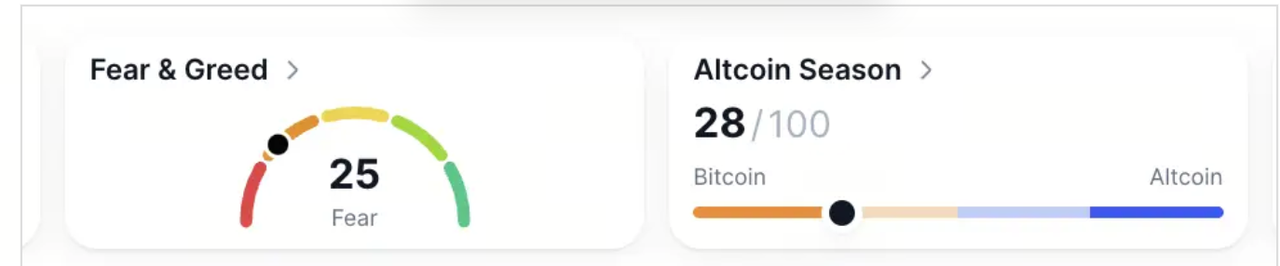

The Fear & Greed Index slipped to 25, signaling deep caution, while the Altcoin Index edged to 28.

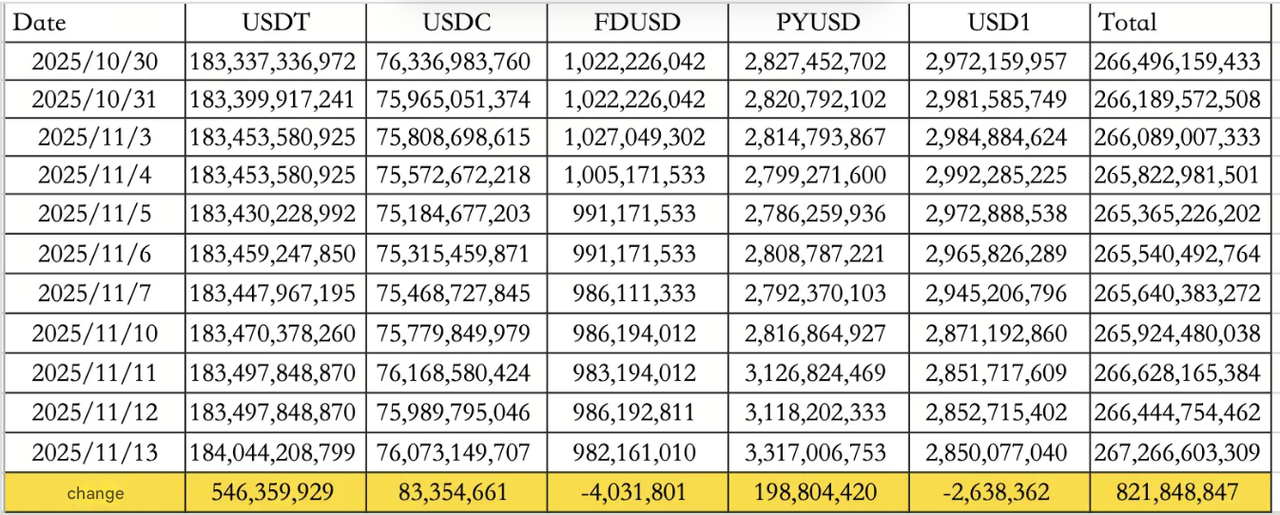

Stablecoin inflows showed early signs of recovery, adding $821.85M across major issuers. USDT led with $546.36M in net inflows, followed by USDC’s $83.35M, lifting the total stablecoin supply to $267.27B.

ETF activity reflected selective appetite.

On Nov 11, Ethereum ETFs recorded $107.1M in outflows, while Ethereum ETFs saw $524M in inflows. Solana ETFs added a modest $8M, extending their steady accumulation trend.

Traditional markets

-

Wall Street: The Dow Jones rose 0.68%, S&P 500 added 0.06%, while the Nasdaq dipped 0.26%.

-

Bonds and dollar: The 10-year U.S. Treasury yield increased 0.47% to 4.08%, as the U.S. Dollar Index fell 0.09% to 99.56.

-

Gold: Spot prices jumped 1.90% to $4,205.08, supported by a weaker dollar and lower yields.

