Crypto markets held steady as investors watched the final Federal Reserve meeting of the year.

Bitcoin dominance slipped 0.53% to 59.09%, while the Fear and Greed Index stabilized at 30, signaling persistent caution but no new panic.

Meanwhile, the Altcoin index has risen slightly to 19.

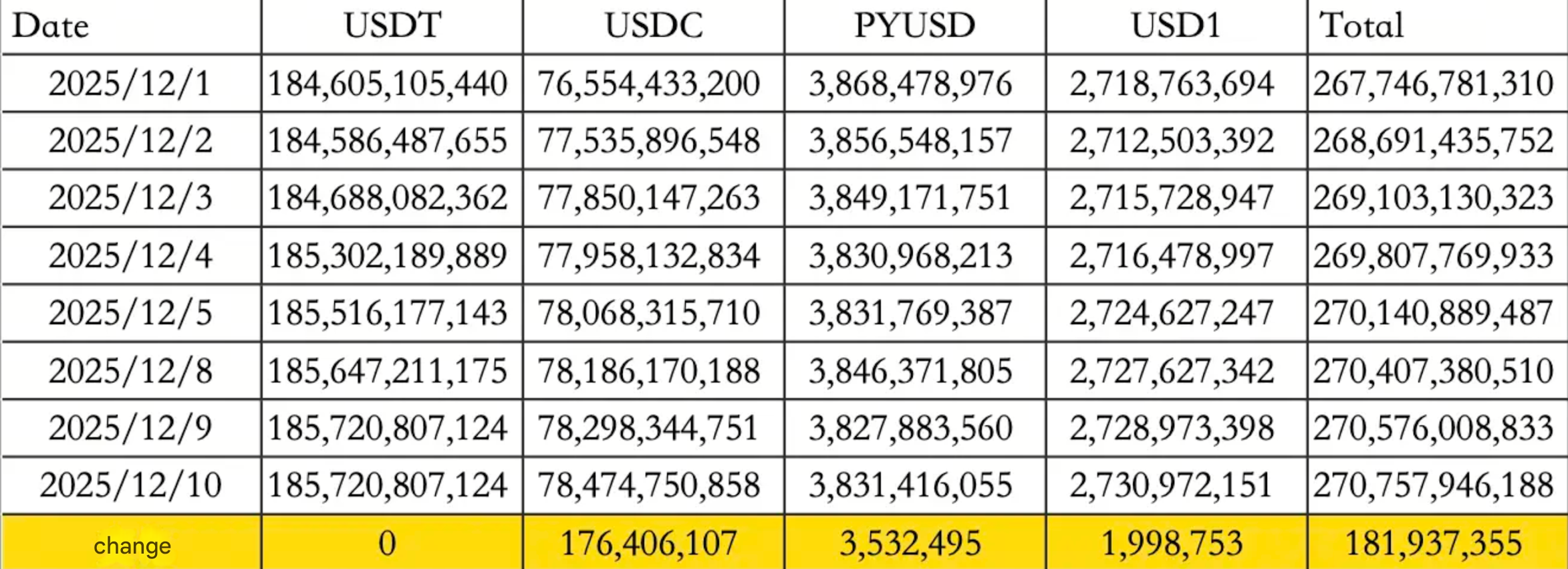

Stablecoin flows strengthened. On December 10, stablecoin inflows reached $181.94M, with USDC alone contributing $176.41M. Total stablecoin supply now sits at $270.76B, confirming that fresh liquidity continues to enter the system.

