Bitcoin dominance slipped 0.42% to 59.16% while the Fear and Greed Index held at 25, signaling lingering caution across the market.

Meanwhile, the Altcoin index has dipped to 18.

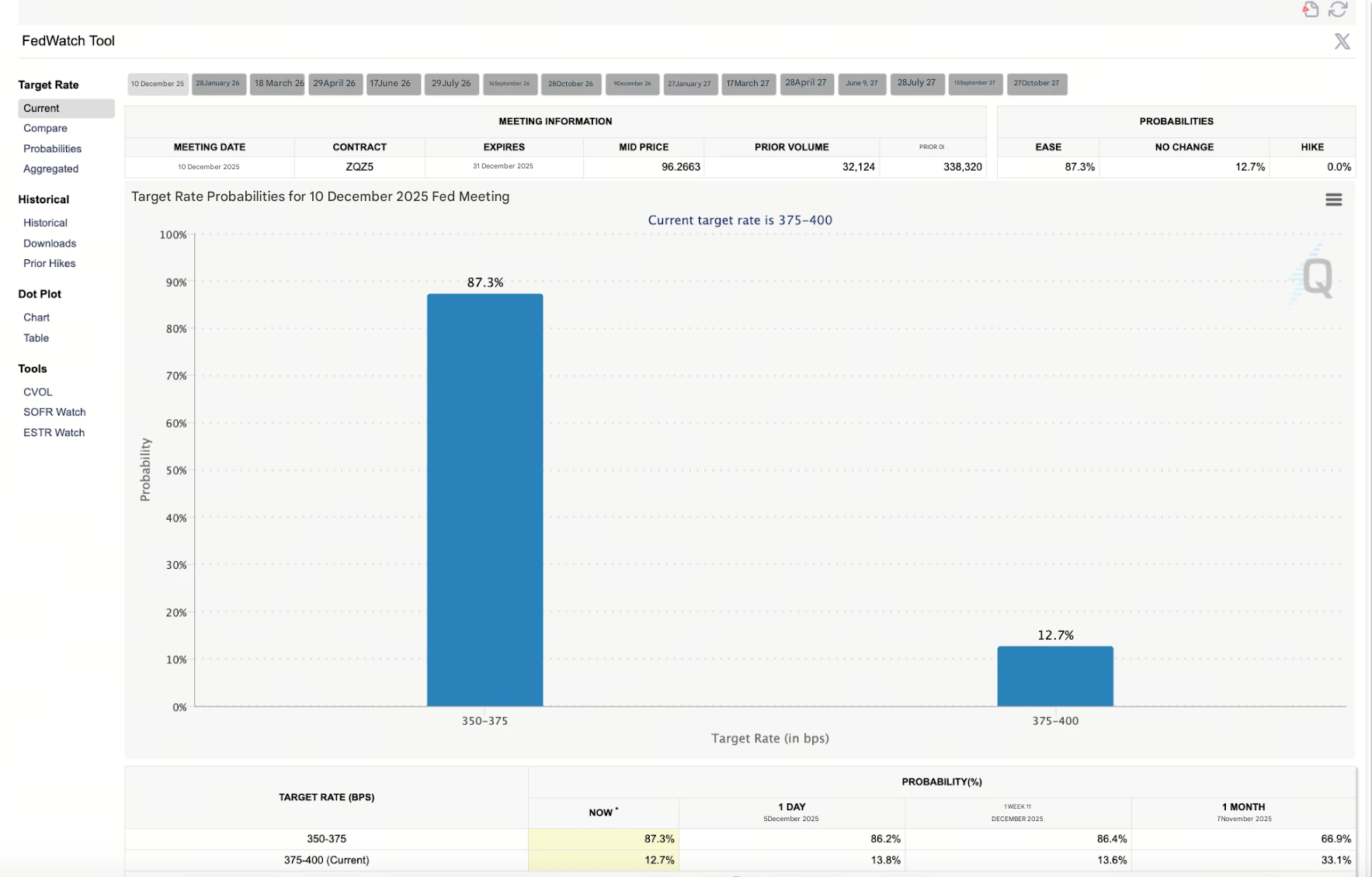

Prices stayed muted ahead of this week's Federal Reserve decision as traders waited for confirmation of another rate cut.

Stablecoins saw a net inflow of $168.63M, with $73.60M entering USDT and $112.17M entering USDC. Total stablecoin supply now stands at $270.58B, marking a meaningful liquidity uptick despite broader market hesitation.

