The markets opened firmer as a series of four policy and institutional catalysts lifted sentiment, setting a constructive tone for the day.

BTC dominance rose to 59.32%, the Fear and Greed Index printed 22, and the Altcoin Index slid down to 21.

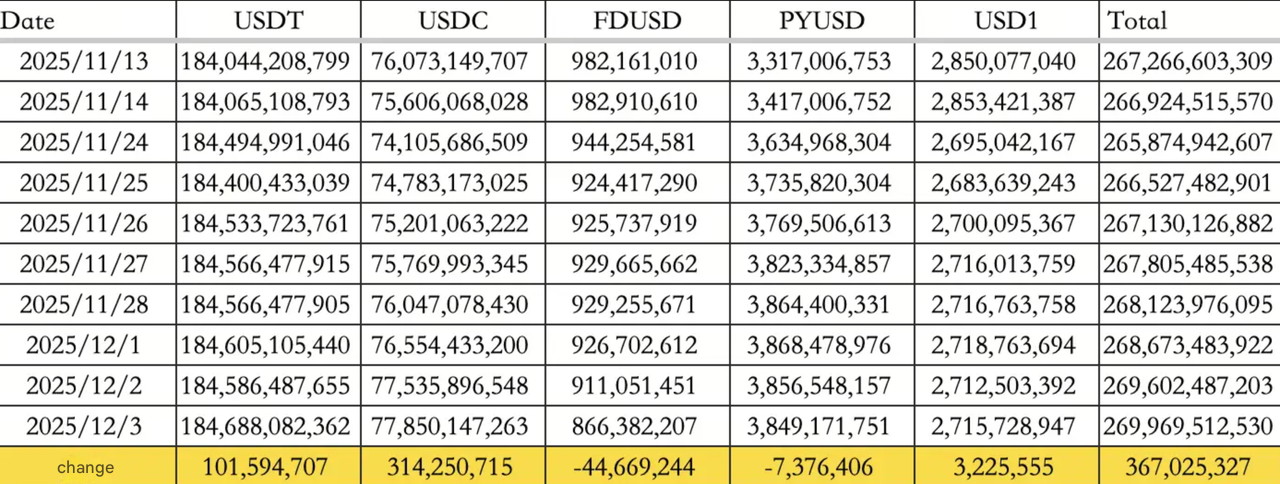

Stablecoin flows strengthened the backdrop. Inflows on December 3 totaled $367.03M, driven by $101.59M into USDT and $314.25M into USDC, expanding total circulating supply to $269.97B.

ETF moves were mixed. Bitcoin ETFs saw $61.6M in outflows on December 2, while Ethereum ETFs brought in $78.8M and Solana ETFs posted $45.7M in inflows.

Traditional markets

US equities posted modest gains:

-

The Dow Jones up 0.39%

-

The Nasdaq rose 0.59%

-

The S&P 500 added 0.25%

The 10Y Treasury yield slipped 0.22% to 4.08, while the US Dollar Index edged down 0.08% to 99.42.

Gold advanced 0.34% to $4,220.71 as softer yields underpinned demand.

Macro policy updates

Policy signals continued to lean supportive.

Vanguard's decision to enable Bitcoin spot ETF trading represents a significant shift for a historically conservative institution, aligning with Bank of America's call for a 1 to 4% allocation to digital assets for suitable clients. Expectations that Hassett may succeed Powell, combined with the Fed formally ending quantitative tightening, strengthened liquidity sentiment. The SEC also reaffirmed that innovation exemptions for digital assets are on track for release within a month.

American Bitcoin Corp, meanwhile, saw extreme volatility, with shares plunging more than half in under 30 minutes before trading was halted multiple times.

Industry highlights

Circle expands global financial initiatives

Circle unveiled the Circle Foundation, supported by its Pledge 1% equity commitment. The foundation will focus on strengthening small business financial infrastructure, improving humanitarian aid systems, and building economic participation frameworks.

Kraken pushes deeper into RWAs

Kraken announced its acquisition of Backed Finance, which issues tokenized representations of equities and ETFs. The company plans to integrate these products more tightly into its existing ecosystem.

Forecasting markets gain momentum

Opinion Labs disclosed it recently secured tens of millions in new financing. Within one month of public beta, cumulative volume surpassed $5B and open interest exceeded $60M, reinforcing its position among the largest prediction platforms. Kalshi also closed a $1B round at an $11B valuation. Tokenized equities remain in an early stage with a total market size of $650M.

