Markets stayed defensive. The Fear & Greed Index continued to hold at 24, and flows did not offer much comfort.

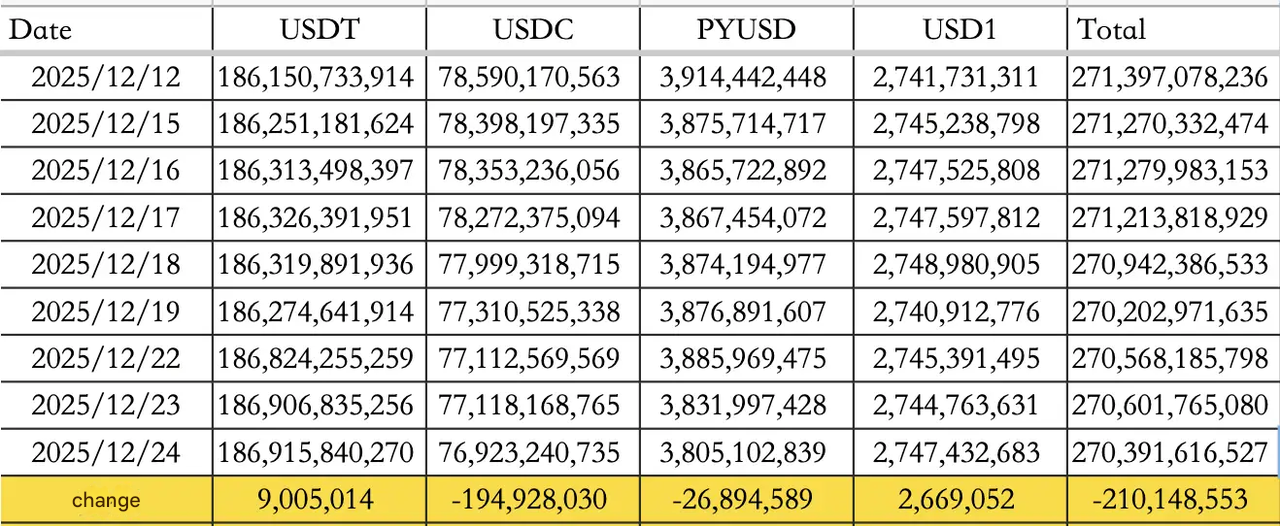

Stablecoins saw $210.15M net outflow on December 24, driven largely by USDC's $194.93M outflow, with USDT offsetting that loss minimally by $9.01M. Total stablecoin supply sits around $270.39B.

