Global markets tumbled as risk sentiment deteriorated across equities and crypto alike.

In Asia, South Korea’s KOSPI slid 4% while Japan’s Nikkei 225 lost 2%.

U.S. stocks followed suit, with the Dow down 0.53%, the Nasdaq off 2.04%, and the S&P 500 falling 1.17%, its steepest one-day drop in a month.

Bond and currency markets showed mixed signals. The 10-year U.S. Treasury yield slipped 0.66% to 4.056%, while the dollar index broke above 100 to 100.15.

Gold gained 0.31% to $3,944.11 as investors rotated toward defensive assets.

Market sentiment and Bitcoin price action

Bitcoin briefly dipped below $100,000 overnight before recovering slightly, with the Fear and Greed Index plunging to 20, deep in “fear” territory while the Altcoin Season Index dipped slightly to 25. Analysts suggest the market may be approaching a short-term bottom.

Bitwise CIO Matt Hougan said retail capitulation is likely nearing its end, noting that “institutional flows through ETFs remain net positive.”

He added that institutional buyers now form the market’s core, while retail selling pressure is almost exhausted. Hougan believes Bitcoin still has a chance to test new highs before year-end, targeting between $125,000 and $130,000, with a possible extension to $150,000 if sentiment improves.

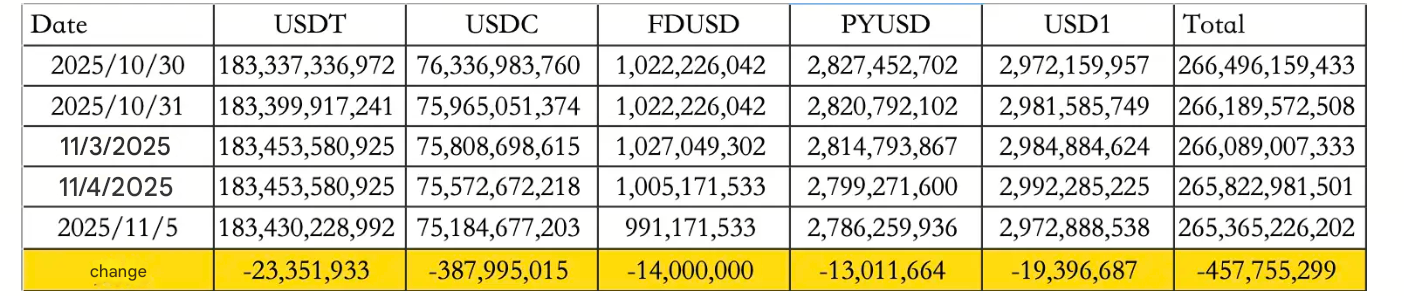

Stablecoin flows and market liquidity

Stablecoins saw heavy outflows on November 5, totaling $457.76M. USDT accounted for $23.35M in outflows, while USDC saw $387.99M in outflows too. The total circulating supply now stands at $265.37B.

The sustained reduction in stablecoin balances suggests traders are pulling liquidity back to sidelines or rotating into fiat.

However, previous data shows that sharp outflows often coincide with local bottoms in major crypto assets.

