Risk appetite continued to erode as liquidity conditions tightened and capital flows weakened across crypto markets.

Bitcoin dominance held firm at 59.35%, signaling a defensive tilt, while the Fear and Greed Index dropped to 16, placing sentiment deep in fear territory.

Price action reflected restraint rather than panic, but participation thinned as traders pulled back exposure.

The broader message was consistent across indicators. This is not a market chasing upside. It is a market preserving capital.

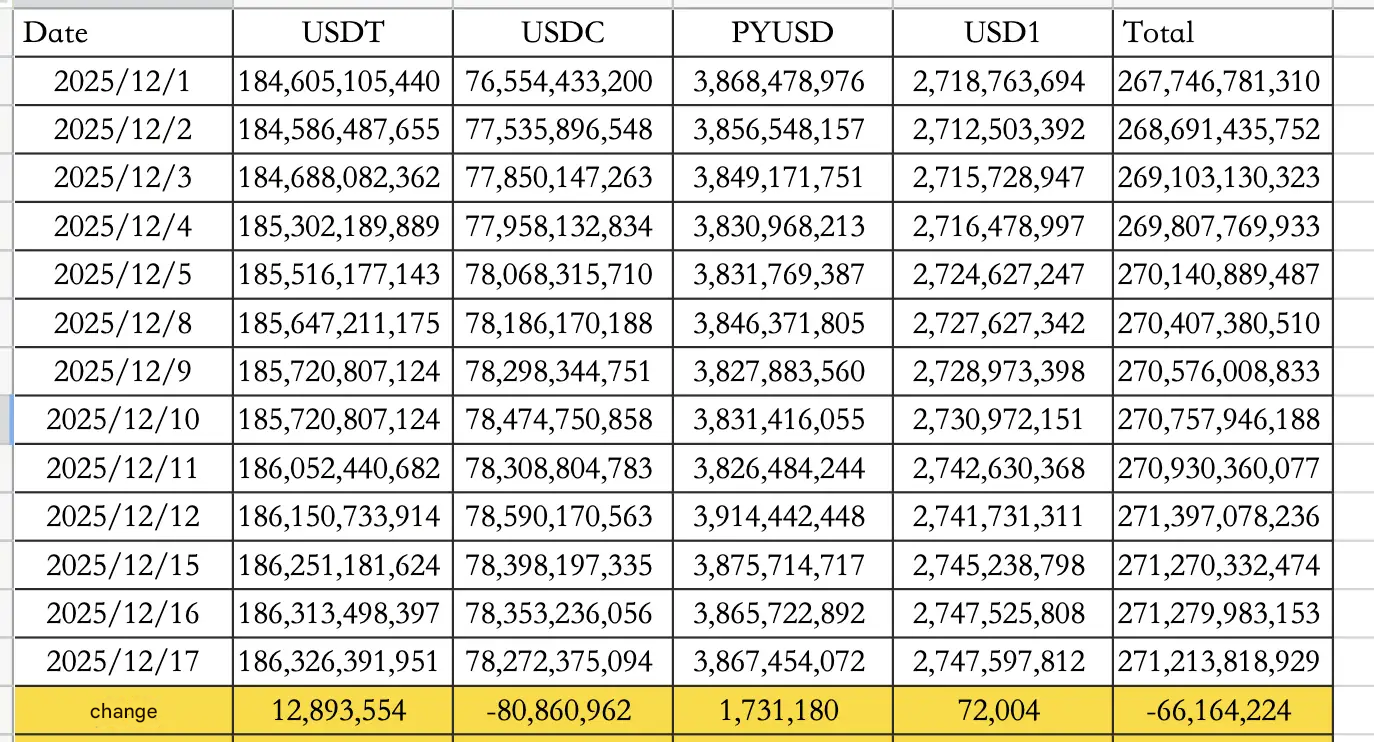

Stablecoin flows reinforced the cautious tone. On December 17, total stablecoin supply fell to $271.21B following a net outflow of $66.16M.

USDT recorded a modest $12.89M inflow, while USDC saw a sharper $80.86M outflow, highlighting selective positioning rather than broad risk re-entry.

The pattern suggests capital is rotating, not exiting crypto entirely, but waiting for clearer direction.

