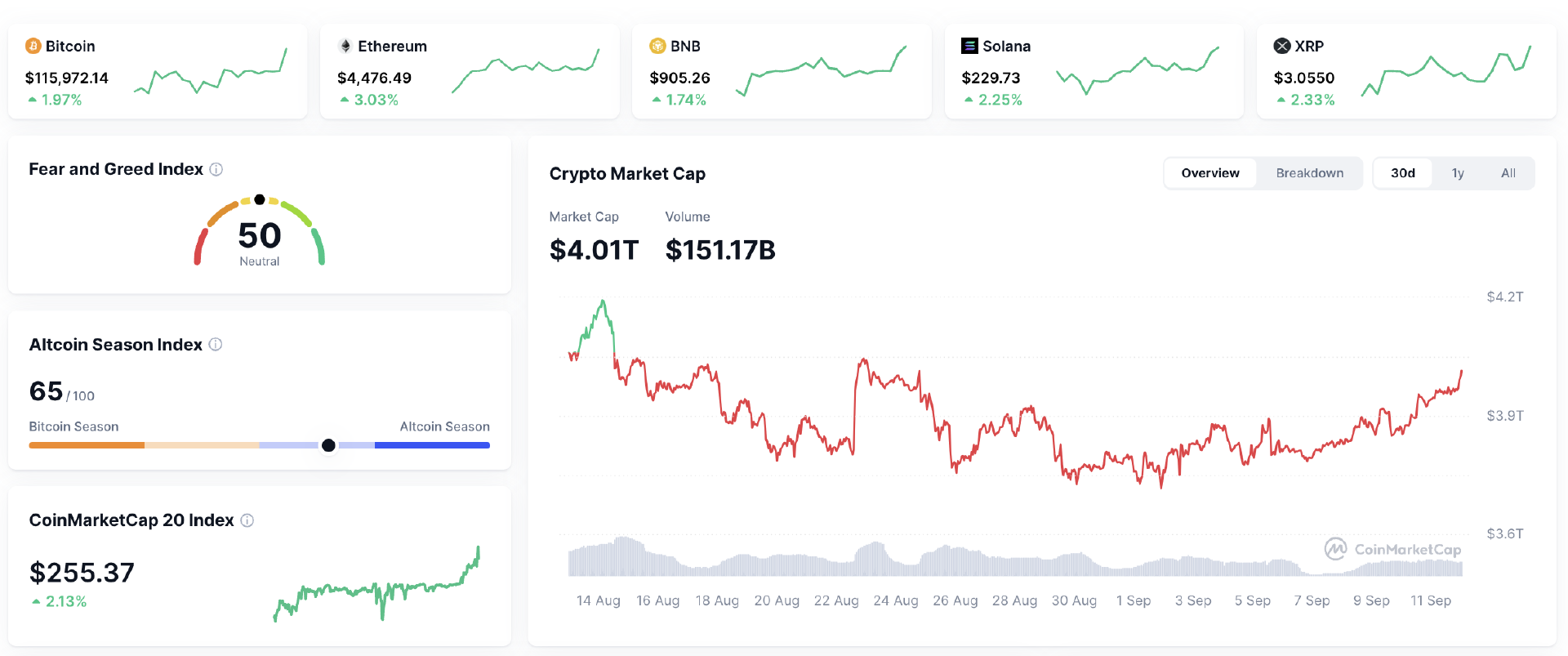

Bitcoin’s grip slipped, with BTC dominance down 0.15% to 58.27%, while the Altcoin Index climbed to 65. The highest in weeks, suggesting traders are leaning back into rotation.

