Bitcoin’s market share eased, with BTC dominance down 0.17% to 58.37%, while the Altcoin Index held at 51. Rotation chatter continues, but the tape remains cautious ahead of macro data.

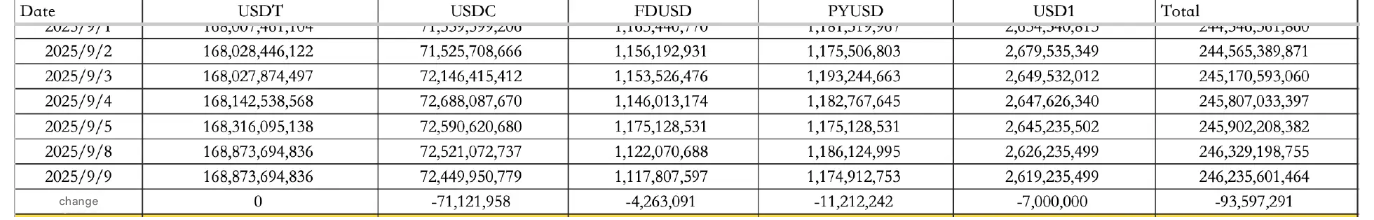

Stablecoins showed mild outflows. On September 9, the basket saw $94M in net redemptions, with USDC down $71M. The total stablecoin supply now stands at $246.24B.

