Sentiment remains fragile. The Crypto Fear and Greed Index sits at 20, firmly in fear territory.

Bitcoin dominance rose 0.08% to 59.98%, signaling continued capital preference for majors over higher beta assets.

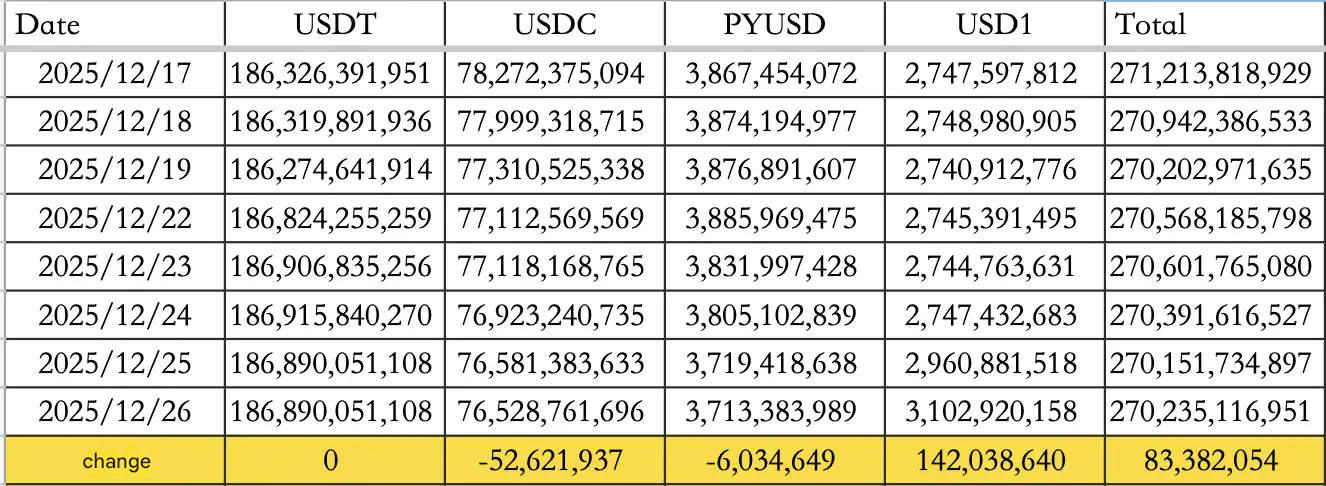

On December 26, stablecoins recorded a net inflow of $83.38M. USDC saw $52.62M in outflows, while USD1 recorded $142.04M in inflows. Total stablecoin supply now stands at $270.24B.

The data points to rotation rather than broad risk re-entry, with capital reallocating inside the stablecoin complex instead of exiting entirely.

Traditional markets

Spot silver broke above $74 per ounce for the first time on record, extending its daily gain to 3%. Year-to-date, silver is up more than $45, marking one of its strongest annual performances in decades.

The gold-to-silver ratio fell another 1.2% on the day and is now down more than 32% for the year, reaching its lowest level since February 2014. The move highlights aggressive capital rotation into hard assets as investors hedge against monetary uncertainty.

Macro policy updates

Rate hold could pressure crypto prices

It has been noted that if the Federal Reserve holds rates steady through the first quarter of 2026, Bitcoin could retrace toward $70,000, while Ethereum could fall to roughly $2,400.

However, this view is tempered by recent policy shifts. On December 1, the Federal Reserve ended quantitative tightening and initiated its Reserve Management Purchases program, buying approximately $40B in short term Treasury bills per month. Some analysts view this as a form of quiet liquidity support.

Stablecoins strengthen financial bridge

Separately, Liquid Capital founder Yi Lihua stated that USD1 surpassing a $3B market cap marks a strong start, reiterating that stablecoins remain the most important bridge between crypto and global financial services. He confirmed continued investment support for the sector.

Bitcoin options: A historic expiry

Bitcoin is heading into the largest options expiry on record. Roughly 300,000 BTC options contracts are set to expire, representing a notional value of approximately $23.7B. Combined BTC and ETH options expiring today total $28.5B, double the size of last year's comparable expiry.

The scale raises the probability of short term volatility, particularly if spot prices move sharply near key strike levels.

Industry highlights

Travel meets stablecoins

Trip.com's international platform has launched stablecoin payments, supporting both USDT and USDC. The move underscores growing real world adoption of stablecoins in cross border commerce.

Ondo brings tokenized TradFi to Solana

Ondo Finance confirmed plans to introduce tokenized U.S. stocks and ETFs on Solana, with a launch targeted for early 2026. The initiative reflects accelerating momentum in tokenized real world assets.

Pantera maps 2026 crypto trends

Pantera Capital released twelve forward looking predictions for 2026, including the rise of capital efficient onchain credit, divergence in prediction markets, agent-based commerce, tokenized gold as a key RWA, and continued consolidation among digital asset treasury firms.

Uniswap fee switch approved

Uniswap's fee switch proposal passed final governance voting. After a two-day timelock, fee switches on Uniswap v2 and v3 will activate on Unichain mainnet. The proposal includes burning 100M UNI from the Uniswap Foundation treasury and implementing protocol fee auctions to enhance liquidity provider returns.

Trust Wallet security incident

Trust Wallet confirmed a security vulnerability in its browser extension version 2.68. Hundreds of users were affected, with losses totaling at least $6M. Users are advised to disable version 2.68 immediately and upgrade to version 2.69 via the official Chrome Web Store.

How to start trading Bitcoin

Bitcoin's the OG—still king of the hill, still moving markets. Whether you're stacking sats or going full degen with leverage, Toobit gives you everything you need. Spot, Futures, and all the bells and whistles.

Alpha watch

a16z on the future of AI

Andreessen Horowitz outlined three practical shifts in AI development. Interfaces will move beyond prompts toward proactive agents, websites and apps will increasingly be designed for AI consumption, and voice-based AI will see wider adoption across regulated industries.

Infinex adjusts token sale terms

Infinex updated details for its Echo Sonar token sale. The offering will now sell 5% of total supply, with the fundraising target reduced to $5M from $15M.

Fully diluted valuation was cut to $99.99M from $300M. Registration opens December 27, with the sale beginning January 3. An additional 2% of tokens will be sold through Uniswap CCA.

Concluding note

Between record breaking options expiry, cautious liquidity flows, and strong signals from hard assets, markets remain in wait mode.

Volatility risk is rising, but conviction is selective. For now, patience remains a position, not a placeholder.