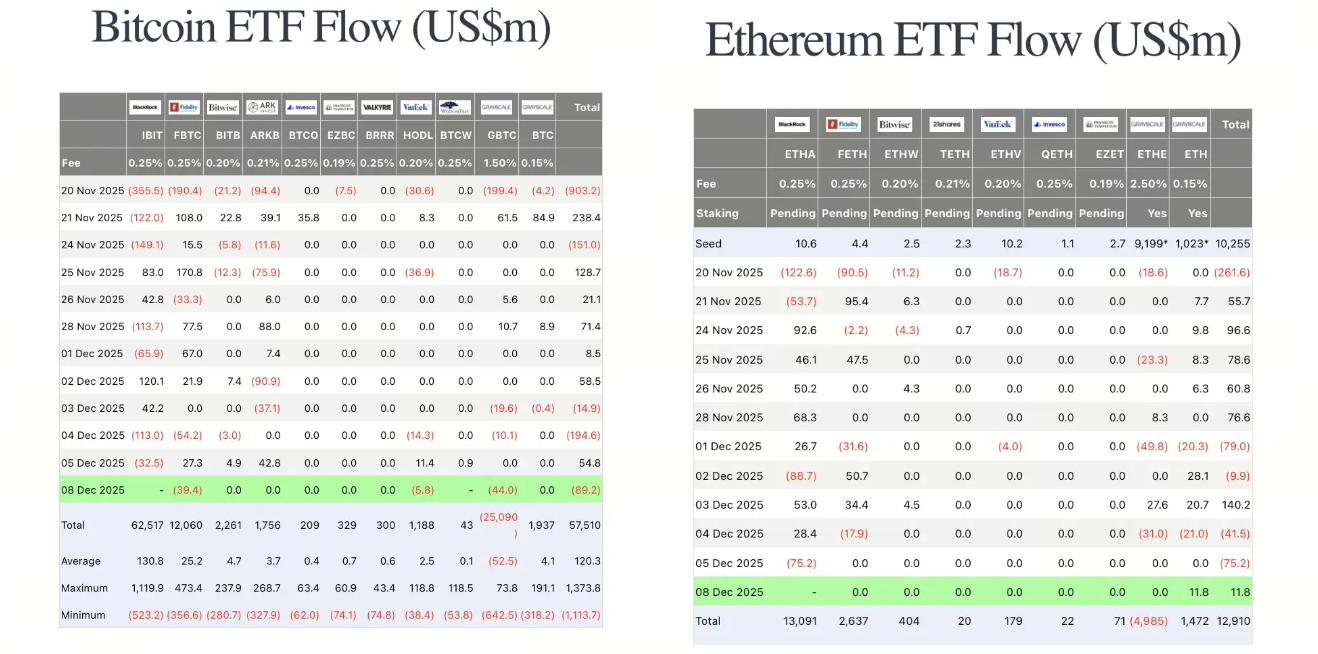

ETF flows on December 8 were mixed. Without updated data from BlackRock, Bitcoin ETFs recorded a net outflow of $89.2M while Ethereum ETFs saw a modest $11.8M inflow.

Traditional markets

U.S. equities moved lower:

-

The Dow slipped 0.45%

-

The Nasdaq fell 0.14%

-

The S&P 500 declined 0.35%

Bond and currency markets showed caution ahead of the Federal Reserve decision:

-

The 10-year Treasury yield edged higher, while the U.S. dollar index held slightly weaker.

-

Gold traded near flat with a mild downward bias.

Macro policy updates

The dollar softened as investors positioned ahead of the Federal Reserve meeting. Analysts widely expect another rate cut. Deutsche Bank projected that the Fed may announce its third and final 25 basis point cut of 2025, although the vote may not be unanimous.

According to FedWatch data, the probability of a rate cut stands at 87.3%.

U.S. policy signals

President Trump outlined new national security priorities in a Friday release, listing artificial intelligence and quantum computing as core strategic interests for American leadership. The statement highlighted the administration’s intent to shape global standards across AI, biotechnology, and quantum technologies.

Regulatory update

The SEC has closed its two-year investigation into Ondo, clearing the path for the project to accelerate its tokenized asset expansion in the U.S.

Industry highlights

Tokenized equities see massive growth

A newly released report on tokenized U.S. equities showed a dramatic surge in activity during the latest earnings season.

From mid-October through the end of November:

- Spot trading volume rose 452%

- Futures trading volume jumped 4,468%

East Asia accounted for 39.66% of total activity, followed by strong participation from Latin America, South Asia, Southeast Asia, and Europe.

High frequency traders executed an average of 51.7 trades per day, far exceeding the activity of selective retail investors.

Futures trading concentrated heavily on Tesla, Meta, and MicroStrategy, reinforcing the idea that capital is clustering around major tech names in tokenized form.

Ethereum gas fees hit an eight-year low

Data from Glassnode showed that Ethereum’s daily total fee revenue, based on a 90-day moving average, has fallen below 300 ETH per day. This is the lowest level recorded since July 2017 and reflects a broad cooldown in network activity.

Uniswap closes its first CCA auction

Uniswap founder Hayden Adams announced the completion of the protocol’s first CCA auction with $59M in total bids. The auction featured no sniping and no timing games, delivering a slow, transparent, and fair price discovery process.

Final settlement prices came in 59% above the reserve price. Early bidders who entered near a $10B FDV level still secured blended pricing between the reserve and final clearing price.

Most of the auction proceeds and token reserves will be deployed as initial liquidity for Uniswap v4 pools, forming one of the main liquidity sources for its secondary markets.

How to start trading Ethereum

Ethereum's more than just a coin, it's an entire ecosystem. If you're ready to trade ETH like a pro (or at least fake it till you make it), Toobit makes trading altcoins easy. From Spot to Futures, we’ve got the whole toolkit.

Alpha Watch

Stablecoin farming guidance

Analysts noted that recent stablecoin issuance data confirms that fewer actions lead to fewer mistakes in current conditions. Stable yield is estimated at 4% on depositable amounts. There is no safety cushion or guaranteed return, and buying yield tokens introduces additional risk.

Polymarket and the Epstein Files prediction

Polymarket’s markets on whether President Trump will release Epstein files by December 19 or December 31 remain tightly contested.

Trump signed the Epstein Files Transparency Act on November 19, requiring the Department of Justice to release all unclassified documents within 30 days. This sets a legal deadline of December 19.

Market pricing reflects uncertainty:

- 56% probability of release by December 19

- 70% probability of release by December 31

Strict settlement rules require that the documents be proactively released by the executive branch through official channels, and the release must contain substantive content about Epstein’s illegal activities.

Court unsealings, congressional disclosures, or metadata without substance do not qualify.

Concluding note

Markets traded cautiously ahead of the Federal Reserve meeting while stablecoin inflows strengthened and ETF flows stayed mixed.

Tokenized equities surged, Ethereum fees hit historic lows, and Uniswap’s first CCA auction drew strong demand, highlighting growing activity across the broader crypto ecosystem.