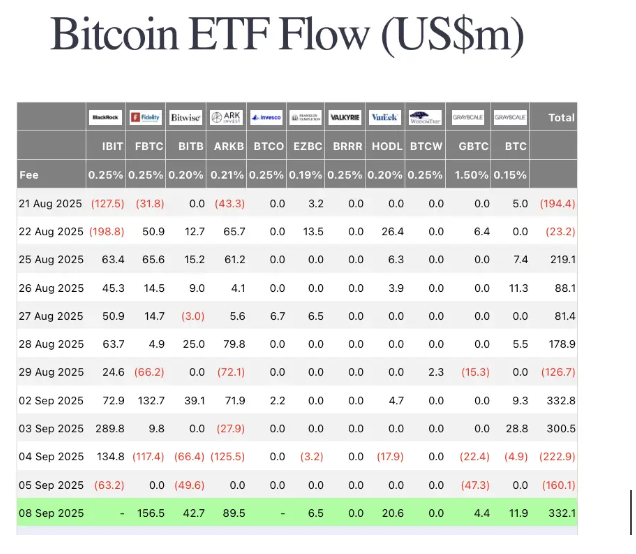

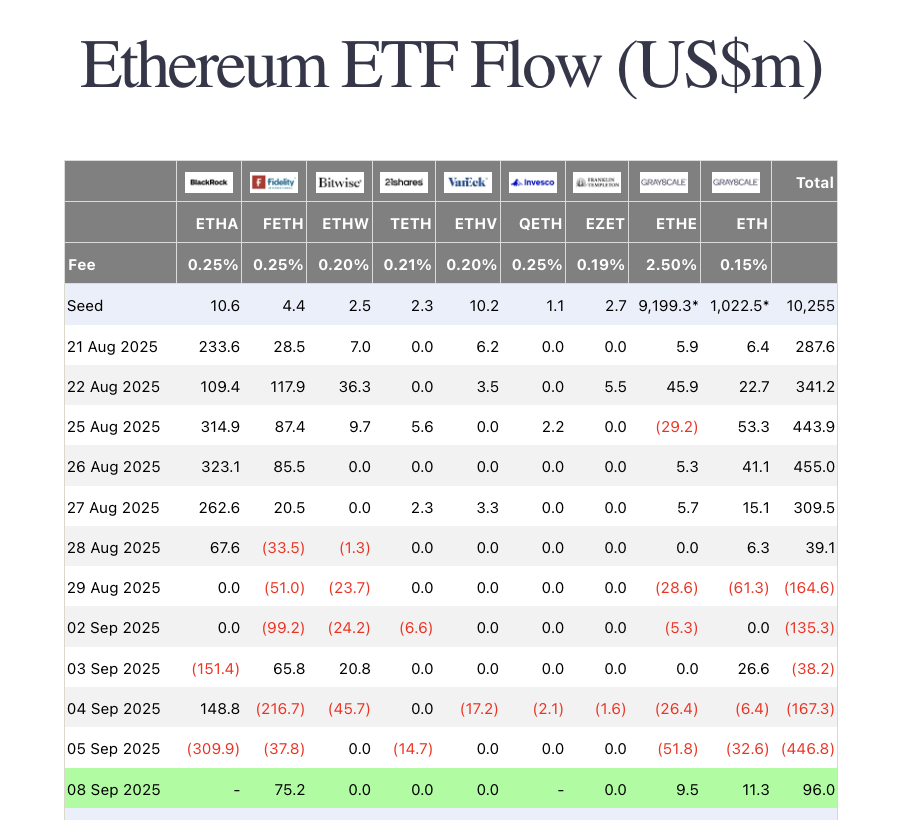

ETF flows stayed green. On September 8, excluding BlackRock’s prints, BTC ETFs took in $332M and ETH ETFs added $96M.

Macro and policy

U.S. equities closed higher, with the Dow up 0.25%, Nasdaq up 0.45%, and S&P 500 up 0.21%. The 10-year Treasury yield slipped 0.83% to 4.04%, while the dollar index fell 0.30% to 97.39. Gold jumped 1.39% to $3,634.84.

All eyes now turn to Thursday’s CPI and core CPI releases, which traders expect to set the tone for September’s rate decision.

Meanwhile, Nasdaq filed a proposal with the SEC to allow trading of tokenized securities alongside traditional ones, provided they carry identical rights. If approved, it would mark the most significant integration of blockchain into U.S. market infrastructure yet.

Separately, the U.S. Congress introduced H.R. 5166, a bill directing Treasury to develop custody and management protocols for federally owned Bitcoin reserves.

Solana: $1.65B treasury play

The biggest headline comes from Solana. Forward Industries, a Nasdaq-listed firm, announced a $1.65B private PIPE financing in cash and stablecoins to launch a Solana treasury strategy. Partners include major funds and crypto-native backers, with Multicoin’s Kyle Samani joining Forward’s board as chairman.

This marks the largest Solana-focused treasury initiative to date, signaling that corporate treasuries are now treating SOL as a reserve-grade asset.

How to start trading Solana

Solana isn’t just fast, it’s lightning. From meme launches to serious DeFi, SOL is where the action lives. If you’re ready to ride the high-speed rails, Toobit makes trading Solana simple. Spot, Futures, and the full pro toolkit are all at your fingertips.

Industry highlights

-

Korea’s largest exchange announced plans to launch an L2 called GIWA, with ETH as its default gas token. Meme speculation is already circling the new chain.

-

A massive supply chain attack is spreading through NPM packages, affecting multiple JavaScript libraries with billions of downloads. The exploit replaces user wallet addresses with attacker-controlled ones. Developers are urged to audit dependencies, and users without hardware wallets should pause on-chain activity until patches propagate.

-

Prediction markets and meme boards noted MYX futures contracts leading liquidations, topping $46.9M in 24h, even above ETH’s $40.87M.

-

OpenSea Foundation confirmed SEA token TGE will be announced in early October.

Alpha watch

Linea confirmed its initial circulating supply of 15.48B LINEA, about 21.5% of max tokens. Early reports show looped lending yields over 30% in its opening phase.

MegaLabs is piloting USDm, a new stablecoin designed for its MegaETH scaling solution. The model is built with Ethena to keep transaction costs low while aligning chain incentives with ecosystem growth.

Airdrop farmers flagged OpenLedger’s campaign, estimated at $300+ per wallet, and the latest Boost launchpad event with 162M tokens in rewards.