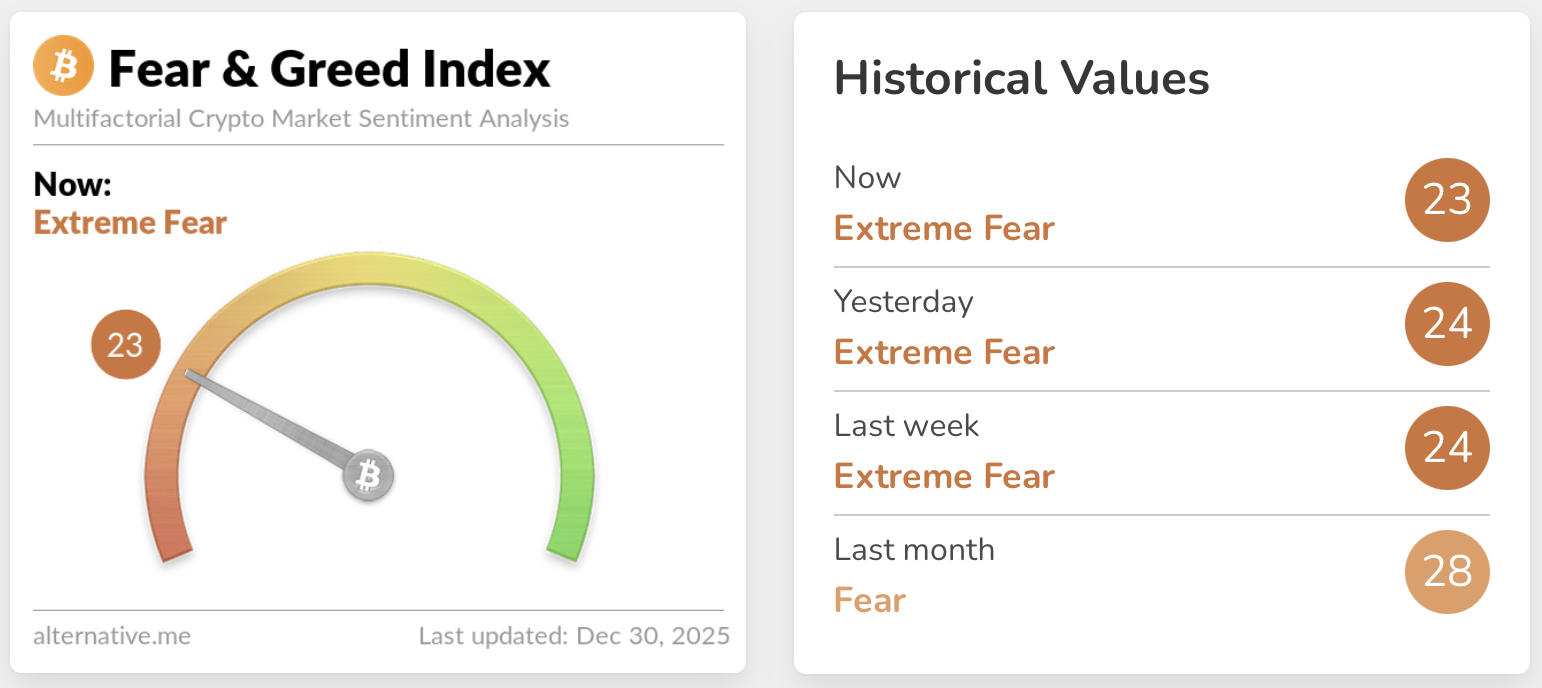

Markets stayed defensive into year-end, with BTC dominance at 59.53% and the Fear and Greed Index at 23.