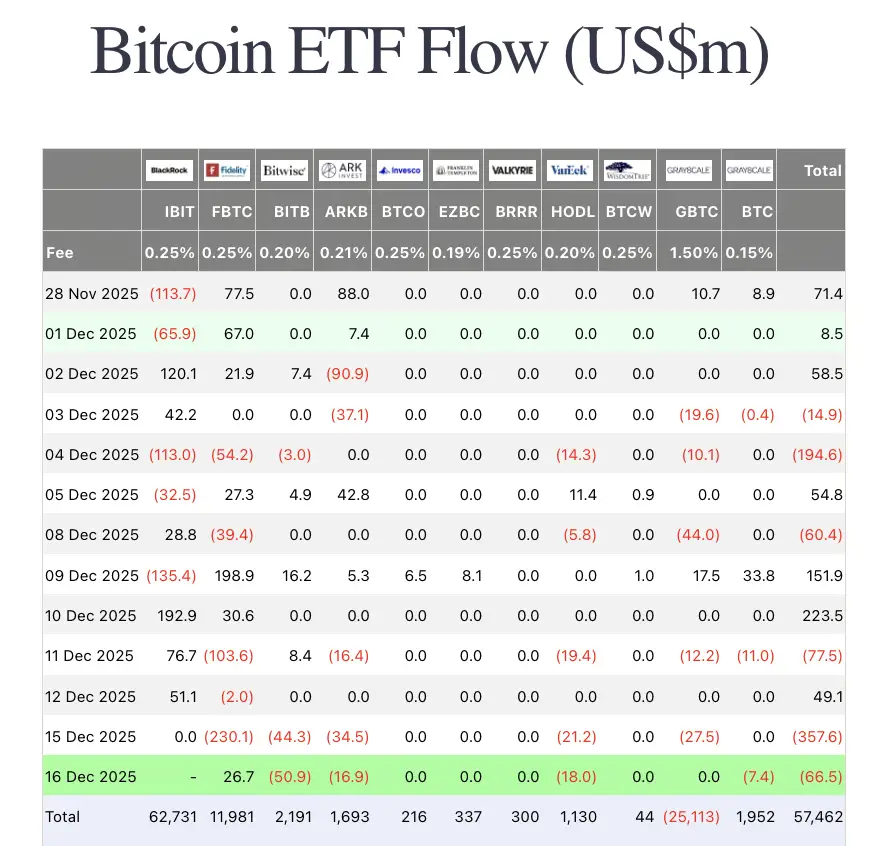

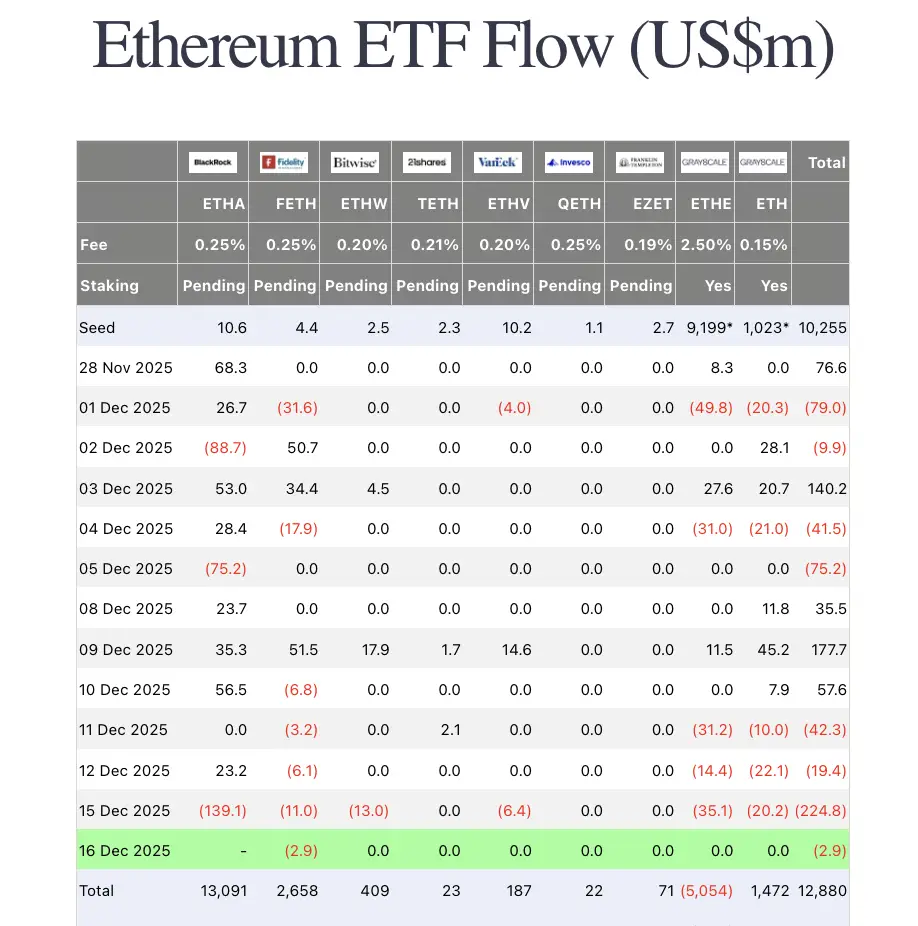

ETF data remained a headwind. On December 16, and excluding BlackRock figures, Bitcoin ETFs recorded $66.5M in net outflows, while Ethereum ETFs saw $2.9M in outflows.

Flows have now turned consistently negative since mid month, confirming that institutional demand has slowed meaningfully. Without ETF support, spot markets have struggled to build sustained momentum.

Traditional markets

U.S. equities posted mixed performance.

-

The Dow fell 0.62%

-

The Nasdaq rose 0.23%

-

The S&P 500 declined 0.24%

This reflects uneven sentiment as gains in technology stocks were offset by broader market weakness.

Macro policy updates

Jobs data supports Fed's cautious stance

U.S. macro data added to uncertainty. November unemployment rose to 4.56%, above expectations of 4.44%, while non-farm payrolls came in at 50,000, below the 64,000 forecast.

Fed Chair Jerome Powell stated last week that the Federal Reserve expects its current policy stance to stabilize unemployment, or at most allow it to rise by "one or two tenths of a percent".

The latest jobs report supports the view that the rate cuts implemented so far were reasonable, but current labor conditions may not yet justify another rate cut in January.

Fed Chair interviews enter final stage

U.S. Treasury Secretary Scott Bessent said there may be one or two additional interviews this week for the next Federal Reserve Chair. He noted that President Trump has been very direct on policy-related issues during the interview process.

Bessent added that both Kevin Warsh and Kevin Hassett are "very, very qualified" candidates. He expects the final decision on the Fed Chair appointment to be announced in early January.

Tax refunds seen as potential liquidity boost

Bessent also stated that U.S. households could receive between $1,000 and $2,000 in tax refunds, with total refunds estimated at $100B to $150B in the first quarter of next year. Markets are closely watching this potential cash injection as a near-term liquidity catalyst.

Trump to address the nation on Thursday

