the loss near 1,000 ETH, or roughly $3M, with some flows routed to Tornado Cash. Yearn confirmed its V2 and V3 vaults remained unaffected as investigations advanced.

Alpha watch

RWA equities gained momentum as a potential next phase of market development.

Nasdaq reiterated that tokenized stocks remain a top priority and that advancing the SEC approval process is now central to its roadmap. The exchange emphasized that tokenization is not designed to displace existing securities frameworks but to broaden access in a responsible, investor-focused structure. If approved, Nasdaq would be among the first major US venues able to list tokenized stocks and ETFs alongside traditional equity products.

Domestic commentary also highlighted growing opportunities for small and mid-sized participants as tokenization infrastructure matures and policy environments evolve.

Concluding note

Sentiment remains low and liquidity remains uneven, yet stablecoin inflows continue to offer some stability.

With policy speculation building and industry headlines leaning defensive, momentum may stay subdued in the near term. The next few sessions hinge on whether macro guidance or sector narratives can break the market out of its early bear rhythm.