Bitcoin’s market dominance rose 0.34% to 58.34%, while the Altcoin Index held at 62.

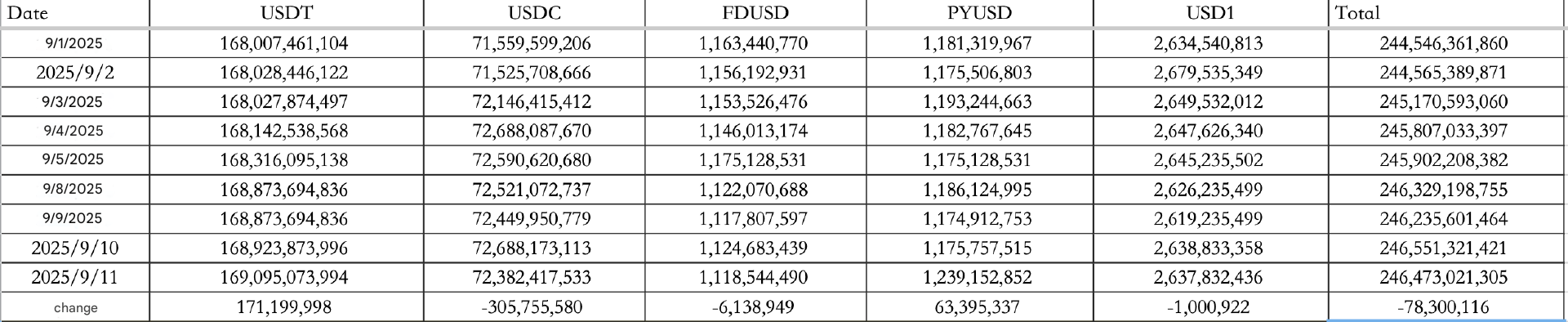

Stablecoin flows showed mixed signals with a net outflow of $78M on September 11. USDT led inflows at $171M, while USDC saw heavy outflows of $3.06M, bringing the total stablecoin supply to $246.47B.

