Markets stayed defensive, but positioning is getting more specific.

BTC dominance rose to 59.96% from December 17 to 18, while Fear and Greed held at 17 (up from 16), keeping sentiment pinned in extreme fear.

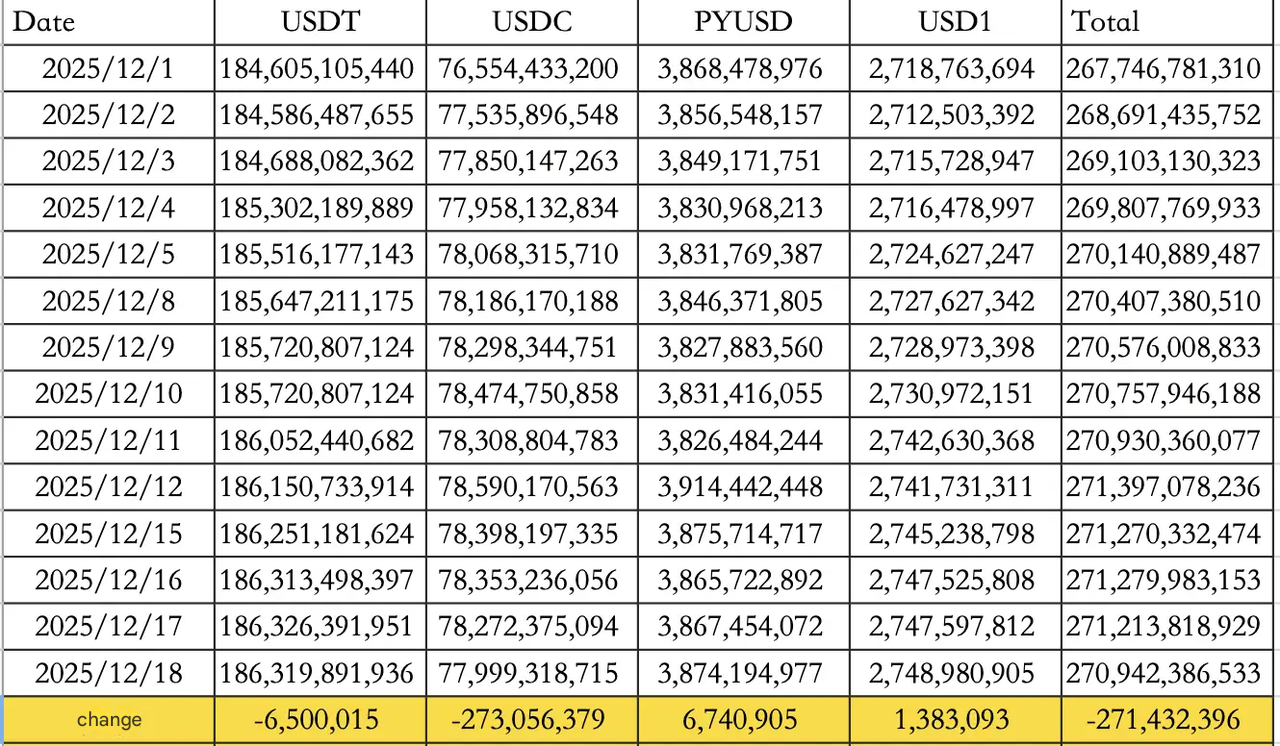

Stablecoin flows leaned risk-off: net outflows hit $271.43M on December 18, led by $273.06M in USDC outflows, with USDT down $6.5M. Total stablecoin supply is about $270.94B.