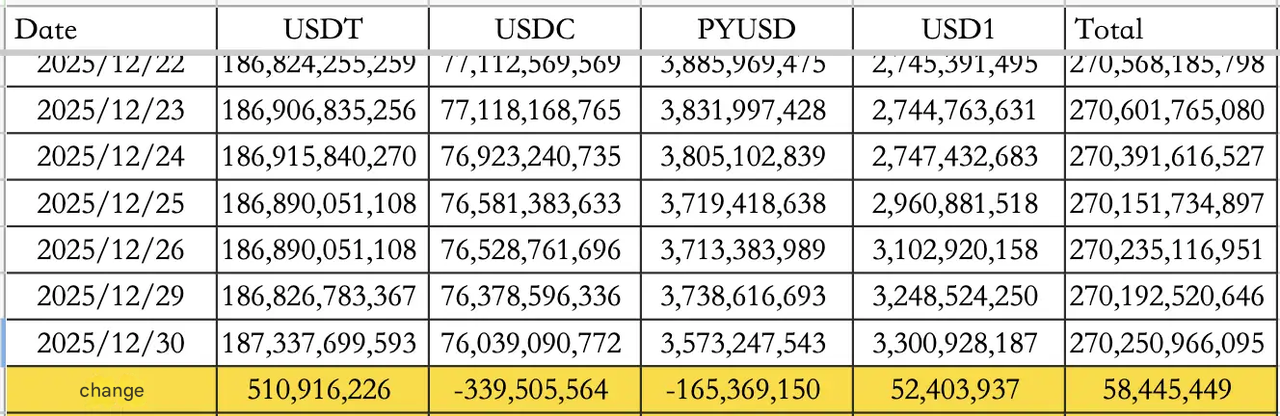

The bigger tell was liquidity: stablecoins showed a net +$58.45M inflow on December 30, led by USDT +$510.92Mwhile USDC -$339.51M softened. Total stablecoin supply was cited at $270.25B.

