Bitcoin stumbled on market share, with BTC dominance sliding 1.24% to 59.4%, the lowest level since February. The Altcoin Index at 43 says it all: alts are chewing away at king BTC’s turf while ETF flows wobble.

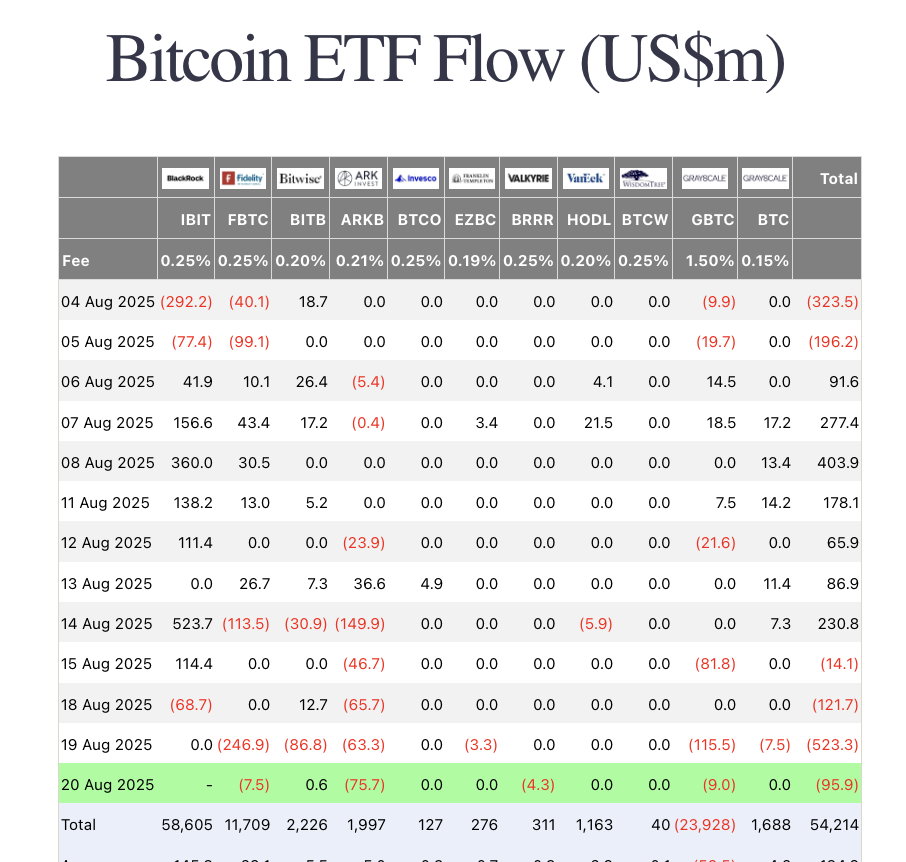

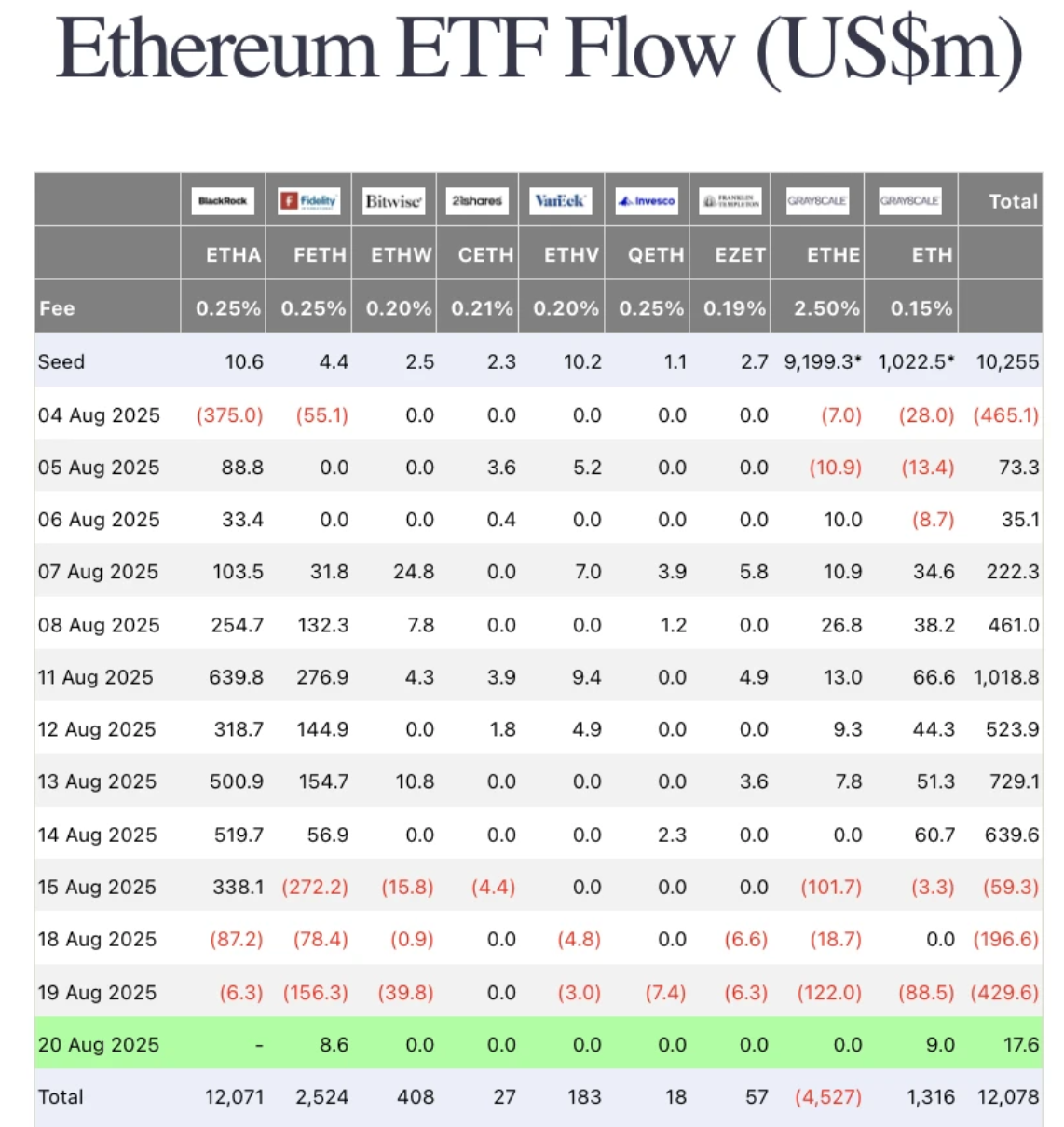

On August 20, BTC ETFs leaked $96M, while ETH ETFs actually pulled in $18M, marking a rare divergence.

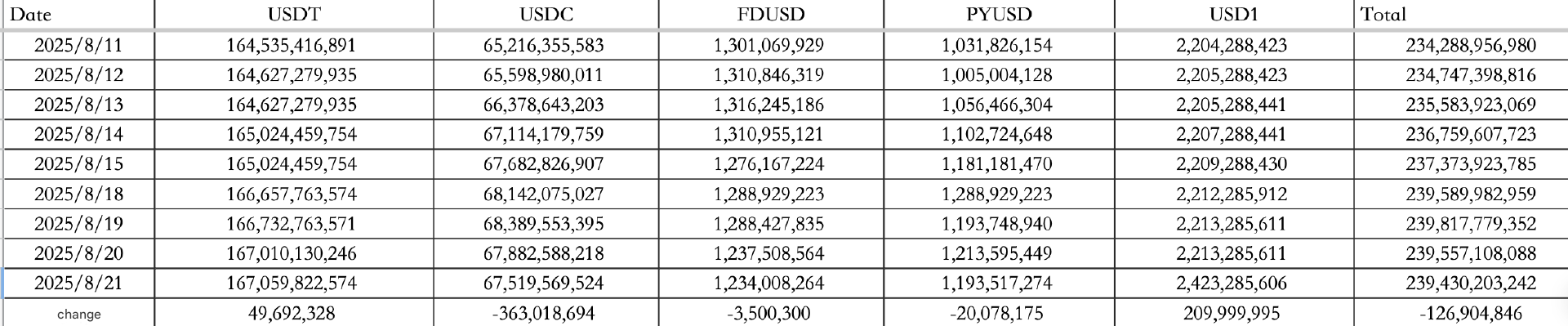

Stablecoins painted the same messy picture. Net outflows hit $126M, with USDC bleeding $363M and USD1 losing $127M. Only USDT managed to scrape together a $50M inflow, leaving the total stablecoin stack at $239.43B after correcting prior miscounts.

Liquidity is still trickling out, even as whales sniff around. Case in point: Hong Kong–based Mingcheng Group just announced a $483M purchase of 4,250 BTC, adding some serious size to its treasury.

How to start trading Ethereum

Ethereum’s more than just a coin, it’s an entire ecosystem. If you're ready to trade ETH like a pro (or at least fake it till you make it), Toobit makes trading altcoins easy. From Spot to Futures, we’ve got the whole toolkit.

Policy heat

Macro markets were muted: the Dow barely up 0.04%, Nasdaq off 0.67%, S&P 500 down 0.24%. Bond yields cooled, the 10-year sliding to 4.29%, while the U.S. dollar index edged down to 98.28. Gold eased 0.18%.

Nothing major on the market front. The real fireworks were political.

