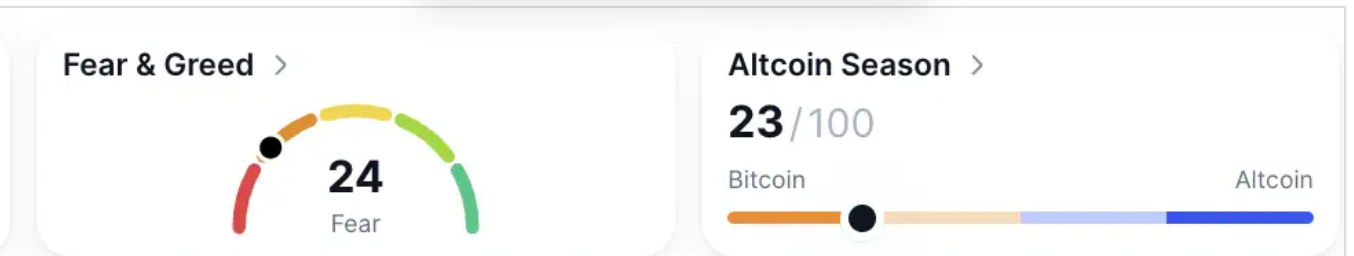

Markets finally caught their breath after days of selling. The Fear and Greed Index climbed slightly to 24 from yesterday’s deep fear level of 20, confirming that the panic zone may have marked a short-term bottom.

The Altcoin Season index has slid further to 23.

Traditional markets rebounded as well. The Dow rose 0.48%, the Nasdaq added 0.65%, and the S&P 500 gained 0.37%.

The 10-year U.S. Treasury yield climbed to 4.15%, up 1.47%, while the dollar index slipped 0.15% to 100.05.

Gold gained 1% to $3,969.77, reflecting a cautious return to risk-on sentiment.

Market pulse

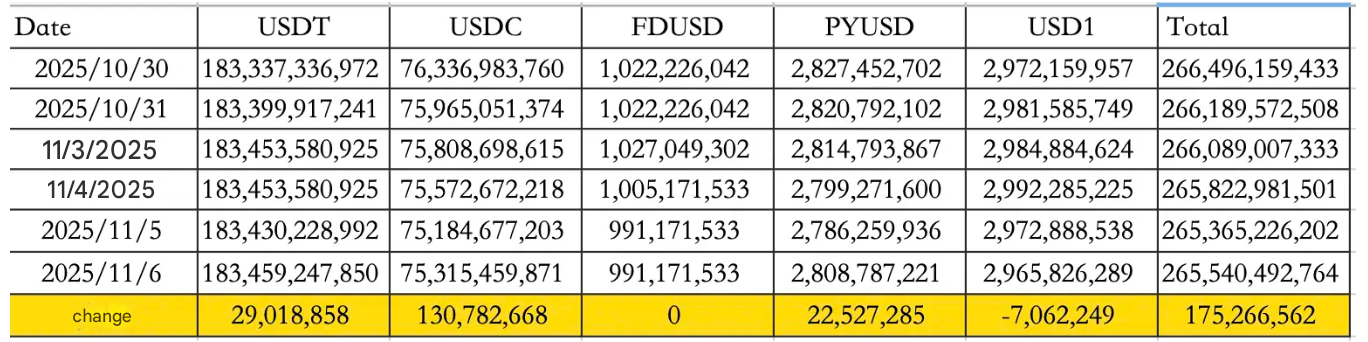

The crypto market rebounded alongside equities. Stablecoin inflows reached $175.27M on November 6, including $29.02M into USDT and $130.78M into USDC, lifting total stablecoin supply to $265.54B.