President Trump is expected to deliver a nationwide address on Thursday, where he may preview upcoming policy initiatives for the new year.

Industry highlights

a16z proposes "Staked Media" model

Andreessen Horowitz introduced the concept of "staked media", proposing a future where publishers and creators cryptographically stake assets such as ETH or USDC to verify content credibility. False information would result in slashed collateral, creating financial incentives for truth.

Bitwise forecasts structural shift in crypto markets

Bitwise released its 2026 crypto outlook, projecting that Bitcoin will break the four year cycle, ETF demand will exceed 100% of the new BTC, ETH, and Solana supply, and that over 100 crypto-linked ETFs will launch in the U.S. The firm also expects stablecoins to face growing political scrutiny in emerging markets.

HashKey IPO trading signals valuation pressure

HashKey Holdings saw its shares briefly trade below the offering price in Hong Kong gray market trading, drawing attention to valuation pressure in crypto related equities.

How to start trading Ethereum

Ethereum's more than just a coin, it's an entire ecosystem. If you're ready to trade ETH like a pro (or at least fake it till you make it), Toobit makes trading altcoins easy. From Spot to Futures, we’ve got the whole toolkit.

Alpha watch

Prediction markets heat up on BSC

Prediction markets continued to draw attention, particularly on BSC, with several projects backed by YZi Labs emerging as volume leaders.

Opinion Labs and Predict.fun compete for flow

Opinion Labs gained traction following high profile social amplification and claims that its trading volume has surpassed Polymarket, while Predict.fun launched aggressive incentive campaigns targeting users from competing platforms.

Probable, incubated by PancakeSwap, remains unreleased but is drawing interest due to its automated USDT conversion model.

Concluding note

Liquidity remains thin, ETF demand is weakening, and sentiment is firmly risk off. Institutions are not abandoning the market, but they are clearly waiting.

Until a new macro or liquidity catalyst emerges, patience remains the most valuable position.