Alpha watch

Stable token distribution

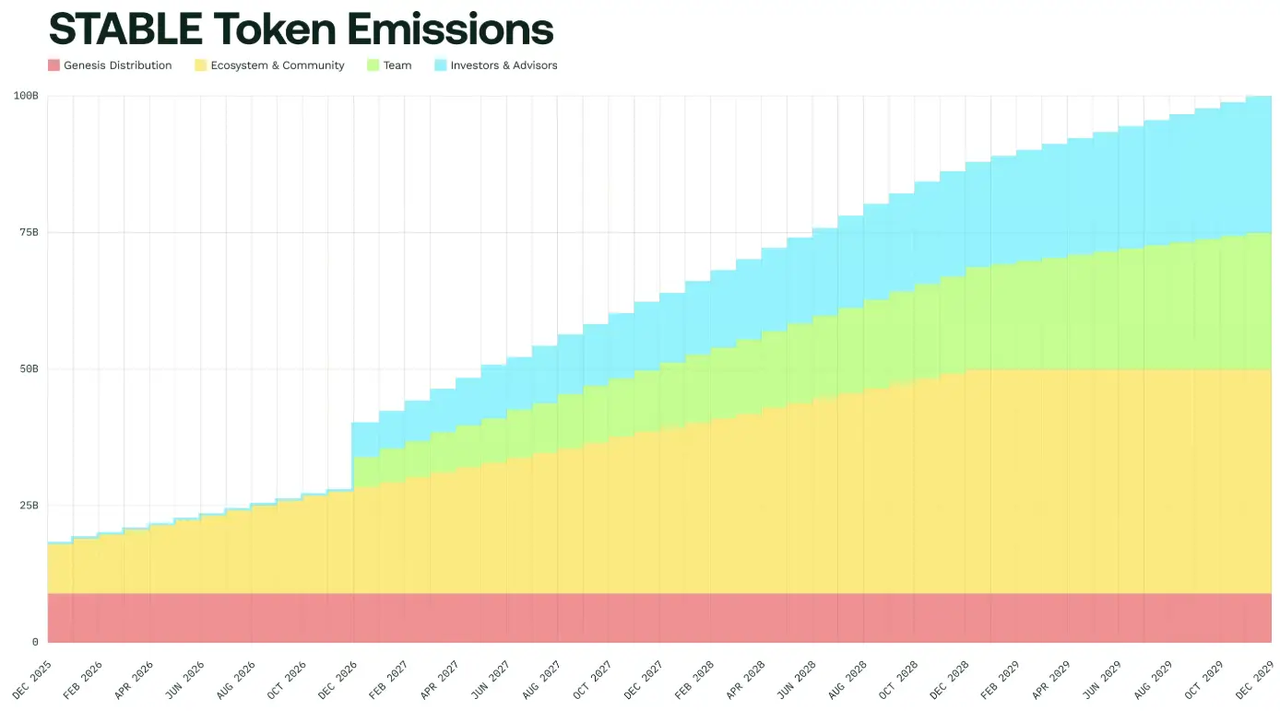

Stable released its tokenomics with the following breakdown:

-

Genesis allocation represents 10% of total supply to support early liquidity, ecosystem activation, and strategic distribution.

-

The ecosystem receives 40% of total allocation for long term development.

-

Team allocation accounts for 25%, while investors and advisors receive 25%.

-

At launch, roughly 20% of tokens are expected to circulate, drawn mainly from genesis and ecosystem pools.

-

Airdrop estimates fall between 5 and 6%, and current deposit models suggest potential returns above 10% under baseline assumptions.

The token will go live once the mainnet launches, with timing still unconfirmed.

Prediction infrastructure in wallets

MyriadMarkets introduced native prediction features inside Trust Wallet, enabling outcome based markets directly in a self custodial environment.

HumidiFi ICO schedule

HumidiFi will begin its ICO on Jupiter on December 3, operating across three first come first served phases with individual caps ranging from $200 to $10,000 depending on the staking tier. Tokens and liquidity will go live shortly after the sale concludes.

Concluding note

Liquidity signals, policy clarity, and strengthening flow data continue to lean constructive as December begins.

While fear remains elevated, the alignment of macro catalysts and sector developments has materially improved the week's setup. The coming sessions will test whether this momentum can transition into a more sustained recovery.