Markets across digital assets and equities fell in tandem as investors priced in lower odds of a December rate cut.

The Fear & Greed Index slumped to 16, signaling deep caution, while BTC dominance rose to 60.13%.

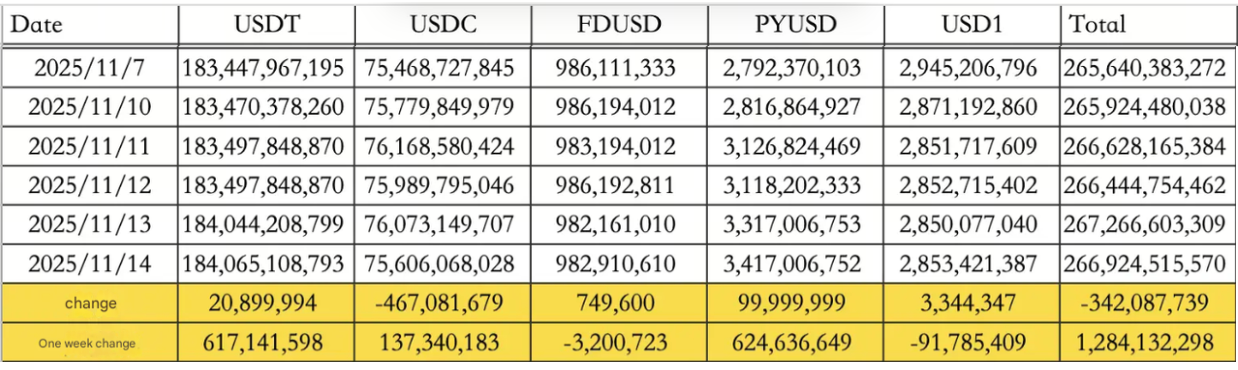

Stablecoins showed continued pressure, with a $342.09M net outflow on November 14. USDT saw $20.90M inflow, but USDC lost $467.08M, bringing total stablecoin supply to $266.92B. Over the last one week, stablecoins experienced an overall positive gain of $1.28B, reflecting a moderate risk appetite and potentially growing investor confidence despite today's spike in the Fear and Greed index.

Spot ETF data on November 12 revealed ETH ETF outflows of $183.7M, BTC ETF outflows of $278.1M, and a minor SOL ETF inflow of $18.1M.

The standout event came as Canary XRP ETF began trading, marking the first spot XRP ETF and broadening institutional access beyond BTC, ETH, and SOL.

Traditional markets

Global markets moved defensively as tightening liquidity and softer risk appetite pressured major asset classes.

-

Wall Street: The Dow Jones fell 1.65%, S&P 500 dropped 1.66%, while the Nasdaq slipped 2.29%.

-

Bonds and dollar: The 10 year U.S. Treasury yield rose 1.23% to 4.12%, while the U.S. Dollar Index dipped 0.22% to 99.25.

-

Gold: Spot prices inched up 0.18% to $4,178.71.

Macro policy updates

White House National Economic Council Director Kevin Hassett projected U.S. Q4 GDP may fall by 1.50% if the government shutdown drags on. A jobs report will be released this week but will exclude the unemployment rate, keeping focus on aggregate employment trends.

In Europe, the Czech National Bank (CNB) launched a $1M pilot portfolio containing BTC, a USD stablecoin, and a tokenized deposit, aiming to test blockchain asset management over 2–3 years. The CNB emphasized it has no immediate plans to include BTC or other digital assets in its official reserves.

Industry highlights

-

KOL sentiment cools: Many influencers are avoiding newly listed tokens amid declining liquidity.

-

EIP-7702 upgrade: A major exchange announced instant support for EIP-7702, which allows EOA addresses to execute smart contract code. This enables account abstraction, batch transactions, and gas fee delegation for a smoother user experience.

-

Risk warning: A leading executive cautioned that DAT (Digital Asset Token) structures could face severe stress in prolonged downturns, echoing prior collapses like STEPN, Luna, and FTX, where leverage triggered reflexive selloffs.

Alpha watch

-

Polymarket x UFC: A multi-year partnership brings on-chain prediction markets into live UFC broadcasts, visualizing fan sentiment in real time.

-

Stable network: The team confirmed a November 26 TGE, with USDT as the native gas token to stabilize fees and ensure predictable payment costs.

-

Aztec Network: Private L2 project Aztec Network priced a secondary sale at $0.03, implying a $337.8M FDV.

-

Uniswap's new CCA protocol: The Continuous Clearing Auction enables fair, transparent token launches on Uniswap v4, co-developed with Aztec using ZK Passport for private but verifiable participation.

Concluding note

Markets continue to be cautious and sentiment remains fragile, as rate-cut hopes fade and ETF flows turn negative today. Still, innovation continues with XRP's ETF debut, CNB's digital asset experiment, and Uniswap's on-chain auction model, showing structural progress even as risk appetite retreats.