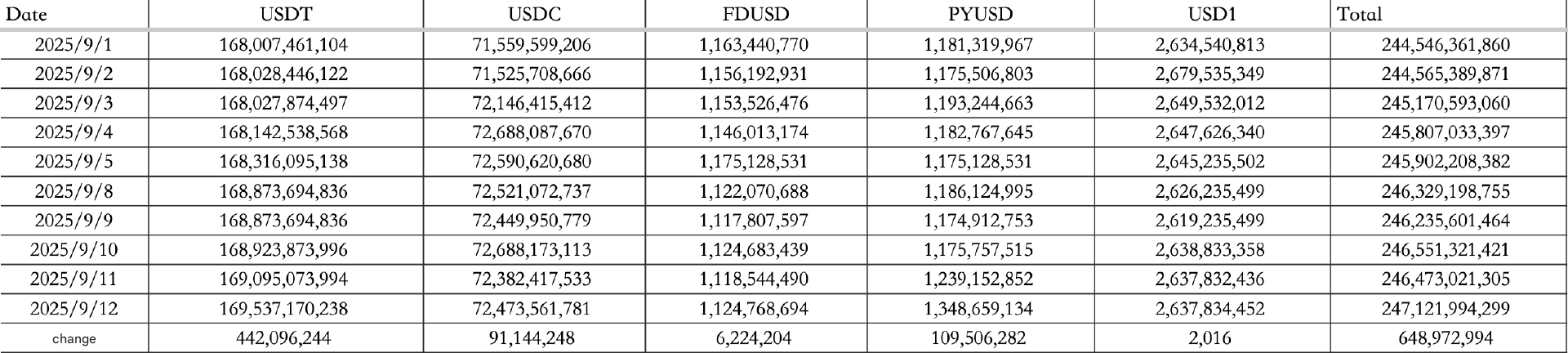

Stablecoins confirmed the appetite. On September 12, the basket saw $649M in inflows, broken down as $442.09M into USDT and $91.14M into USDC, lifting the total supply to $247.122B.