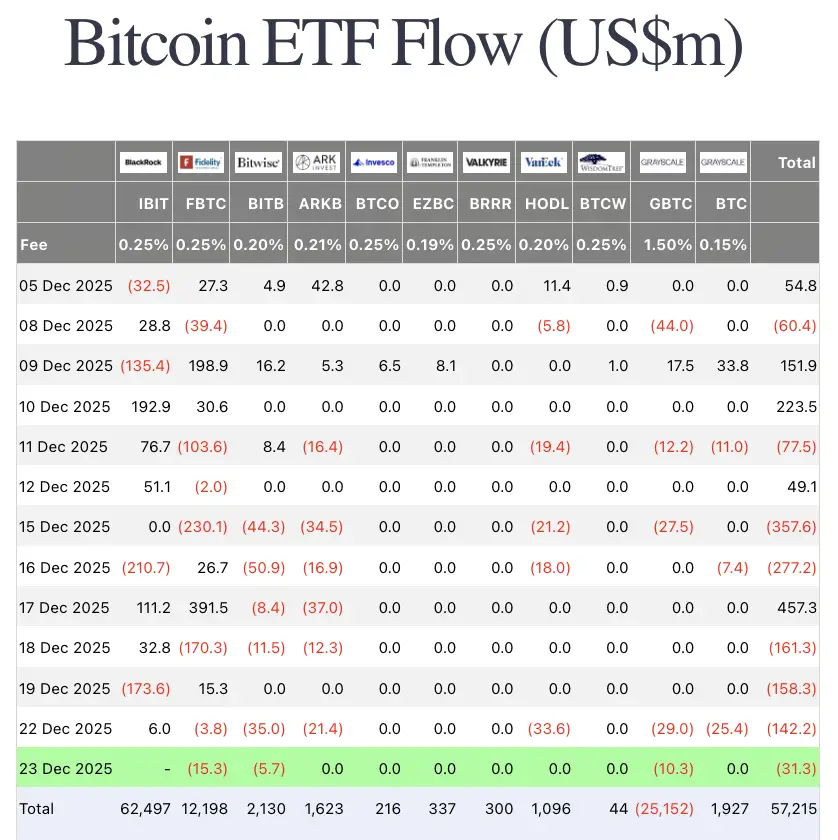

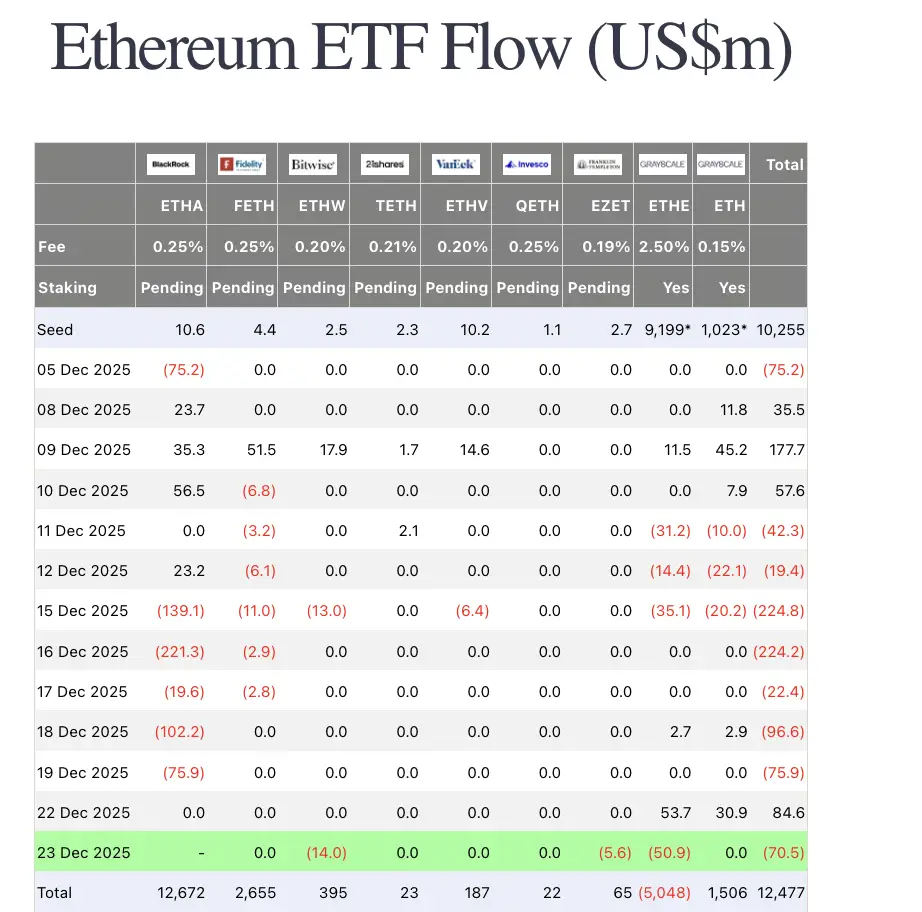

On the ETF front (as of December 23), both spot BTC ETFs and spot ETH ETFs posted outflows of $31.3M and $70.5M respectively, with the day flagged as missing a key issuer dataset in the briefing. That makes the message directionally clear even if the print is not fully complete: flows are still leaning risk-off.

Traditional markets

U.S. equities leaned positive:

-

The Dow +0.16%

-

Nasdaq +0.57%

-

S&P 500 +0.45%

Rates moved the other way: the U.S. 10Y hovered around 4.16% as yields eased, while the U.S. Dollar Index slipped to 97.76.

Gold extended its record run to hit new highs, up 0.51% to $4,508.73, reinforcing the "growth is strong, but hedges are still crowded" setup.

