Market sentiment weakened further as the Fear & Greed Index slipped to 26, mirroring the altcoin index at the same level. Both readings signal deep fear and reinforce that conditions have entered a sustained bearish phase.

Stablecoin liquidity contracted again, with $183.41M leaving the market. USDC alone saw $178.79M in net outflows, bringing the total stablecoin supply down to $266.44B.

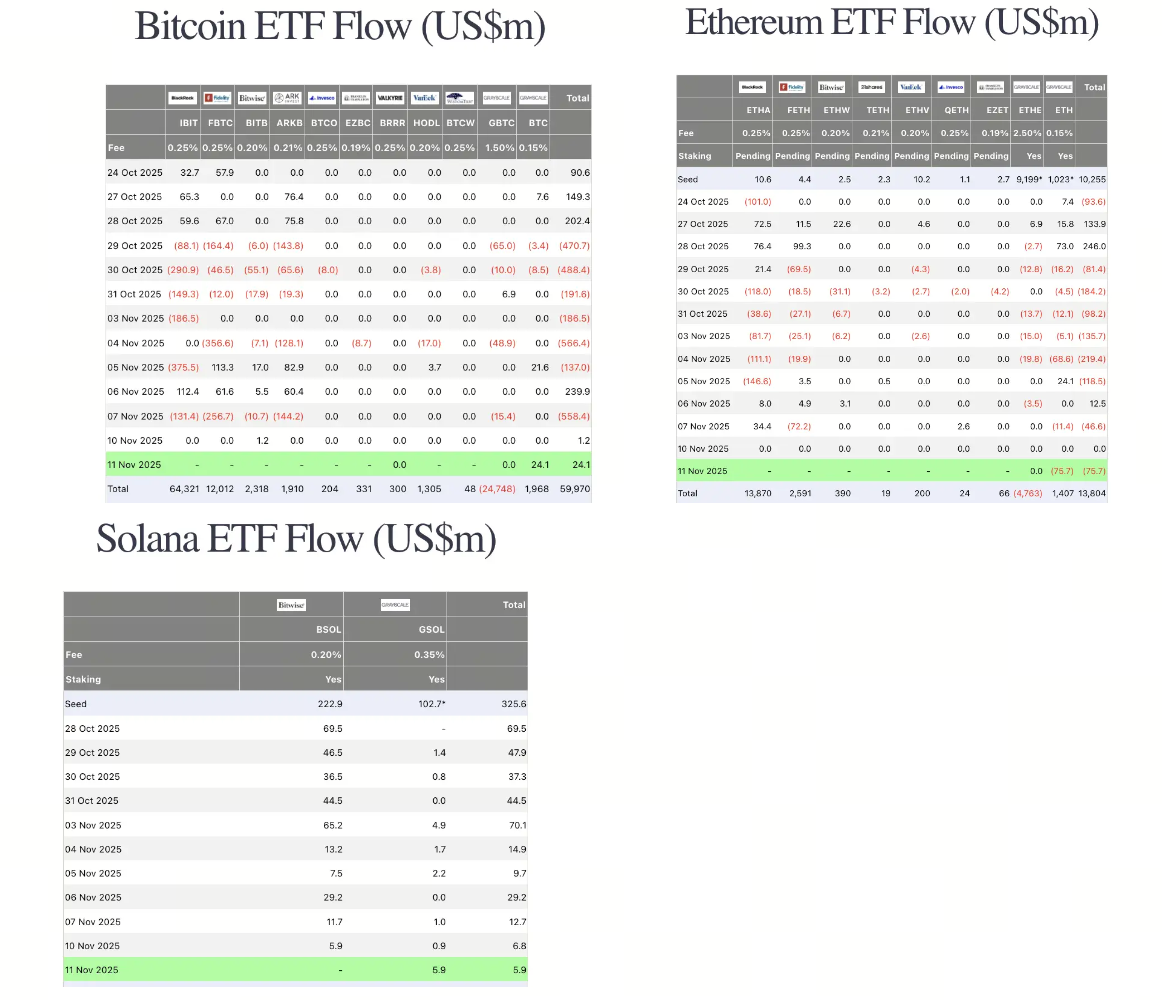

ETF momentum softened.

On Nov 10, BTC ETFs recorded $1.2M in inflows, ETH ETFs remained flat, while SOL ETFs attracted $6.8M.

Despite ongoing opportunities for staking yield, Lido (LDO) and Jito (JTO) declined, reflecting reduced risk appetite.

Traditional markets

Wall Street ended the session mixed as investors rotated into safer assets:

-

Dow Jones rose 1.18%

-

S&P 500 rose 0.21%

-

Nasdaq slipped 0.25% amid rotation into value stocks

U.S. Treasury yields fell, with the 10-year yield down 1.04% to 4.08%, while the dollar index hovered near 99.48, little changed.

Gold rose 0.37% to $4,141.85, supported by renewed rate-cut bets.

Macro policy updates

Labor market pressures mount

Goldman Sachs projected that October nonfarm payrolls fell by about 50K, marking the largest monthly drop since 2020. Another 100K jobs were reportedly lost due to the government's "deferred separation program". Rising layoffs have weakened employment indicators, increasing expectations for a Federal Reserve rate cut in December.