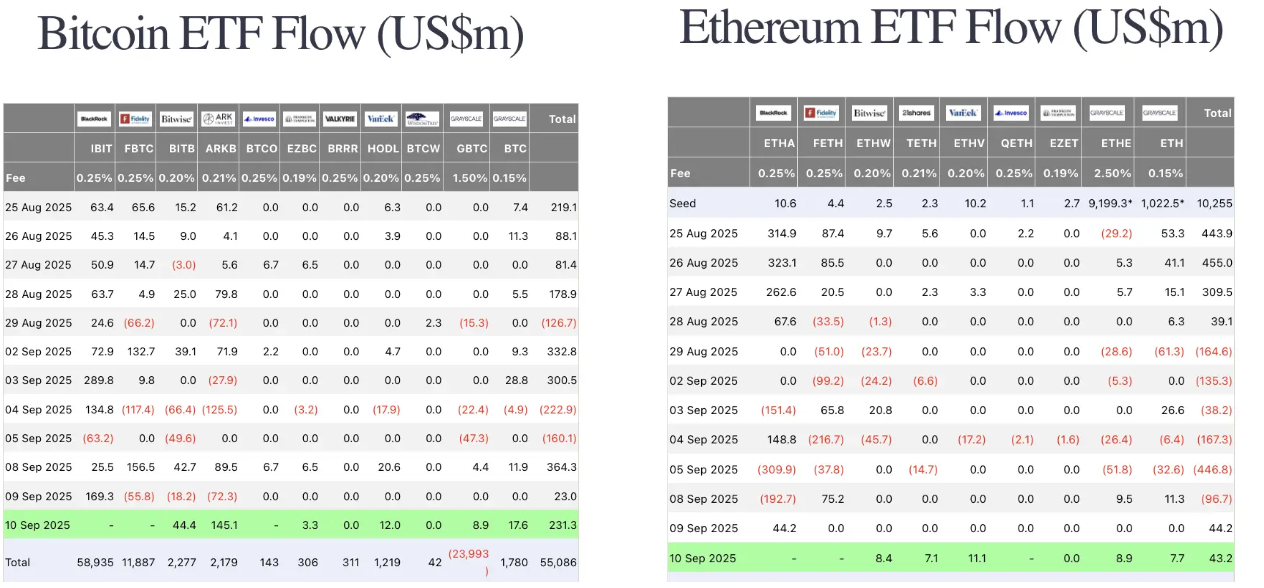

ETF activity remained a key driver. On September 10, excluding BlackRock data, Bitcoin ETFs recorded $231M in inflows and Ethereum ETFs added $43M.

Analysts are closely watching Solana, as Bitwise CIO Matt Hougan suggested inflows and treasury allocations could trigger a sharp rally into year-end. Multiple Solana spot ETF applications await SEC decisions by October 10, setting the stage for potential momentum in Q4.

Macro and policy

Macro sentiment was mixed. U.S. equities closed narrowly split, with the Dow falling 0.48%, the Nasdaq up 0.03%, and the S&P 500 rising 0.30%.

The 10-year Treasury yield eased 1.00% to 4.05%, while the dollar index ticked higher to 97.85. Gold advanced 0.48% to $3,643.41.

Political tensions resurfaced over the Fed’s independence. President Donald Trump criticized Chair Jerome Powell and pushed for aggressive rate cuts, while a federal court temporarily blocked Trump’s attempt to remove Fed Governor Cook.

The ruling ensures Cook retains voting power at the upcoming FOMC meeting unless overturned, with the case likely headed to the Supreme Court.

Regulatory developments

SEC Chair Paul Atkins clarified at the OECD that most tokens are not securities, offering entrepreneurs a path to raise funds directly on-chain. He emphasized the need for unified platforms that can provide trading, lending, and staking under a single framework, while underscoring his goal of ensuring crypto innovation remains centered in the U.S.

Separately, Senate Democrats unveiled a comprehensive crypto market structure framework, aligning closely with Republican proposals.

The plan focuses on token jurisdiction, platform oversight, combating illicit activity, and providing agencies with additional enforcement resources.

The overlap between the two parties raises hopes for rare bipartisan progress in crypto regulation.

Eric Trump clarifies role shift

Eric Trump addressed his removal from the World Liberty Treasury Company ALT5 Sigma, clarifying it was a reassignment to observer status required by Nasdaq rules rather than a withdrawal.

How to start trading WLFI

WLFI is the new kid on the block, built to shake up the tokenized finance game. If you want in early, Toobit gives you the simplest way to trade WLFI. Spot, Futures, and the full suite of tools are ready to go.

Nasdaq prepares for market evolution

Meanwhile, Nasdaq CEO Adena Friedman highlighted plans to integrate tokenized stocks directly into the core exchange system, extend trading toward a 24/7 model, and position Nasdaq for convergence between traditional and digital assets once regulatory clarity emerges.

Industry highlights

SwissBorg’s validator partner Kiln suffered a $41M SOL exploit, forcing emergency withdrawals from Ethereum staking operations to secure assets.

Linea’s token generation event faced severe delays, with allocations not distributed on schedule. Exploiters took advantage of routing contracts, draining $500,000 in USDC through a single transaction.

Kamino vaults continue to offer annualized yields above 15%. Holoworld’s HOLO token to debut at 18:00 Beijing time on September 11, with 1.5% of supply allocated to HODLer airdrops and another tranche reserved for market activities after six months. HoloLaunch’s first-phase campaign is also drawing strong participation.

MYX surged 176x between August 2 and September 10, underscoring the rapid rotation into speculative plays. Meanwhile, Moonshot partnered with xStocks to launch tokenized versions of over 60 equities, including Coinbase, Meta, Amazon, and Tesla, leveraging Solana’s liquidity advantage.