Macro policy updates

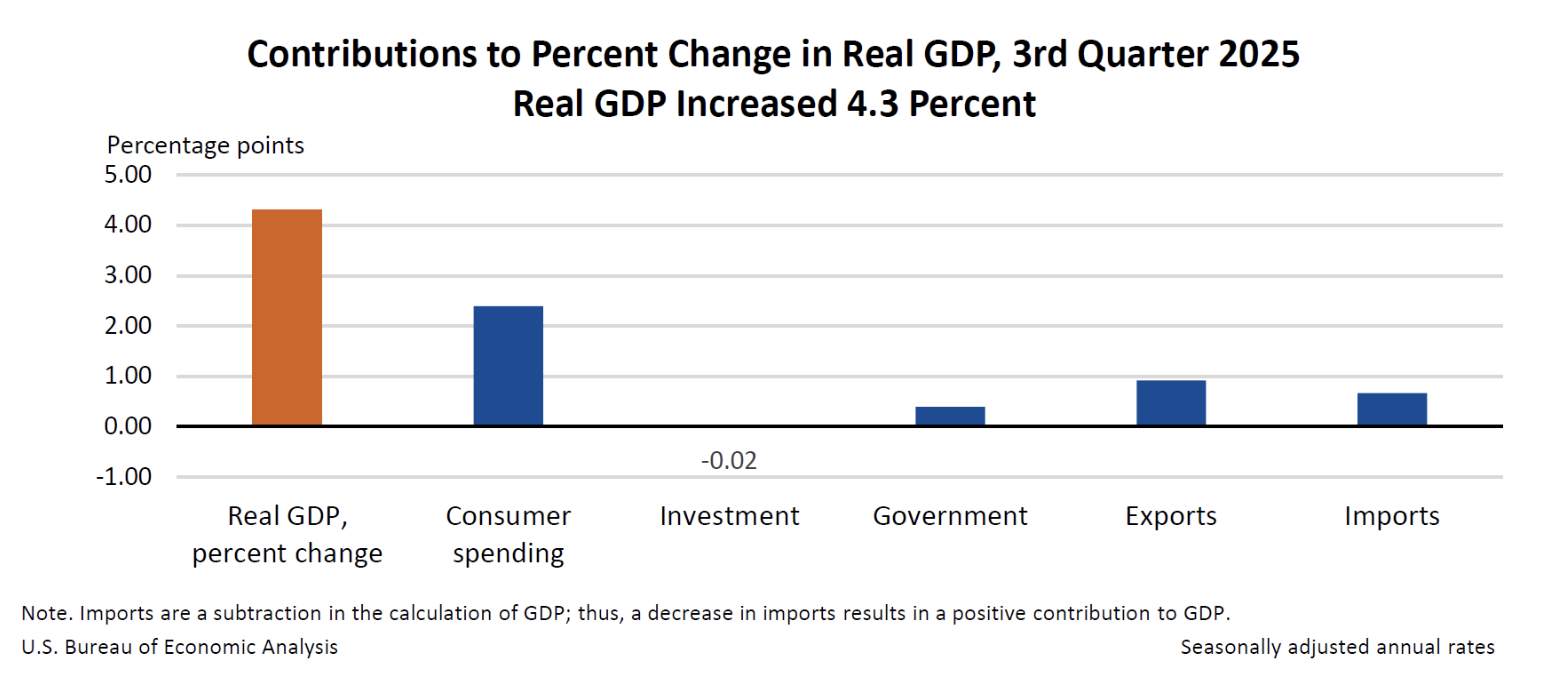

Macro set the tone with a familiar push-pull: growth is accelerating, but the Fed's preferred inflation gauges are still firm enough to keep the rate path contested.

BEA's initial estimate showed real GDP rising at a 4.3% annual rate in Q3, while the PCE price index and the core PCE price index (excluding food and energy) increased by 2.8% and 2.9% respectively.

Additionally, Kevin Hassett leaned into the AI productivity angle in his interview with CNBC, arguing that if growth stays near 4%, monthly job gains could re-accelerate toward 100,000 to 150,000, and that the Fed is behind the trend on rate cuts.

Separately, Treasury Secretary Scott Bessent signaled openness to revisiting the Fed's 2% inflation target structure, floating a potential range such as 1.5% to 2.5% or 1% to 3%. Even talk like this can matter because it changes how traders frame the destination for policy, not just the next meeting.

Industry highlights

MicroStrategy builds a liquidity buffer

MicroStrategy's positioning read like a volatility playbook.

The firm reportedly sold 4.5M shares to raise $740M, pushing that capital into a newly established USD reserve pool. The briefing puts the reserve at $2.19B total, framed as enough runway to manage liabilities for roughly 3 years without selling BTC.

AI settlement rails move closer to the protocol layer

HTX Ventures highlighted two proposals as "machine economy" building blocks:

-

x402 (bringing payments into the protocol layer for automated settlement), and

-

ERC-8004 (verifiable execution and reputation for machine collaboration).

The subtext is that AI agents are shifting from app-layer experiments to economic actors, and on-chain rails will eventually be the default settlement layer.

Hyperliquid defends its market structure

Hyperliquid publicly positioned itself against centralized-sequencer venues, emphasizing its fully on-chain design and validator model, while also responding to community concerns around a HYPE token shorting controversy tied to a former employee in its statement.

Prediction markets put conflicts and execution under the spotlight

A major exchange recently posted an open position for a quant role in running an internal market-making team on sports prediction products. The job framing explicitly points at operating the book and optimizing profitability, which will keep spotlight pressure on how these venues disclose conflicts and execution quality.

Alpha watch

Lighter's S2 (public test phase) looks like it is entering a final stretch. The briefing notes total points distributed reaching 12M, and frames a likely conversion expectation of 1:20 from points to tokens, based on community redistribution logic. If that ratio holds, attention will shift quickly from "farming" to liquidity conditions and listing mechanics.

Concluding note

Today's signal is not price, it is positioning. Flows stayed tight and risk looked selective, which is usually how year-end tapes behave when liquidity is thin and conviction gets rationed.

Stablecoin movement remains uneven, ETFs have not flipped into consistent support, and the industry's attention is drifting toward infrastructure. When those three line up, you usually get selective rallies, quicker reversals, and choppier follow-through.

With Christmas tomorrow, expect lighter volumes and sharper reactions to any surprise headline. The setup for 2026 is clear: watch whether liquidity finally turns supportive, because that is what typically decides whether the next move is a breakout or just another holiday fade.