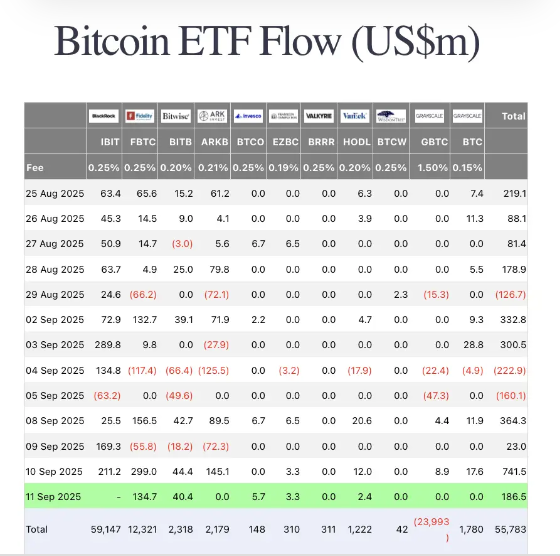

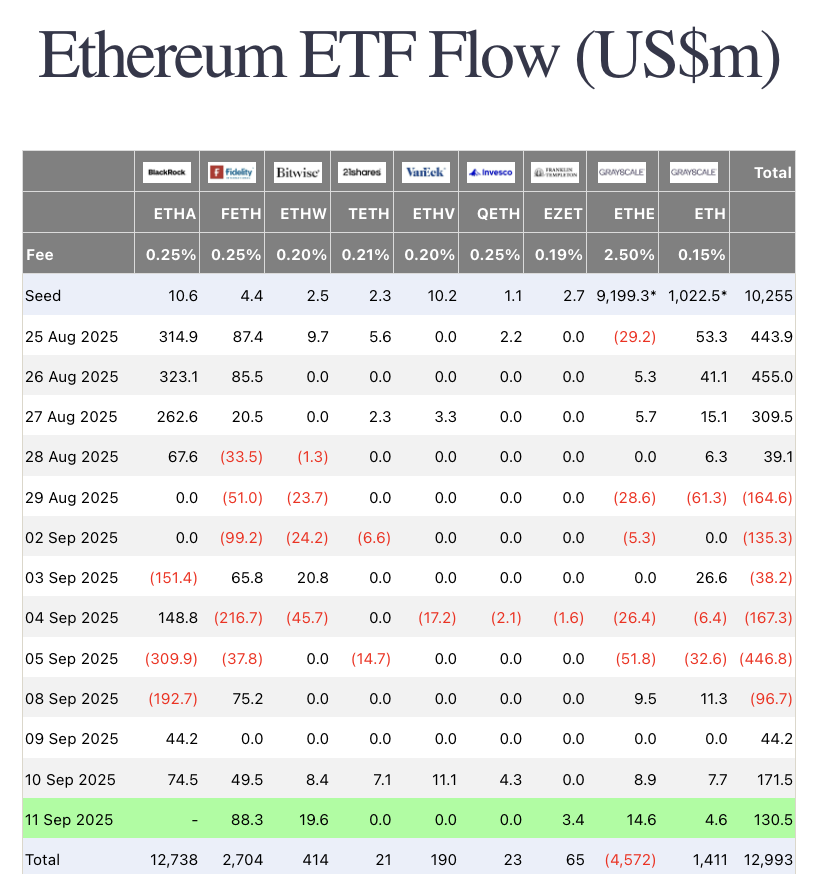

ETF flows also supported the move. On September 11, excluding BlackRock’s prints, BTC ETFs brought in $186M, while ETH ETFs added $130M.

Macro and policy

U.S. equities rallied, with the Dow up 1.36%, Nasdaq higher by 0.72%, and the S&P 500 climbing 0.85%. Bond yields eased, with the 10-year Treasury down 0.47% to 4.03%, while the dollar index slipped 0.31% to 97.60. Gold stayed firm at $3,640.67, near record highs.

On the policy side, U.S. jobless claims surged to a four-year high, fueling market bets for aggressive easing. Short-term futures are now fully pricing three rate cuts before year-end, meaning traders expect the Fed to cut at every remaining 2025 meeting.

Solana season?

The Solana narrative dominated headlines. Galaxy Digital withdrew 1,452,392 SOL worth $326M from trading venues in the past 12 hours, confirming it is helping Forward Industries close a $1.65B Solana treasury deal.

CEO Mike Novogratz said the market is entering “Solana season,” citing both momentum and regulatory clarity as tailwinds. Some traders are already banking gains: Eugene Ng Ah Sio announced he closed his SOL longs for a small win, preferring to reset.

On the ETH side, former LD Capital founder Yi Lihua reiterated his thesis that ETH continues to outpace most other majors. His rule of thumb: after every $1,000 leg higher, ETH consolidates, then climbs again. Recent onchain data showed a Trend Research-linked wallet leveraged into another 9,377 ETH buy.

How to start trading Solana

Solana isn’t just fast, it’s lightning. From meme launches to serious DeFi, SOL is where the action lives. If you’re ready to ride the high-speed rails, Toobit makes trading Solana simple. Spot, Futures, and the full pro toolkit are all at your fingertips.

Industry highlights

-

Scroll DAO announced its leadership has resigned, suspending governance and pledging to redesign its structure.

-

Market research flagged Digital Asset Treasuries (DATs) as hitting a pivot point. Analysts warn the early scarcity premium for treasury-style plays has faded, with competition and regulation compressing multiples. Still, Bitcoin-focused DATs now hold over 1M BTC (~5% of supply), and ETH-focused DATs hold about 4.9M ETH (~$21.3B), more than 4% of supply.

Alpha watch

-

Joseph Lubin (Ethereum co-founder, Consensys founder) said holding Linea tokens could unlock future rewards, from protocol staking to airdrops by Consensys and partner projects. Holding size and duration may determine allocations.

-

Falcon Finance’s presale went live on Buidlpad, drawing heavy attention.

-

Karak Network rebranded its token ticker to GDP.

-

Hololaunch’s first two projects are being billed as “can’t-miss” plays, with analysts already dissecting expected upside.

-

Aster airdrop query tool went live, showing 137,000+ wallets eligible for the upcoming allocation.

-

Traders in Korea piled into HOLO ahead of its BSC listing, pushing the token as high as $0.80 on-chain in a frenzy described as “full-blown FOMO”.