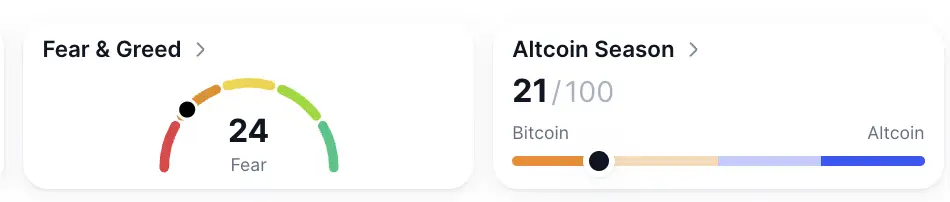

Market sentiment remained cautious as the Fear and Greed Index held at 24 with Altcoin index at 21, showing that risk appetite has stabilized but not improved meaningfully.

Traders continue to prioritize capital preservation ahead of clearer policy direction.

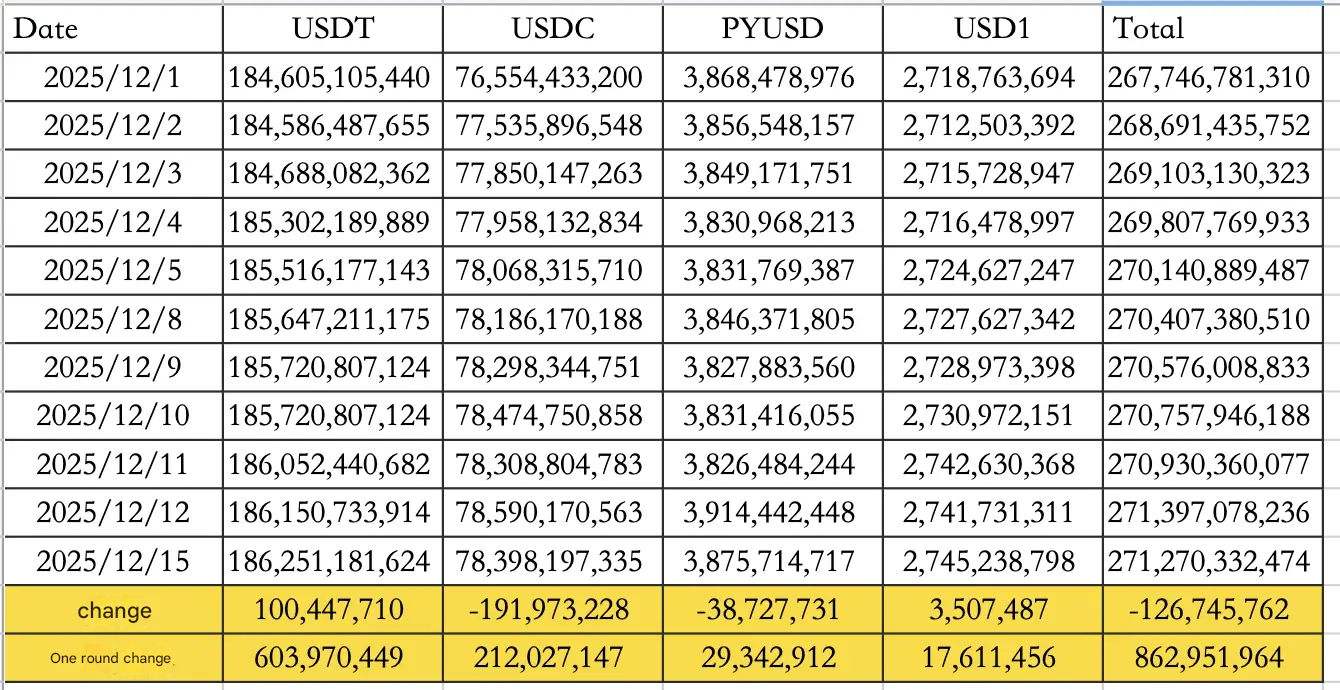

Stablecoin flows showed net outflows of $126.75M on December 15, driven by a $100.45M inflow into USDT and a $191.97M outflow from USDC.