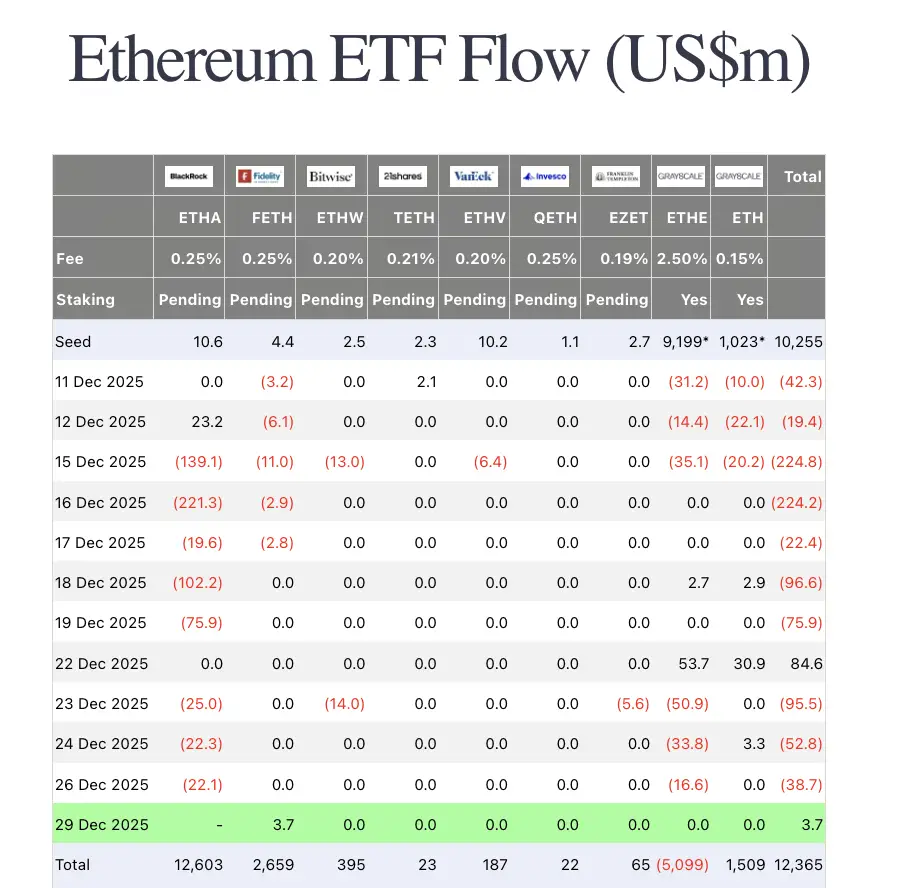

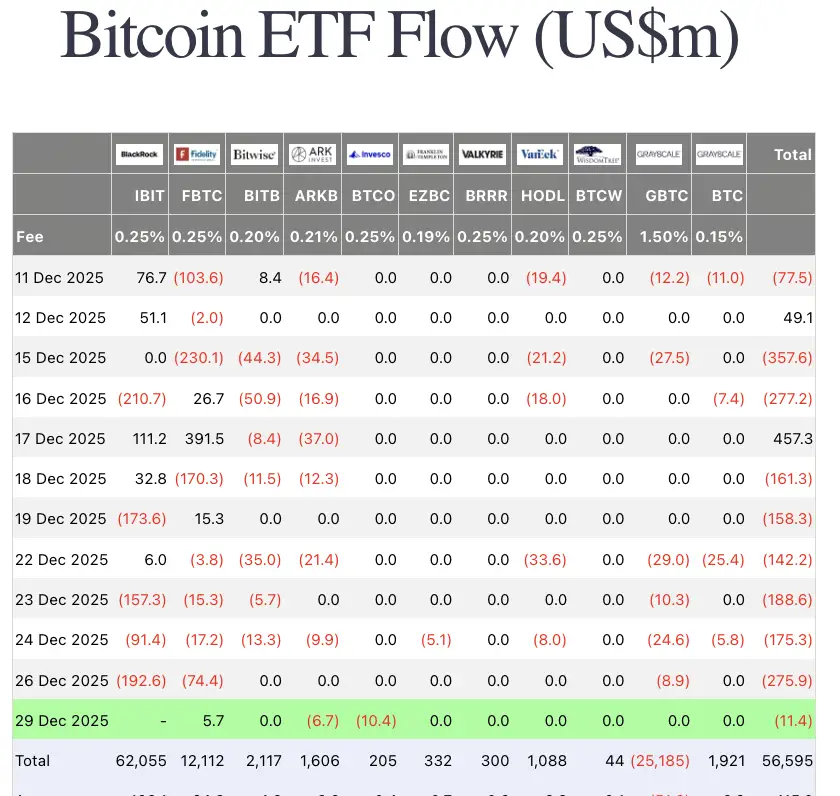

Spot ETF flows were still not a clean tailwind. On December 29, BTC ETFs -$11.4M while ETH ETFs +$3.70M, with the note that flows were reported without one major issuer’s data, so the read is directionally useful, not complete.

Traditional markets

Risk-off pressure showed up across the tape.

-

The Dow dropped 0.51%

-

The Nasdaq declined 0.50%

-

The S&P 500 decreased 0.35%

Rates pushed higher with the 10Y U.S. Treasury yield rising 0.1% to 4.12, while the U.S. Dollar Index rose 0.02% to 98.03.

Gold climbed 0.64% to $4,359.91.

Macro policy updates

Two policy headlines are setting the tone for 2026.

Nomura Securities' warning for H2 2026

The firm expects a new Fed chair to take over in May 2026 and potentially steer a June cut, but flags a high risk of internal resistance to further easing if the U.S. economy is still recovering.

Their base case is that uncertainty concentrates in July to November 2026, with a possible "flight from U.S. assets" dynamic if policy splits harden and politics heats up. This can lead to a decline in U.S. bond yields, a pullback in U.S. Stocks, and the weakening of the U.S. Dollar.

A liquidity reversal may occur during this period, which may result in major economies globally halting rate cuts, or even starting a cycle of increasing interest rates, thereby weakening the relative advantage of U.S. assets.

The policy stalemate, coupled with the signal of bottoming out inflation and the end of the Fed's interest rate cut cycle, will exacerbate market volatility.

White House pressure adds headline risk

Trump re-escalated the Powell pressure campaign, saying he is considering a lawsuit and repeating that he would "love" to remove Powell, while also noting the chair decision is expected in January. The point for markets is not courtroom probability, it is headline volatility and perceived central bank independence risk.