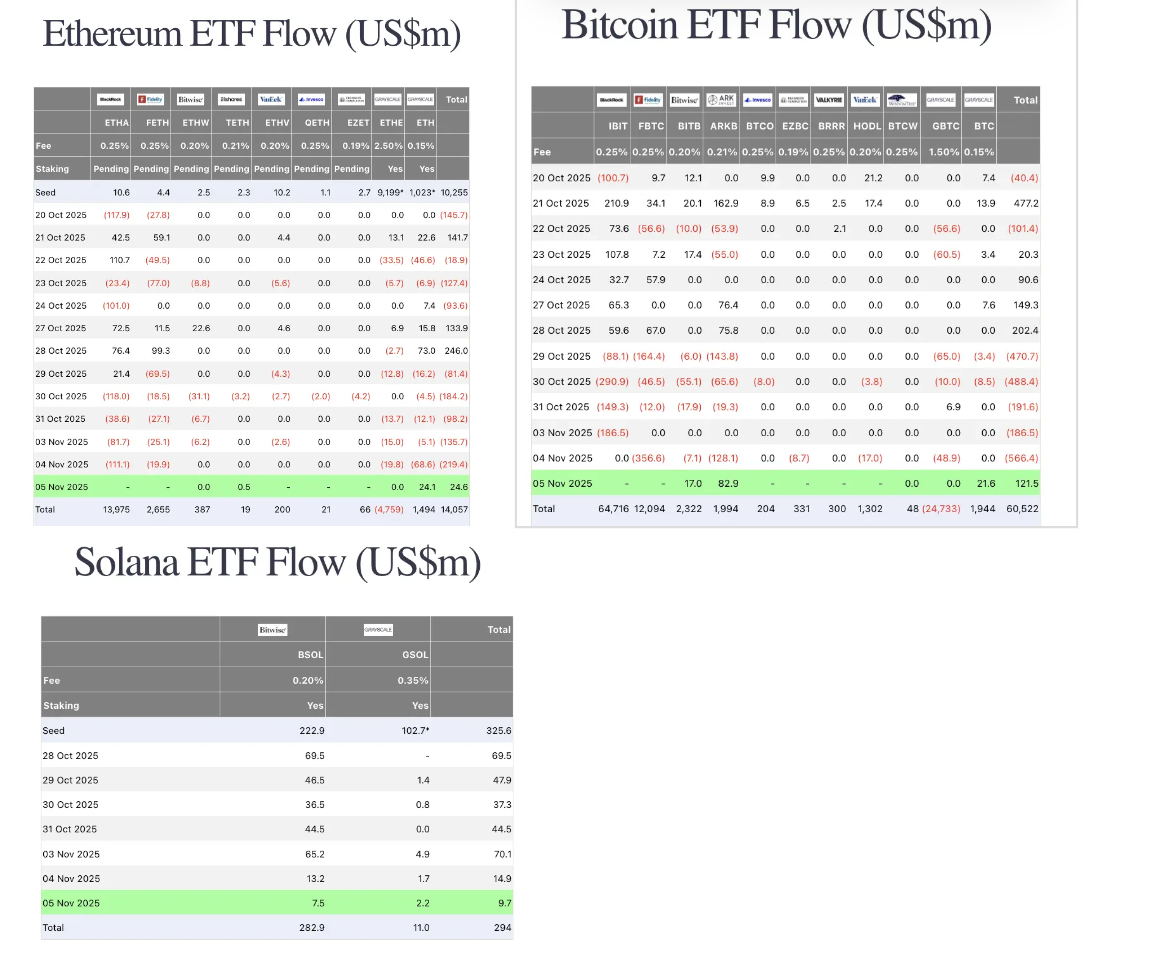

ETF flows turned positive across major assets on November 5. Bitcoin ETFs saw the largest inflows at $121.5M, followed by Ethereum ETFs at $24.6M and Solana ETFs at $9.7M, signaling renewed institutional confidence and a short-term recovery in digital asset sentiment.

Policy and legal watch

The U.S. Supreme Court is reviewing Learning Resources v. Trump, a landmark case that could redefine presidential authority over tariffs under the International Emergency Economic Powers Act.

The outcome could reshape hundreds of billions in trade and debt arrangements. Analysts are split, calling it a “50-50 decision.” If the court rules against the administration, the White House may need to refund previously collected tariffs and could face tighter limits on economic emergency powers.

President Trump commented that the ongoing government shutdown has weighed on the stock market but remains confident equities will “set new highs again.”

White House Press Secretary Karoline Leavitt confirmed that the pardon for CZ underwent a standard review process before reaching the president’s desk for final approval.

Institutional and corporate developments

Grayscale announced it will temporarily waive sponsor fees for the Grayscale Solana Trust ETF (GSOL) and lower staking-related fees for up to three months, or until the fund’s AUM reaches $1B, whichever comes first. The trust has now staked 100% of its SOL holdings, offering a 7.23% yield.

Ripple closed a $500M funding round led by Galaxy Digital and several institutional backers. The raise reinforces Ripple’s push to expand cross-border payment infrastructure and enterprise blockchain adoption amid renewed optimism around digital finance integration.

Metaplanet raised $100M by collateralizing its Bitcoin holdings. The company plans to use the funds to buy more Bitcoin, expand revenue streams, and conduct share buybacks. As of October 31, Metaplanet holds 30,823 BTC.

Ecosystem highlights

Solana's Junk.fun cleans up meme coins

Solana meme token BONK teamed up with privacy protocol Manta Network to launch Junk.fun, a cleanup tool for on-chain clutter. The platform allows users to burn worthless meme coins or NFTs, freeing locked SOL rent fees in exchange for CREDITS points.

These points can be used to join official ecosystem campaigns, with a $75,000 rewards pool running over the next three weeks.

MicroStrategy's debt pressure draws analyst attention

Crypto analyst Willy Woo raised concerns that MicroStrategy may face liquidation risks during the next bear cycle. The firm holds about $1.01B in convertible notes maturing on September 15, 2027.

To avoid selling Bitcoin to cover its debt, MicroStrategy’s stock must stay above $183.19 per share, roughly equivalent to a Bitcoin price of $91,502. The company retains flexibility to repay in cash, stock, or both.

DeFi systemic risk warning

Analysts issued a warning that DeFi could face systemic risk as leverage ratios across smaller lending protocols rise sharply. Several cross-chain liquidity pools have shown stress, with elevated utilization rates and unusually high APYs suggesting liquidity mismatches may be forming.

Alpha watch

Solana's "1 Coin Can Change Your Life" soars

Solana-based meme token 1 Coin Can Change Your Life (1) hit an all-time high with a market cap of $31.12M, up 59.68% in 24 hours. On-chain data shows the WLFI treasury address received 10.84M tokens worth roughly $239,000, signaling growing ecosystem adoption.

Aster expands utility and perpetual trading integration

Aster announced that its token, ASTER, can now be used as collateral for perpetual futures trading with an 80% margin ratio. Traders can also use ASTER to pay transaction fees and receive a 5% discount.

The platform plans to integrate traditional assets like stock token futures and partner with Buidlpad to offer pre-market futures for new listings, improving early liquidity and price discovery.

How to start trading Bitcoin

Bitcoin’s the OG: still king of the hill, still moving markets. Whether you're stacking sats or going full degen with leverage, Toobit gives you everything you need. Spot, Futures, and all the bells and whistles.