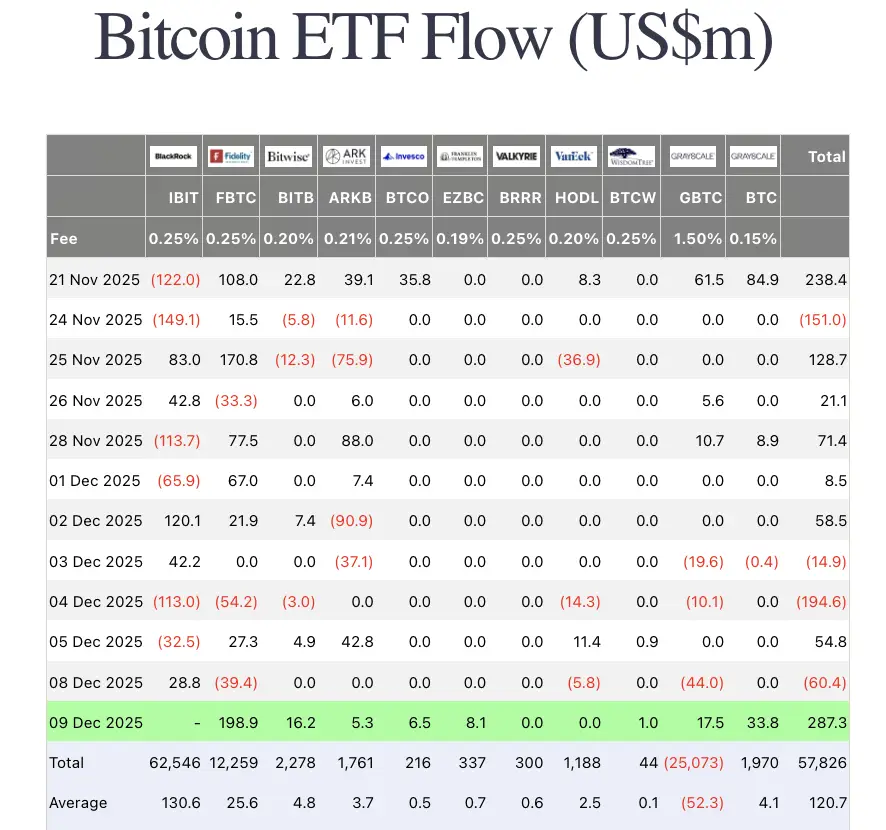

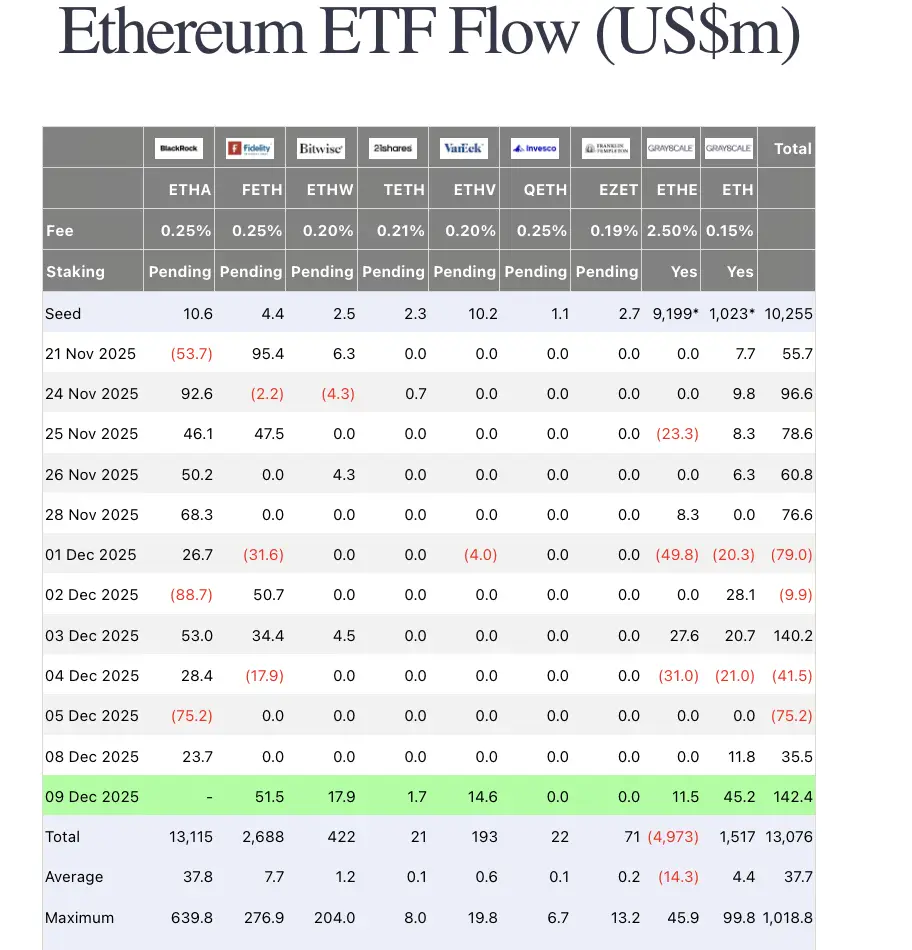

ETF flows turned sharply positive. With no updated BlackRock data, Bitcoin ETFs still recorded 287.3M in net inflows and Ethereum ETFs posted $142.4M in inflows. This marks one of the strongest ETF days of the month.

Traditional markets

U.S. equities traded mixed.

-

The Dow fell 0.38%

-

The Nasdaq rose 0.13%

-

The S&P 500 slipped 0.09%

Treasuries and currency markets showed mild softening. The 10-year yield fell 0.29% to 4.18% and the dollar index dipped to 99.22. Gold edged higher to $4213.16, reflecting a cautious pre-FOMC environment.

Macro policy

Powell faces internal pushback on rate cuts

Chair Jerome Powell may still push for a rate cut at this week’s meeting, even though nearly half of the committee is expected to oppose the move. Despite the rare level of internal disagreement, Powell appears intent on delivering one more cut before year-end.

CLARITY Act nears release

Senator Cynthia Lummis confirmed that the draft of the CLARITY Act, the key market structure bill, will be released before the end of this week. A hearing and vote are scheduled for next week.

Lummis said bipartisan negotiations are moving smoothly and nothing currently stands in the way of the bill advancing.

SEC Chairman: Many ICOs are not securities

SEC Chairman Paul Atkins said several categories of ICOs should be treated as non-securities and therefore fall outside SEC jurisdiction.

His updated token classification framework divides the industry into four categories and states that network tokens, digital collectibles, and digital utilities should not be regulated as securities.

The only ICO category under SEC oversight would be tokenized securities, meaning on-chain representations of already regulated assets.

CFTC approves BTC, ETH, and USDC as collateral

The CFTC confirmed that BTC, ETH, and USDC will be accepted as collateral for derivatives trading in U.S. clearinghouses. This is one of the largest regulatory shifts of the year and marks a major step toward integrating crypto assets into formal market infrastructure.