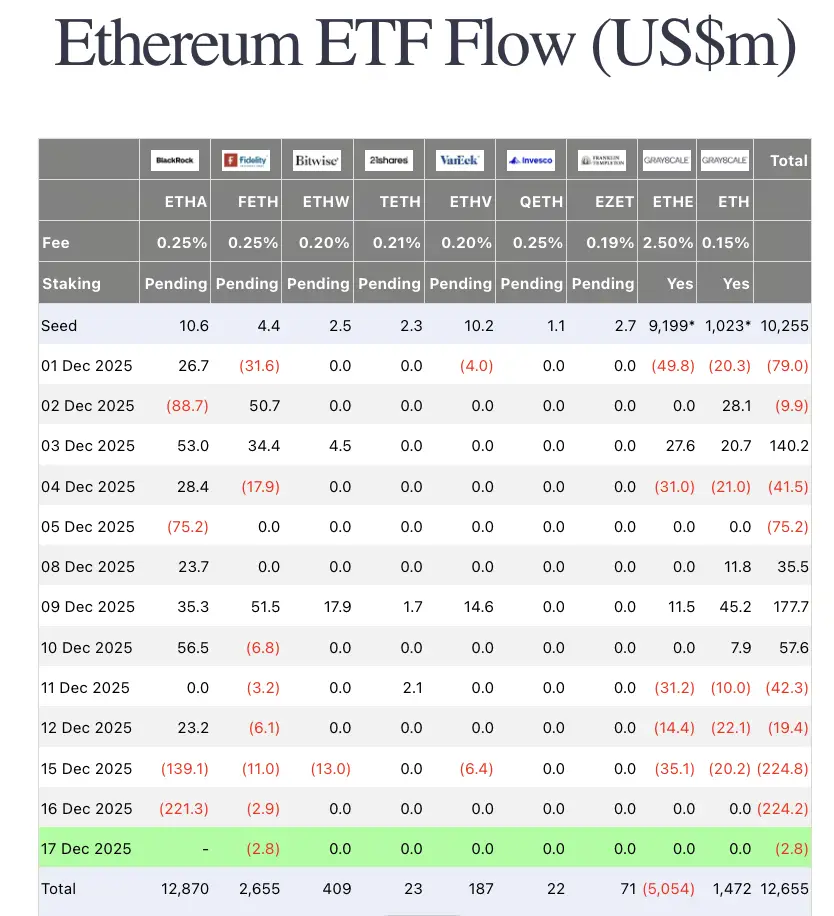

ETFs offered a one-day counterweight. On December 17, spot BTC ETFs posted $346.1M of inflows, while ETH ETFs saw $2.80M of outflows.

But the highlighted trend is still the trend: since October 10, U.S. listed spot BTC ETFs are down over -$5.2B net, and reported market depth is about 30% below the yearly high, which can keep rallies narrow even when the daily tape improves.

How to start trading Bitcoin

Bitcoin's the OG—still king of the hill, still moving markets. Whether you're stacking sats or going full degen with leverage, Toobit gives you everything you need. Spot, Futures, and all the bells and whistles.

Traditional markets

Traditional risk took a hit:

-

The Dow fell 0.47%

-

The S&P 500 slid 1.16%

-

The Nasdaq dropped 1.81%

Additionally, Nvidia also sank about 2% to a three-week low.

Macro policy updates

U.S. political risk headlines stayed loud.

President Trump met attorney Alan Dershowitz at the White House to discuss the constitutional angles around a potential third term scenario.

AI financing is also back in the macro frame.

-

OpenAI discussed raising up to tens of billions at a valuation of roughly $750B, underscoring how aggressively the compute cycle is accelerating.

-

In parallel, reports say Amazon is in talks for a $10B+ investment tied to OpenAI's infrastructure needs and potential use of Trainium chips.

One market structure signal came from clearing and settlement rails: Depository Trust and Clearing Corporation (DTCC) has said it plans to enable tokenization of a subset of DTC-custodied U.S. Treasuries on Canton Network, targeting an H1 2026 MVP.

Industry highlights

Prediction markets are trying to graduate from entertainment to capital tool.

Sports may dominate headline volume on some venues, but the briefing flagged that politics, economics, and election themes dominate open interest, suggesting more "hedge and express" behavior than "watch-and-bet".

Accuracy claims are getting sharper too:

-

Dune's report notes Brier scores around 0.09 across thousands of resolved markets, putting these platforms among the most accurate large-scale forecasting systems measured.

-

On "leading indicator" value, a Keyrock study compared a Kalshi inflation market to the Cleveland Fed's Nowcast, arguing the market-implied path moved earlier and more smoothly ahead of a CPI print.

Tokenized equities also picked up steam. One major exchange has agreed to acquire Backed Finance, aiming to unify xStocks issuance, trading, and settlement under one roof.

The same ecosystem is pushing new rails, including a Chainlink CCIP based bridge for moving tokenized equities cross-chain, plus deeper liquidity integrations and broader distribution via Telegram wallet pathways.

Alpha watch

Stablecoins are becoming infrastructure as payment rails adopt them for real-world settlement.

-

Visa announced USDC settlement in the U.S., allowing issuer and acquirer partners to settle with Visa using Circle's USDC as part of its stablecoin settlement program.

-

Mastercard also announced Middle East partnerships aimed at expanding stablecoin settlement and tokenized asset use cases.

On the incentive front, Aster announced Stage 5: Crystal begins December 22 and runs 6 weeks through February 1, 2026, allocating 1.2% of total supply (about 96M ASTER). Half of this supply is available immediately (0.6%), while the other half (0.6%) unlocks after a 3-month lock, with unselected lock rewards slated for burn.

Concluding note

Today's message is friction plus progress.

Daily BTC ETF inflows help, but the highlighted reality of -$5.20B net outflows since October 10 and 30% thinner depth means rallies can stay selective.

At the same time, AI's fundraising headlines and tokenized settlement initiatives are pushing risk narratives beyond price charts, and that is where the next durable trend usually starts.

So the big question is simple: can 2025 still finish strong?