Total stablecoin supply now stands at $271.27B, indicating modest liquidity contraction after recent inflow streaks.

Macro policy updates

Federal Reserve leadership signals

White House National Economic Council Director Kevin Hassett stated that if selected to lead the Federal Reserve, he would consider President Trump’s policy views while maintaining the Fed’s independence in rate decisions. His comments reinforced expectations that political pressure may shape the policy debate without formally overriding central bank autonomy.

Former Federal Reserve Governor Kevin Warsh saw a sharp rise in nomination odds. On prediction markets, the probability of Warsh being nominated as the next Fed Chair jumped from 7% to 38%, while Hassett's odds fell from a prior high of 85% to 52%. The rapid shift highlights growing uncertainty around future monetary leadership.

President Trump reiterated his preference for aggressive easing, stating that he would like to see interest rates remain at 1% or lower within one year, reinforcing market expectations of continued pressure on the Fed to cut.

Equity index changes

The Nasdaq 100 completed its annual rebalancing, removing six companies and adding three new constituents, with changes taking effect on December 22. Notably, Bitcoin treasury company Strategy will remain in the index, underscoring the growing acceptance of crypto-linked firms in major equity benchmarks.

Regulatory update

The U.S. Securities and Exchange Commission (SEC) released new educational materials focused on crypto wallet usage. While framed as investor education, the move signals ongoing regulatory engagement with self custody and on-chain infrastructure.

Industry highlights

Bitcoin cycles reframed

10x Research head Markus Thielen argued that Bitcoin's four-year cycle remains intact, but its primary drivers have shifted away from halvings. Instead, he pointed to political dynamics, liquidity conditions, and election cycles as the dominant forces shaping market peaks.

Thielen highlighted that Bitcoin market tops in 2013, 2017, and 2021 all occurred in the fourth quarter, aligning more closely with U.S. election timing than halving schedules, which vary across calendar years.

Portfolio rebalancing toward crypto

ARK Invest CEO Cathie Wood said the firm trimmed Tesla holdings near recent highs and reallocated part of the profits into crypto assets. She described the move as a disciplined rebalancing strategy, increasing exposure to assets experiencing temporary stress while reducing positions that have outperformed.

Ethereum supply concentration

Fund strategist Tom Lee revealed that Bitmine is approaching ownership of nearly 4% of Ethereum's total supply. He added that he believes the company has no intention of selling its ETH holdings, reinforcing the narrative of long-term institutional conviction in Ethereum.

Solana breakpoint 2025 takeaways

Key observations from Solana Breakpoint 2025 focused on network resilience and decentralization. The launch of Firedancer on mainnet marks Solana's first fully independent validator client, separate from Agave and Jito. This reduces the risk of network outages caused by single-client bugs and represents a meaningful step toward decentralization.

While Firedancer is a major milestone, the more transformative performance upgrade is expected with the Alpenglow consensus protocol, currently targeted for Q1 2026. Alpenglow is anticipated to deliver a more visible leap in throughput and latency.

How to start trading Solana

Solana isn't just fast, it's lightning. From meme launches to serious DeFi, SOL is where the action lives. If you're ready to ride the high-speed rails, Toobit makes trading Solana simple. Spot, Futures, and the full pro toolkit are all at your fingertips.

Alpha watch

High conviction accumulation

A prominent crypto founder confirmed continued accumulation of the ASTER token, stating that total purchases exceeded $2M and that additional buys were made after the initial disclosure.

Previously shared transaction data showed holdings of 2,090,598.14 ASTER acquired at a price of $0.913, with subsequent additions made days later. The continued buying has drawn attention from traders tracking high-conviction capital flows.

Concluding note

Markets remain cautious as liquidity tightens slightly and rate expectations stay in focus.

Institutional conviction is building beneath the surface, with concentrated Ethereum holdings, steady Bitcoin cycle analysis, and meaningful progress across the Solana ecosystem.

While sentiment remains restrained, long-term positioning suggests confidence has not faded.