Markets opened steadier as BTC dominance slipped 0.18% to 59.18, while the Fear and Greed Index shifted slightly to 27. This remains close to the accumulation zone seen when readings dipped below 20 earlier this week.

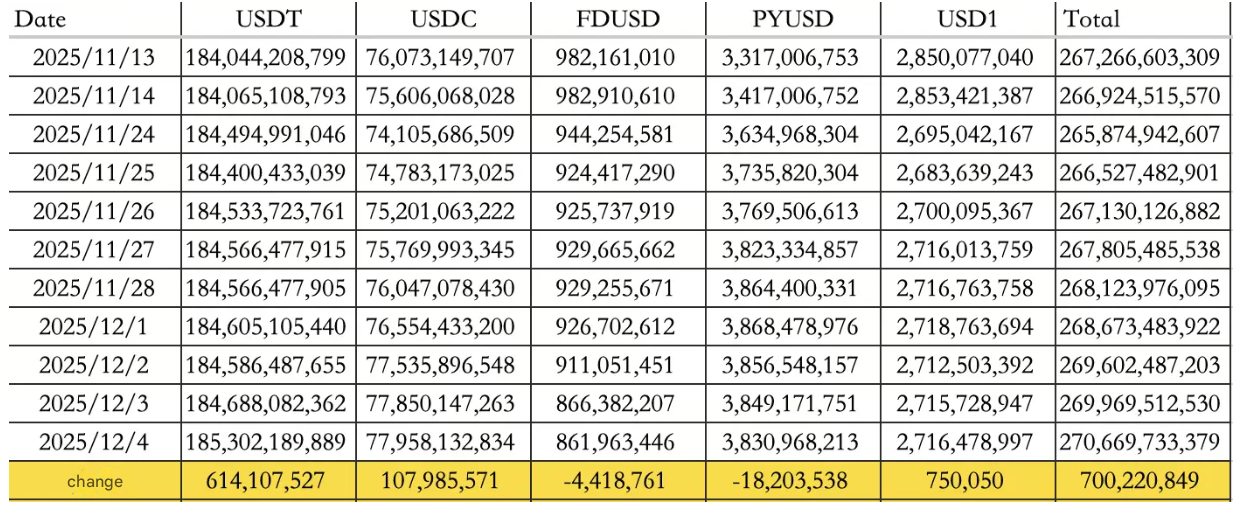

Stablecoin activity added support. Total inflows reached $700.22M, lifting circulating supply to $270.67B. This included $614.11M in USDT inflows and $107.99M into USDC.

ETF flows added modest reinforcement, with BTC products drawing $57.1M and ETH ETFs adding $87.2M in fresh inflows.

Traditional markets

Wall Street ended the session firmly:

-

The Dow gaining 0.86%

-

The S&P 500 up 0.30%

-

The Nasdaq advancing 0.17%

Treasury yields inched higher, with the 10Y rising 0.39% to 4.08%, while the Dollar Index edged up 0.06% to 98.93.

Gold saw a mild uptick of 0.16% to $4208.75 as markets priced in softer labor data.

Macro policy updates

Soft labor data shaped expectations after November ADP payrolls fell 32,000, well below the expected 10,000 increase. Markets now look toward Friday's core PCE release as the next major catalyst.

In policy commentary, SEC Chair Paul Atkins stated live on air that the Crypto Market Structure Bill is approaching passage. If enacted, the bill would provide long awaited regulatory clarity, and directly benefit fundamentally strong and highly decentralized majors such as BTC, ETH, and SOL.

Separately, the administration signaled growing strategic interest in robotics development after months of focus on AI, with senior officials meeting industry leaders to accelerate sector expansion.

Industry highlights

Prediction markets dominated headlines.

-

Polymarket launched its US app, marking the first time US residents can access its on-chain forecasting markets.

-

Fanatics unveiled a two phase prediction platform in partnership with a major ecosystem partner, and plans to expand it next year into areas spanning digital assets, equities, AI, climate, and culture.

-

Predict.fun, backed by YZiLabs, entered the space with a founder track record spanning research, token listings, and past product launches.

Meanwhile, CNN announced it will integrate Kalshi's feeds directly into news tickers through an exclusive partnership covering political, economic, and cultural forecasts.

Beyond prediction markets, the file notes expansion in youth oriented financial tools, with a leading exchange launching a junior savings app for ages 6 to 17 with parental controls and simplified interfaces.

Additionally, Robinhood's growing tokenized equity initiative now includes 943 deployed equity tokens on Arbitrum as preparations continue for a dedicated L2 expected early next year.

Alpha watch

Stable and Theo confirmed an investment exceeding $100M into the ULTRA, the only AAA rated tokenized US Treasury strategy by Particula. The ULTRA mainnet is scheduled to go live on December 8 and institutions can access the strategy through thBILL.

Ethereum's Fusaka upgrade activates within hours, raising the block gas limit to 60M and enabling BPO forks. This is expected to cut L2 fees by 40 to 60% and increase throughput for major scaling networks.

Within the social ecosystem, Farcaster's Clanker presale begins this week, running seven days with uniform terms. Trading is set to open 24 hours after the presale ends.

Activity on MSX continues to surge, with 24 hour volume reaching $2B and cumulative volume surpassing $20.6B, up more than $7.5B in the past five days. Solana Mobile confirmed the SKR token will launch in January 2026 with a total supply of 10B, allocating across airdrop, ecosystem growth, liquidity, community funds, and team holdings.

Concluding note

Liquidity trends are improving, policy signals continue to warm, and upcoming data and protocol upgrades add near-term catalysts.

While positioning remains cautious, structural shifts in stablecoin supply, regulated market frameworks, and scaling technologies are forming a more supportive backdrop as the week progresses.