Note: This market update reflects data and developments for 5 December 2025.

Markets opened the day steadily; BTC dominance slipped 0.04% to 59.33%, while the Fear and Greed Index held at 25, and the Altcoin Index remains at 21.

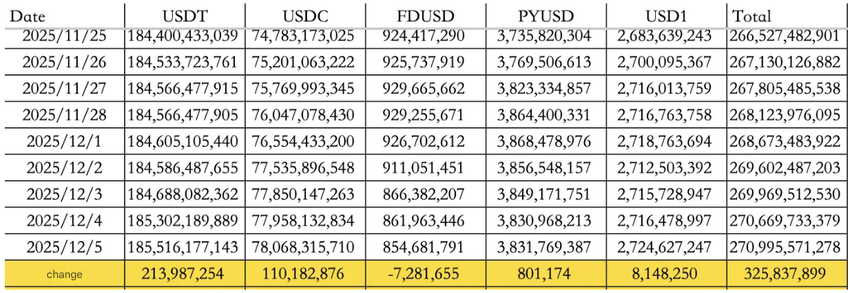

Stablecoin liquidity added a modest lift, with total inflows hitting $325.84M, driven by $213.99M into USDT and $110.18M into USDC.

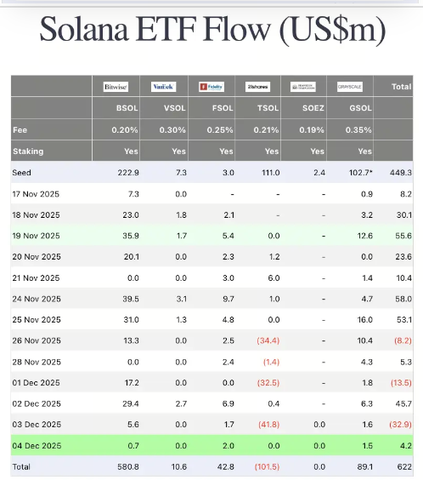

ETF flows leaned risk off. With BlackRock data unavailable, ETH ETFs saw $69.9M in outflows, and BTC ETFs posted $81.6M in outflows. Meanwhile, Solana ETFs saw inflows of $4.2M.

Traditional markets

U.S. equities traded mixed:

-

The Dow edged 0.07% lower

-

The Nasdaq added 0.22%

-

The S&P 500 ticked up 0.11%

The pullback in yields helped soften conditions.

-

The 10Y Treasury yield dipped 0.20% to 4.09%, and the DXY eased 0.08% to 99.00.

-

Gold slipped 0.07% to $4,201.09, reflecting a mild unwind in recent risk hedging.

Japan's 10Y yield pushed above 1.90%, marking the highest level since 2006 on growing expectations that the Bank of Japan may move toward a rate hike this month.

Meta rallied more than 5% to a one month high after announcing plans to reduce Metaverse-related spending by as much as 30%.

Macro policy updates

MSCI is evaluating whether to exclude digital asset treasury model companies from its investable indices, with a final decision slated for 15 January. JPM estimates that if Strategy is removed, passive outflows could reach up to $2.8B, a figure that has placed the industry on alert.

Separately, U.S. Treasury data showed America's outstanding notes, bills, and bonds have surpassed $30.2T, more than doubling since 2018. The scale of issuance is increasingly shaping liquidity conditions across global markets.

U.S. regulators also moved the needle. The CFTC confirmed that spot crypto assets can now be traded on CFTC registered platforms, widening the regulatory perimeter.

Industry highlights

Within the sector, commentary from Tom Lee resurfaced during a major conference, noting that this year's digital asset performance has lagged traditional assets, yet the underlying cause of the decline remains "difficult to explain". He highlighted that the pace of deleveraging mirrors the eight week post FTX recovery cycle, a pattern he interprets as a potential sign of a market floor forming.

Elsewhere in the industry:

-

Aster published a new roadmap, confirming work on a stock perpetual market and its upcoming Aster Chain testnet.

-

On cross-chain development, a major L2 network introduced a new Solana bridge powered by Chainlink CCIP, enabling native Solana asset usage and asset migration between chains.

Alpha watch

-

Opinion is estimated to be 8 to 9 weeks from its expected TGE window.

-

Stable will officially launch on 8 December, though no new deposit campaigns have surfaced. The outlook suggests potential APR boost events on external platforms.

-

For Wet, all public sale allocations appear to have been routed into automated accounts, tightening available supply.

Additional activity includes Polymarket expanding its internal market making team and securing a multi-year collaboration with CNBC, which will integrate real time prediction data into flagship programming beginning 2026. Its mobile integration via MetaMask is also now live.

Concluding note

Liquidity signals were mixed on 5 December, but the setup continues to lean cautiously constructive.

ETF outflows kept directional conviction muted, while stablecoin inflows and ongoing infrastructure upgrades offered quiet support. With sentiment anchored in fear and policy noise still elevated, the market remains in a holding pattern that could shift quickly once clearer signals emerge.