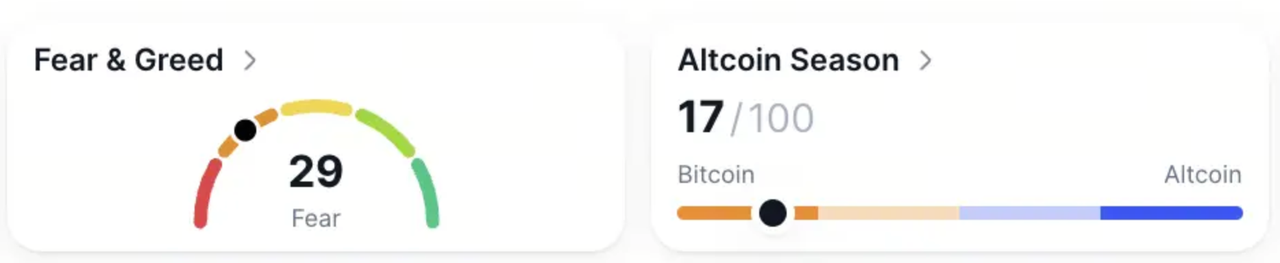

Markets opened with a firmer tone after the Fear and Greed Index climbed to 29, its highest in one month despite remaining in fear territory. The Altcoin Index printed 17, confirming muted risk rotation.

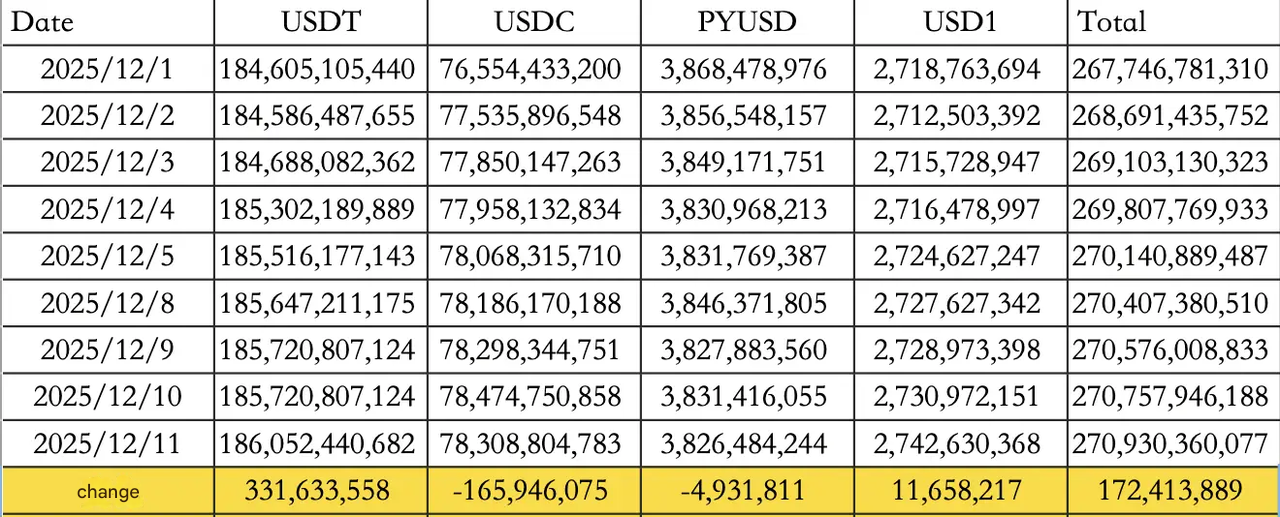

Stablecoin activity strengthened the backdrop, with $172.41M in net inflows for the day, supported by $331.63M USDT inflow and a $165.95M USDC outflow. Total circulating supply hits $270.93B today.

ETF flows stayed steady. On 10 December, excluding BlackRock data, ETH ETFs recorded $1.1M in net inflows, while BTC ETFs added $30.6M.

Traditional markets

Wall Street gained across the board:

-

The Dow up 1.05%

-

The Nasdaq up 0.33%

-

The S&P 500 up 0.67%

Yields eased as the U.S. 10Y fell 0.34% to 4.14, while the DXY slipped 0.03% to 98.60. Gold also softened slightly, closing at $4,224.69, down 0.07%.

Macro policy updates

The Fed delivered its third consecutive 25bp cut, moving the policy rate from 3.50% to 3.75% and completing 75bp of cumulative cuts this year. The updated dot plot signaled one 25bp cut in 2026 and another in 2027, reinforcing a controlled normalization path rather than an aggressive easing cycle.

President Trump reiterated criticism of Chair Powell, calling the cut "too small" and suggesting the Fed could have doubled the move. The policy tone still leans supportive, but messaging reflects rising political scrutiny heading into 2026.

Industry highlights

Institutions continued reinforcing long horizon narratives around sector growth.

Liquid Capital founder Yi Lihua noted that ETH remains deeply undervalued, framing the current setup around rate cut momentum, policy tailwinds, and long term stablecoin expansion. He highlighted that ETH's fundamentals have diverged meaningfully from prior cycles, adding that volatility in spot markets already offers sufficient opportunity without engaging in leveraged derivatives.

Separately, Bitwise's CEO argued that the industry's four year cycle is effectively over, contending that when looking back at 2025, it will become clear that markets entered a bear phase as early as February but were masked by consistent buy flows from reserve asset entities. His view positions the groundwork for a 2026 macro driven breakout already in motion.

Alpha watch

Activity centered around yield, pre IPO exposure, and evolving derivatives incentives.

A new Yield+ USDD USDT strategy offers a share of $300K equivalent USDD APR rewards for participants who complete all staking steps with at least $100 committed.

Attention also turned to the Pre IPO track, where early access narratives continue to build.

Additionally, Aster announced 0% maker and taker fees for all U.S. equity perpetuals, including NVDA, TSLA, AMZN, and AAPL. Its fourth phase Harvest rules introduce rewards for deepening liquidity through maker activity, positioning the platform to grow on chain equity perpetual depth.

Concluding note

Liquidity continues leaning constructively.

The Fed's measured easing path, stablecoin inflows, and steady ETF participation hint at a market preparing gradually for 2026 rather than chasing aggressive short term swings. With sentiment recovering from recent lows, conditions remain sensitive but increasingly receptive to incremental catalysts.