Industry highlights

Aster launches human vs AI trading battle

Aster opened a large-scale trading competition pitting human traders against AI systems. Human traders are currently far ahead, drawing attention to skill-based trading strategies and setting the stage for future product launches.

Social platforms shift strategies

Web3 social network Tako Protocol announced it will join the Trends tokenized post project and continue building within the Solana ecosystem. The team confirmed it will leave the Farcaster ecosystem entirely and shut down all Farcaster-related data services.

Tako was previously one of the largest clients on Farcaster.

How to start trading Bitcoin

Bitcoin's the OG—still king of the hill, still moving markets. Whether you're stacking sats or going full degen with leverage, Toobit gives you everything you need. Spot, Futures, and all the bells and whistles.

Alpha watch

Polymarket prioritizes market expansion over profit

Polymarket CEO Shayne Coplan told Axios that the platform is currently operating at a loss by design. The priority is aggressive market expansion rather than near-term profitability.

He explained that every prediction market contains a spread similar to sports betting. Users do not pay an explicit fee but pay indirectly through this spread. On Polymarket, the spread revenue is paid to liquidity providers and profitable traders rather than to the platform.

Concluding note

Markets stayed steady ahead of the Federal Reserve decision, with stablecoin inflows rising and ETF demand strengthening across Bitcoin and Ethereum.

Regulatory momentum picked up as the CFTC approved BTC, ETH, and USDC as collateral and the SEC signaled lighter oversight for non-security tokens.

Industry activity remained lively, highlighted by Aster's human versus AI trading event as well as new shifts in Web3 social platforms.