Bitcoin’s grip on market share barely moved, with BTC dominance up 0.12% to 58.64%, while the Altcoin Index stayed flat at 49. That leaves the rotation narrative muted for now.

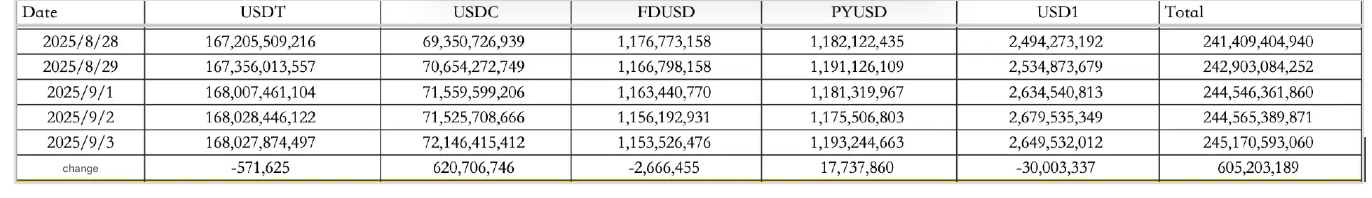

Stablecoins showed renewed inflows. On September 3, the basket added $605M, with USDT slipping $600,000 but USDC surging $621M. The total supply now sits at $245.17B.

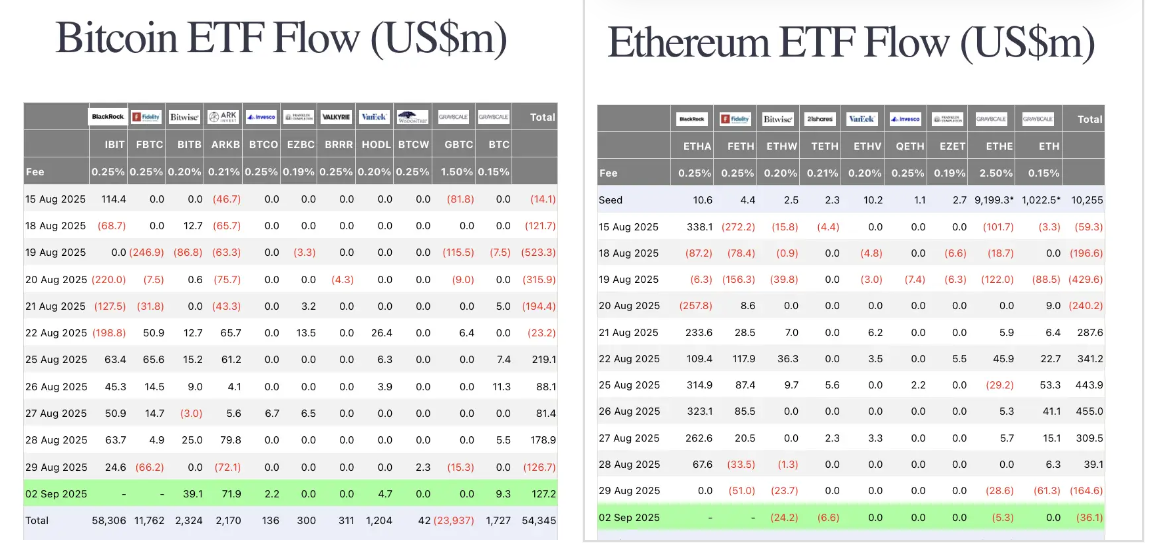

ETF flows split. On September 2, without BlackRock’s numbers, BTC ETFs added $127M, while ETH ETFs lost $165M.

Macro and policy

U.S. equities closed red across the board, with the Dow down 0.55%, Nasdaq off 0.82%, and the S&P 500 down 0.69%. Bond yields ticked higher, the 10-year up 0.38% to 4.28%, while the 30-year hit 4.98%, its highest since July.

The dollar index climbed 0.63% to 98.45, while gold surged 2.48% to $3,535.33.

Adding relief to political jitters, Trump appeared live at 2 p.m. Eastern, looking sharp and dismissing health rumors as “fake news.”

Ethereum: staking queues swell

Ethereum’s Proof-of-Stake (PoS) activation queue is heating up. New validator demand reached 832,000 ETH, valued around $3.58B, the highest since September 2023. The estimated wait time is 14 days and 11 hours.

On the exit side, 861,000 ETH are queued to leave staking, worth about $3.7B, with an estimated delay of 14 days and 23 hours. Both entry and exit queues at these levels underscore just how much ETH is in motion.

Institutions: ETH treasuries and Solana buys

Ether Machine raised $654M privately to expand its ETH treasury and prepare for a Nasdaq listing later this year. Longtime backer Jeffrey Berns added 150,000 ETH to the firm’s wallet and will join the board.

On the Solana side, Sharps Technology purchased more than 2M SOL worth about $400M as part of a new digital asset treasury strategy.

Separately, Yunfeng Financial, tied to Alibaba founder Jack Ma, acquired 10,000 ETH as a strategic reserve.

WLFI: whales start to cash out

WLFI’s top 10 holders are split. 80% have partially or fully taken profits, with only the #2 and #5 wallets untouched. The #1 holder, moonmanifest.eth, still holds most of their bag, worth $230M at current prices ($0.2318 WLFI), though drawdowns have cut into paper gains.

Meanwhile, convexcuck.eth (WLFI’s 6th largest holder) sold $3.8M of WLFI via Whales Market to 36 buyers, marking one of the largest OTC exits.

How to start trading WLFI

WLFI is the new kid on the block, built to shake up the tokenized finance game. If you want in early, Toobit gives you the simplest way to trade WLFI. Spot, Futures, and the full suite of tools are ready to go.

Industry and alpha

KaitoAI rolled out a prediction-market board that aggregates macro, airdrop, and event markets. as an airdrop farming tool.

Linea launched a 1B token liquidity mining program ($35M subsidy) across pools on Etherex, Aave, and Euler, running until October 26. Rewards unlock 40% on October 27 with the rest linear over 45 days.

Venus Protocol paused after a phishing exploit, forcing an emergency vote to partially restore positions and liquidate the attacker.

StarkNet raised $260M even as its mainnet suffered repeated outages.

MSTR added 4,048 BTC at an average $110,981, worth $450M, bringing total holdings to 636,505 BTC at an average cost of $73,765.

Alpha chatter focused on WLFI whales, Linea’s subsidy farming, and meme presales, with traders also eyeing DeFi “smart money” addresses like AndreIsBack, who turned a $580K WLFI seed entry into $1.85M unlocked tokens, while hedging with shorts already in profit.