Near-term catalyst

The next Fed meeting minutes will be released on December 30, 2025 at 2 PM EST. The minutes are the immediate checkpoint for how officials are weighing inflation versus growth risk, and how long the "pause" logic is intended to last.

Industry highlights

The market's forward narrative is getting crowded, but three threads stand out.

Solana closes 2025 with scale, stability, and "infrastructure first" pitch

Solana's year-end recap leaned heavily on scale and reliability: over $1.70T in 2025 DEX volume, 15 straight days of net ETF inflows with cumulative size over $766M, and $185M in on-chain tokenized stocks, alongside nearly 700 daysof network stability.

The review showcased Solana's accelerated expansion in 2025, launching thousands of new products and cooperative projects throughout the year, and making breakthroughs in prediction markets (Phantom, Solflare), flexible fee payments (Kora), and various tokenized asset tools.

Galaxy releases 2026 predictions

Galaxy's 2026 outlook pushed the same direction:

-

BTC to hit $250K by 2027, where prices will slowly approach. It is, however, difficult to make a clearer prediction in 2026 largely due to unstable macroeconomic conditions.

-

The Solana inflation reduction plan will not be passed (SIMD-0411 withdrawn), and Solana's inflation reform will be deadlocked, with a lower priority than market structure improvement. It is expected that no proposal will be passed in 2026.

-

The U.S. Securities and Exchange Commission (SEC) is expected to open a path for tokenized securities in DeFi, with more formal rule-setting later in 2026.

-

DEX volumes are projected to rise more than 25% of spot volume by end-2026 as more flow migrates on-chain.

Dragonfly's market structure thesis

On positioning and market structure, Dragonfly's Haseeb sketched a 2026 map that includes BTC >$150K with lower dominance, winners in neutral infrastructure (with ETH and Solana framed as potential overperformers), and a prediction that a handful of perpetual DEXs consolidate most share.

Treat it as a thesis, but note how consistent it is with the "fewer venues, deeper liquidity" direction the market keeps rewarding.

How to start trading Bitcoin

Bitcoin's the OG—still king of the hill, still moving markets. Whether you're stacking sats or going full degen with leverage, Toobit gives you everything you need. Spot, Futures, and all the bells and whistles.

Alpha watch

edgeX's timeline shift

edgeX confirmed its TGE delay, now expected no later than March 31. If you are tracking the name, this turns into a timing and attention risk: the window is longer, but the market will demand clearer proof of traction before it re-prices the story.

Prediction markets continue to move mainstream

Prediction markets keep graduating from niche to infrastructure.

It is reported that prediction markets are to hit $95.5B by 2035, with a compound annual growth rate of nearly 47%. The brief cites weekly volume across leading platforms has exceeded $2B, with deal-making and institutional backing accelerating the legitimacy of prediction markets. That includes Polymarket's $112M acquisition of a CFTC-licensed exchange and Intercontinental Exchange's (ICE) plan to invest up to $2B in Polymarket.

Meanwhile, emerging platforms such as Limitless and Myriad have achieved several-fold growth in transaction volume in just a few months. Although there are still regulatory frictions in states such as Texas and New York, there has been little to stop the industry's expansion.

Opinion hits over $10B in cumulative notional volume

A smaller but fast-moving datapoint: Opinion reportedly exceeded $10B in cumulative notional volume in 55 days, with open interest over $110M. Whether every platform survives is an open question, but the category is clearly competing for attention, capital, and regulation-ready distribution.

Concluding note

2025 is closing with a clear split: sentiment stays fearful, but liquidity is still holding together.

Stablecoins turned net positive (+$58M) even as ETF flows stayed mixed and incomplete, and macro headlines are already pricing in extra tail risk for 2026. If Nomura's July to November uncertainty window becomes the consensus trade, the real edge will be spotting the moment it stops reading like a warning and starts showing up as positioning.

The final sessions of 2025 call for discipline: stay selective, respect thin liquidity, and watch whether policy noise forces risk to reprice before fundamentals can catch up.