The Fed got dragged into the mud when housing finance chief Bill Pulte accused Fed Governor Lisa Cook of falsifying documents to secure better loan terms, calling for criminal charges.

Lisa Cook, a permanent FOMC voter, is one of the most dovish on the board. If she’s forced out, the balance of power could tilt sharply. That alone has traders gaming future rate cuts.

<blockquote class="twitter-tweet"><p lang="en" dir="ltr">Federal Reserve Governor Lisa Cook signaled her intention to remain at the central bank in defiance of calls for her resignation by President Donald Trump over allegations of mortgage fraud <a href="https://t.co/jGSfgOlTu5">https://t.co/jGSfgOlTu5</a></p>— Bloomberg (@business) <a href="https://twitter.com/business/status/1958282012659204213?ref_src=twsrc%5Etfw" rel="nofollow">August 20, 2025</a></blockquote> <script async src="https://platform.twitter.com/widgets.js" charset="utf-8"></script>

Meanwhile, SEC Chair Paul Atkins drew a line under the Gensler era, saying only a “tiny fraction” of tokens should be treated as securities.

The message was blunt: innovation over restriction. The regulatory winds are shifting.

Alpha watch

Lombard’s latest community round underwhelmed at a $450M FDV, paling next to Babylon’s $520M tag. Investors aren’t biting hard.

In contrast, StableStock just wrapped a seed round with YZi Labs, MPCi, and Vertex Ventures, positioning itself as a DeFi layer for tokenized equities.

With public beta now live, it’s one to watch for airdrop hunters.