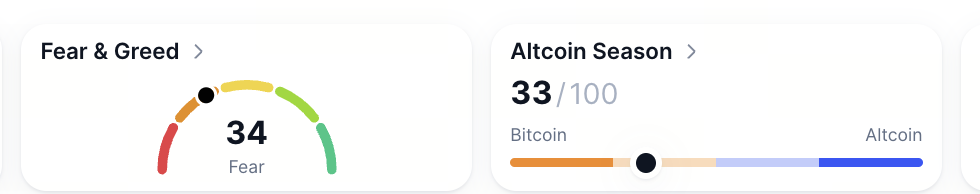

Crypto sentiment steadied overnight with the Fear & Greed Index at 34, despite increased risk appetites around tech and AI stocks. Bitcoin continues to dominate at 59.51%, while the Altcoin Index inched down to 33, showing continued caution towards smaller caps.

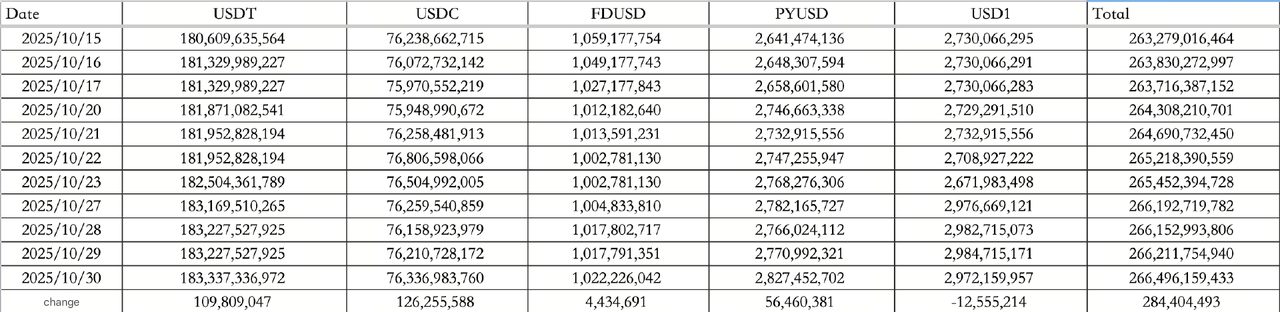

Stablecoins saw renewed momentum, with $284.40M in inflows on October 30: USDT added $109.81M, while USDC saw $126.26M inflow, pushing total stablecoin circulation to $266.49B.

ETF activity stayed muted as investors digested macro cues. However, Fidelity's updated S-1 filing for its Solana ETF drew attention, echoing last week's enthusiasm for crypto-backed funds.

Traditional markets

Wall Street traded cautiously after the Federal Reserve's decision to cut rates by 25 basis points, lowering the target range to 3.75–4.00%. This makes it the Reserve's second consecutive rate cut, aligning to market expectations.

The Dow Jones slipped 0.16%, while the Nasdaq rose 0.55% on tech resilience. The S&P 500 closed flat.

Bond yields inched higher: the 10-year Treasury increased from 2.51% to 4.07%, while the Dollar Index inched upwards by 0.35% to 99.07.

Gold held steady at $3,954, signaling investor hesitation as markets reassess the Fed's next move.

Macro policy highlights

The Fed's latest statement confirmed it will end balance sheet reduction on December 1, concluding its $5B monthly Treasury and $35B MBS runoff. Chair Jerome Powell emphasized that a December rate cut is "far from certain", revealing clear divisions within the committee.

Powell hinted that the pace of future easing could slow without stronger data, noting that limited economic reporting during the government shutdown has complicated the outlook.

Meanwhile, Donald Trump projected $21–22T in investment inflows into the U.S. if re-elected, targeting 4% GDP growth next quarter and reaffirming his opposition to higher interest rates.

Industry highlights

Institutional moves underscored selective optimism.

Solana Company disclosed it had raised its holdings to 2.3M SOL (~$230M), while Fidelity's revised Solana ETF filing removed a delay clause to align with Bitwise's SOL ETF structure, granting the SEC more timing control.

At the same time, 21Shares submitted paperwork for a Hyperliquid ETF, signaling persistent interest in altcoin-linked instruments.

In the tech sector, OpenAI is reportedly eyeing a 2027 IPO, while ConsenSys, the parent of MetaMask, has hired JPMorgan and Goldman Sachs to lead its initial IPO, potentially in 2026.

On-chain data from Glassnode showed Bitcoin struggling to regain momentum, failing to hold above the short-term holder cost price of approximately $113K, a signal that consolidation may extend before long-term accumulation resumes.

Alpha radar

The second phase of Stable deposits is set to launch next week, implementing a fixed total deposit cap and per-wallet deposit limits.

Simultaneously, traders are watching the ARC and Temopo stablecoin projects for upcoming activity.

Another key launch to keep an eye out is Base's token launch. As the coin debut draws closer, attention is turning to 13 standout projects building within Base's ecosystem, ranging from Web3 social platforms and AI-driven protocols to decentralized trading and lending networks. Highlights include BaseApp, Farcaster, Aerodrome, and Morpho, each showing strong growth in user activity and liquidity.

How to start trading Solana

Solana isn't just fast, it's lightning. From meme launches to serious DeFi, SOL is where the action lives. If you're ready to ride the high-speed rails, Toobit makes trading Solana simple. Spot, Futures, and the full pro toolkit are all at your fingertips.