Government funding talks stall

House Democrats said they would oppose any short-term funding bill that excludes Affordable Care Act subsidies, heightening the risk of a short-term government shutdown.

Regulatory overhaul gains traction

A new bipartisan U.S. Senate proposal could redefine how digital assets are supervised.

The bill seeks to transfer oversight authority from the U.S. Securities and Exchange Commission (SEC) to the Commodity Futures Trading Commission (CFTC). It calls for a digital commodity registration system, stricter disclosure requirements, and transaction fees to fund oversight. The move could streamline regulation and end the long-standing jurisdictional ambiguity in the U.S. market.

Banking meets blockchain

SoFi Bank became the first federally chartered U.S. bank to provide direct digital asset trading through customer savings accounts. The initial rollout supports BTC, ETH, and SOL, marking a significant integration between traditional banking and digital assets.

Industry highlights

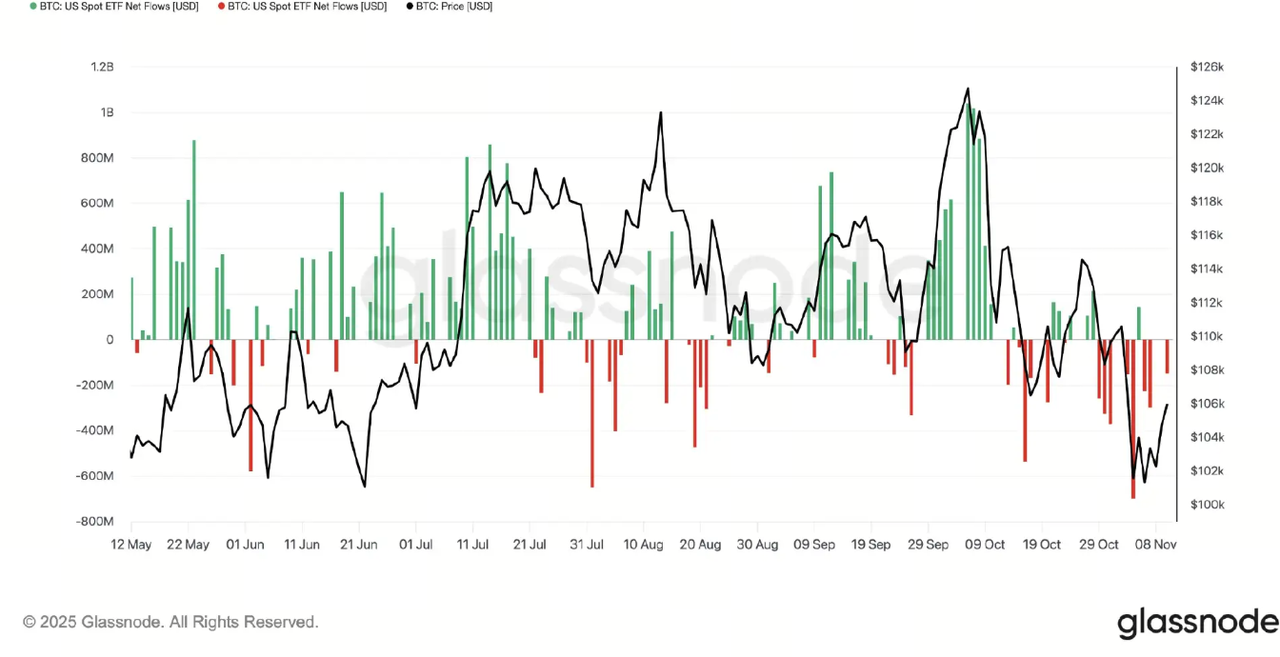

ETF sentiment remains risk-off

According to Glassnode, U.S. Bitcoin ETFs have seen continuous net outflows since early October, averaging about $700M per day. The data points to broad-based risk reduction among institutional participants.

Ethereum Foundation aligns with AI

Davide Crapis, head of the dAI team under the Ethereum Foundation, unveiled a roadmap to make Ethereum a global decentralized coordination layer for AI systems by 2026. The plan introduces standards such as ERC-8004 and x402 to facilitate autonomous agents and robots that can transact, verify work results, and collaborate under transparent rules.

Alpha watch

Fantasy sports join prediction markets

Fantasy platform PrizePicks has teamed up with Polymarket to launch performance-based prediction markets. Participants can place wagers on individual athlete statistics such as points, rebounds, or assists, bridging fantasy gaming with real-time event prediction.

Perp DEX Lighter raises $68M

Perpetual trading protocol Lighter completed a $68M funding round led by Founders Fund and Ribbit Capital, with backing from Haun Ventures and Robinhood. The raise reportedly pushes its valuation to $1.5B, underscoring continued investor demand for advanced decentralized trading infrastructure.

Concluding note

Markets remain defensive as liquidity tightens and policy uncertainty lingers. ETF flows and stablecoin data point to sustained caution, but the coming weeks could shift tone if a Fed pivot and government restart materialize.