On Wednesday, Strategy's (MSTR) market capitalization fell below the value of its Bitcoin holdings. Its mNAV ratio (market cap to BTC value) dropped to 0.99, as shares slipped 2.16% to a valuation of $65B, holding 641,692 BTC worth $65.05B at an average purchase price of $74,085.

Macro policy updates

Tariff developments

U.S. Treasury Secretary Scott Bessent hinted that "major tariff announcements" are coming in the next few days. He also confirmed discussions on a $2,000 tax rebate for families earning below $100K, expected to take effect in early 2026.

Government shutdown resolution

The House approved a procedural vote to end the ongoing shutdown, potentially reopening the government today. The White House confirmed that delayed September labor data will be released once operations resume.

Federal Reserve policy

New York Fed President John Williams stated the Fed will restart bond purchases, marking the end of quantitative tightening and the start of a new expansion phase. Atlanta Fed President Raphael Bostic is set to retire on February 28, 2026, signaling upcoming leadership reshuffles at the central bank.

Industry highlights

Morgan Stanley warns of 'crypto autumn'

Strategist Denny Galindo described Bitcoin’s current stage as the "autumn" of its four-year cycle, advising investors to secure profits before a potential "winter". He noted Bitcoin’s historical rhythm of "three rises and one fall", implying that a correction could soon follow. "Autumn is harvest season," he said, "the question is, how long before winter arrives?"

This metaphor underscores how institutional strategists are now viewing Bitcoin through a cyclical, macro-lens similar to commodities or liquidity-driven markets.

Technical sentiment and KOL views

Analysts noted that current candlestick reversals resemble October 2024 price action, hinting at a possible mid-cycle rebound. However, some KOLs argued that despite the government’s reopening, market liquidity remains constrained.

Regulatory direction

Paul Atkins, Chair of the U.S. Securities and Exchange Commission (SEC), outlined a "token classification framework" distinguishing securities from utility-based digital assets. Tokens with real functionality (e.g., identity verification tools or network tokens like ETH and SOL) are not considered securities under the proposed scheme.

The Commodity Futures Trading Commission (CFTC), which oversees derivatives, is expected to align its stance once formal definitions are released.

XRP and SOL ETF momentum

Following the shutdown resolution, analysts expect XRP and SOL to be the biggest ETF beneficiaries. New issuers include VanEck, Fidelity, 21Shares, Canary, and Franklin Templeton, signaling stronger institutional confidence.

Alpha watch

Circle's Q3 strong earnings spells long-term USDC growth

USDC issuer Circle reported strong Q3 results, revealing plans to issue a native token on the Arc Network. Its Circle Payments Network now includes 29 financial institutions, adding new partners such as Brex, Deutsche Börse, Finastra, Fireblocks, Itaú, and Visa.

-

Q3 USDC circulating supply: $73.70B (+108% YoY)

-

Revenue + interest: $740M (+66% YoY)

-

Net profit: $214M (+202% YoY)

Circle expects 40% CAGR growth in USDC supply over the long term.

Polymarket x Yahoo Finance partnership

Prediction platform Polymarket announced its exclusive partnership with Yahoo Finance, integrating real-time prediction probabilities directly into search results. This move bridges mainstream finance and on-chain forecasting.

Stable mainnet launch accelerated

Stable's mainnet may launch earlier than expected, potentially going live by November 20, according to project insiders.

Analysts' two-year outlook

-

Bitcoin: Expected to enter a short bear phase after completing its four-year cycle. Analysts see a possible bottom near $84K, followed by a rebound toward $240K, supported by liquidity from the AI stock boom.

-

Gold: In a structural currency transition phase, projected to trade between $3,350–$3,750, with an extreme top near $3,100. Long-term accumulation below $3,750 remains favored.

-

U.S. equities: Still in a late-stage expansion. Despite fatigue, AI-driven optimism keeps a buy-the-dip outlook for the next two years.

-

AI sector: A bubble may form as overleveraged M&A and heavy capital spending lift valuations. Warning signs include inflated prices, aggressive deals, and rising inflation risks.

Perpetual platform volumes

-

Lighter: $11.24B 24h volume; TVL $1.17B

-

Hyperliquid: $9.14B 24h volume; TVL $4.73B

-

Aster: $7.88B 24h volume; TVL $1.46B

-

EdgeX: $6.21B 24h volume; TVL $0.50B

Concluding note

Markets appear to be entering a cautious phase, balancing between optimism over ETF inflows and concerns about tightening liquidity. Institutional signals, from Morgan Stanley's profit-taking warning to the Fed's bond-buying restart, suggest that volatility could rise as traders recalibrate risk before year-end.