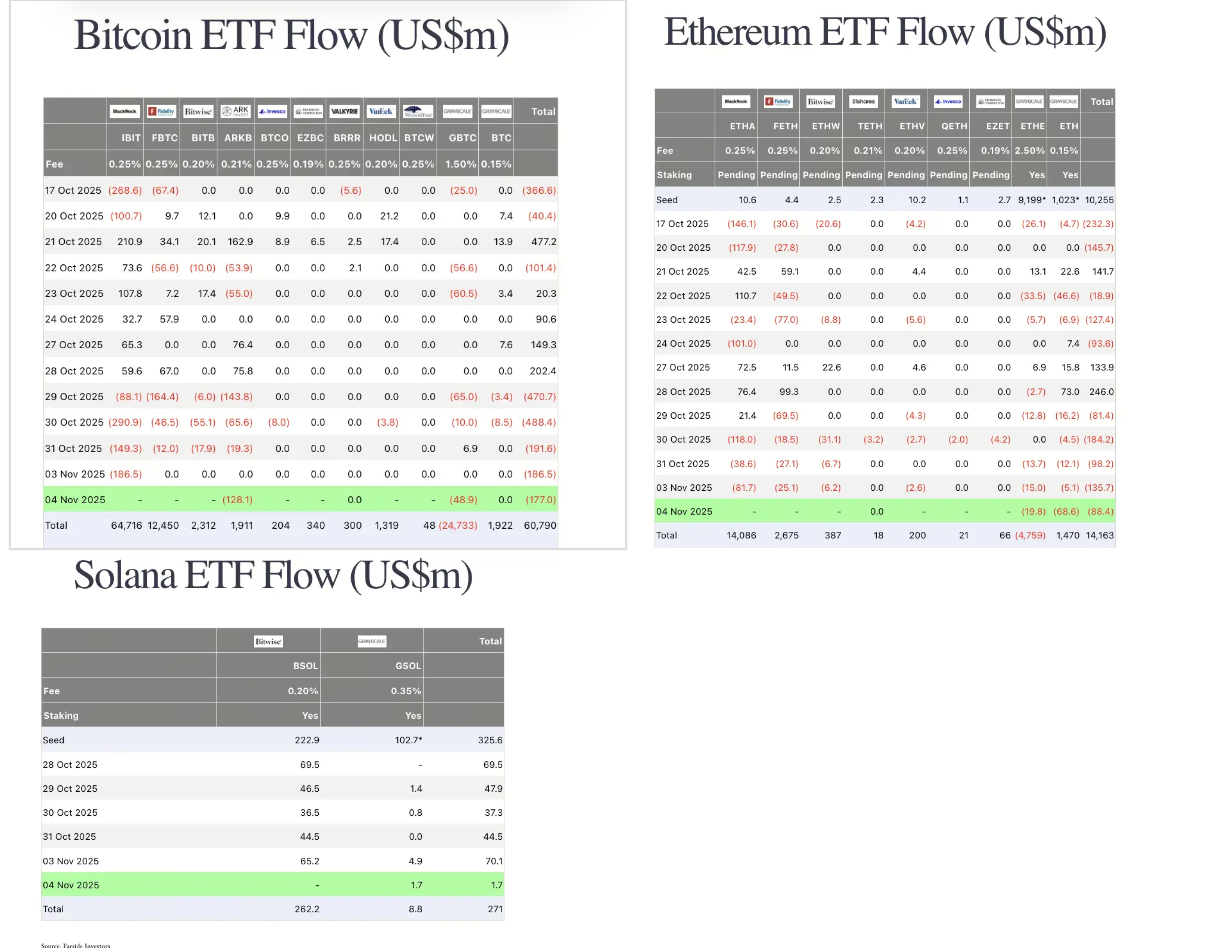

ETF data showed mixed flows on November 4. Bitcoin ETFs saw total net outflows of $177M while Ethereum ETFs posted outflows of $88.4M, marking continued weakness across institutional products.

In contrast, Solana ETFs recorded a small $1.7M inflow, signaling steady investor interest in alternative layer-1 exposure.

Policy and government watch

The U.S. government shutdown, which began on October 1, has now surpassed the 2018–2019 record to become the longest in American history. The Senate once again failed to pass a short-term funding bill on November 4, though optimism is building that a resolution could come soon.

Senator Markwayne Mullin of Oklahoma told reporters he was “confident a deal will be reached this week,” with some moderate Democrats considering a compromise to reopen the government temporarily before revisiting ACA subsidy extensions. Political analysts expect an agreement between November 8 and 11.

The Senate is expected to vote again on the temporary funding bill passed by the House on November 5 or later that same day.

However, reports indicate that while the Senate is currently in session, no specific time has been set for the next vote.

In addition, both chambers of Congress had previously discussed passing a short-term bill to extend government funding until November 21.

Industry highlights

Solana eyes on-chain IPOs

Solana Foundation President Lily Liu said during a recent panel that “on-chain native IPOs” could become a reality within a few years.

She also confirmed new partnerships with Western Union to expand blockchain payment solutions and stablecoin adoption.

Liu emphasized that “the essence of blockchain is to serve financial infrastructure through liquidity, speed, and cost efficiency.”

Michael Burry reloads on big tech shorts

Michael Burry’s hedge fund, Scion Asset Management, disclosed in its latest 13F filing that 80% of its portfolio is in put options against Nvidia and Palantir.

The fund holds $912M in Palantir puts and $186M in Nvidia puts, reflecting Burry’s view that valuations across AI-related equities have entered “bubble territory.”

Giggle becomes the first deflationary meme token

Giggle became the first meme token supported by exchange trading fees. Its “Giggle Fund Token” contract donates fees to the Giggle Academy, which in turn burns half of the tokens received and converts the rest into BNB for future operations.

CZ wrote that the initiative “marks a new phase where community contributions evolve into a sustainable feedback loop.” Giggle surged over 120% following the announcement.

Berachain recovers from exploit

Berachain confirmed that all $12.8M in funds lost due to the BEX / Balancer v2 vulnerability have been fully recovered and returned to the Berachain Foundation’s deployer address. The network has since resumed normal operations.

Alpha Watch

DEX trading boom continues

Perpetual DEX volume in October exceeded $1.7T for the fourth consecutive record month. Aster led the pack with $820.8B in volume, followed by Hyperliquid at $317B, Lighter at $272.5B, and EdgeX at $137.5B. The sector recorded 64,600 monthly active users, also an all-time high.

Steam Fund takes the first hit in the “1011 Chain Reaction”

The first casualty of the so-called “1011 chain reaction” has surfaced, as Steam Fund disclosed losses of $93M. Analysts are closely monitoring whether similar liquidity pressures emerge among other overexposed institutions.

How to start trading Solana

Solana isn’t just fast, it’s lightning. From meme launches to serious DeFi, SOL is where the action lives. If you’re ready to ride the high-speed rails, Toobit makes trading Solana simple. Spot, Futures, and the full pro toolkit are all at your fingertips.