Bitcoin’s market share slipped again, with BTC dominance down 0.98% to 58.23%, while the Altcoin Index held steady at 43. That balance says alts are not breaking out, but they are refusing to collapse alongside BTC: quiet rotation, not full risk-on.

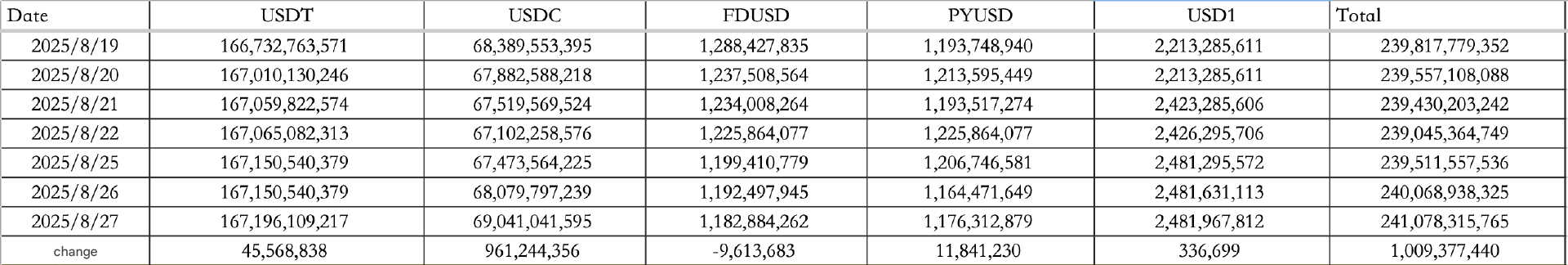

Stablecoins told the real story. On August 27, the basket saw $1.093B of inflows, led by $961M into USDC and a smaller $46M into USDT, lifting the total circulating supply to $241.078B.

This marks one of the strongest inflow days of the month, hinting that sidelined capital is back on the move.

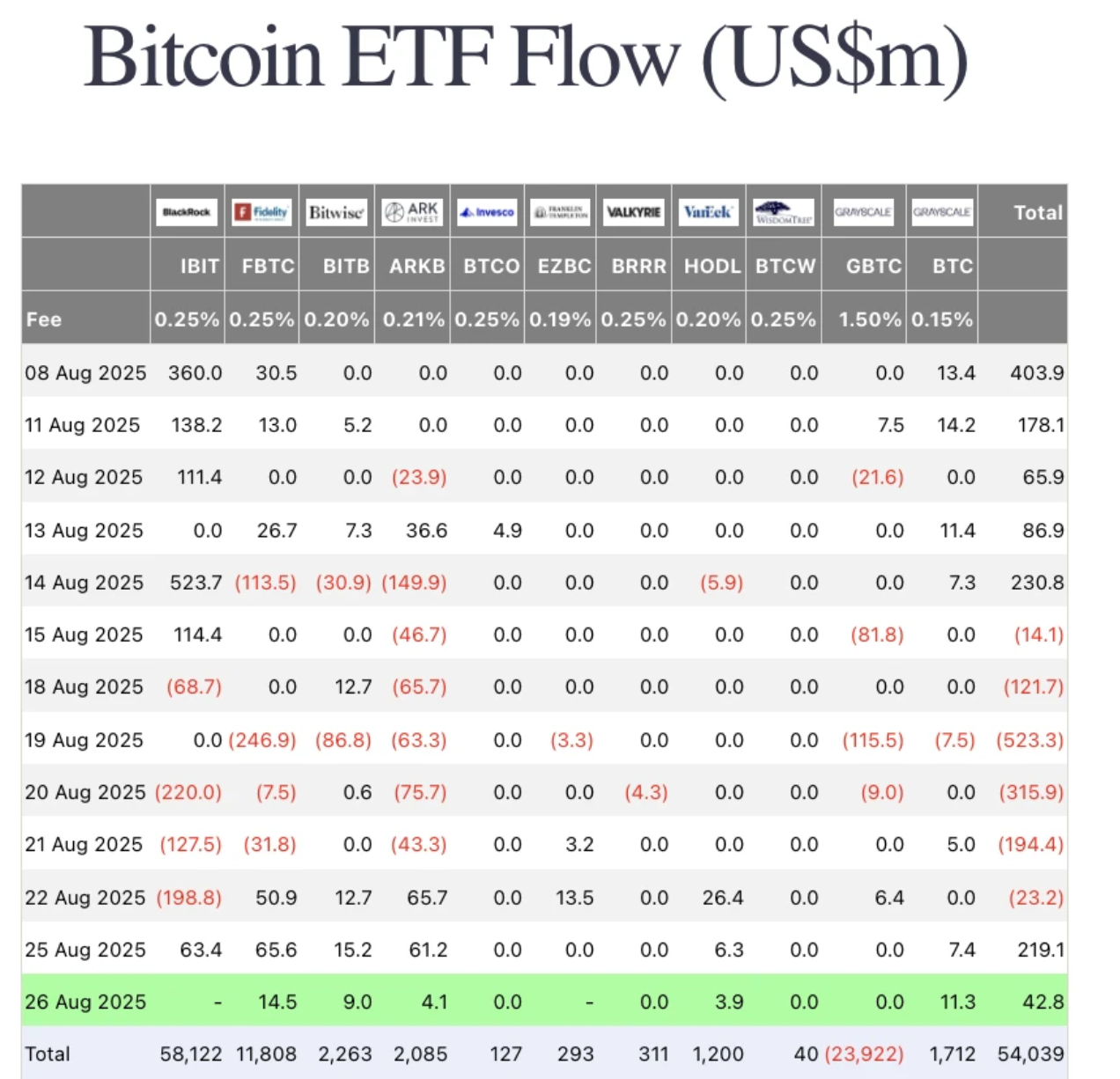

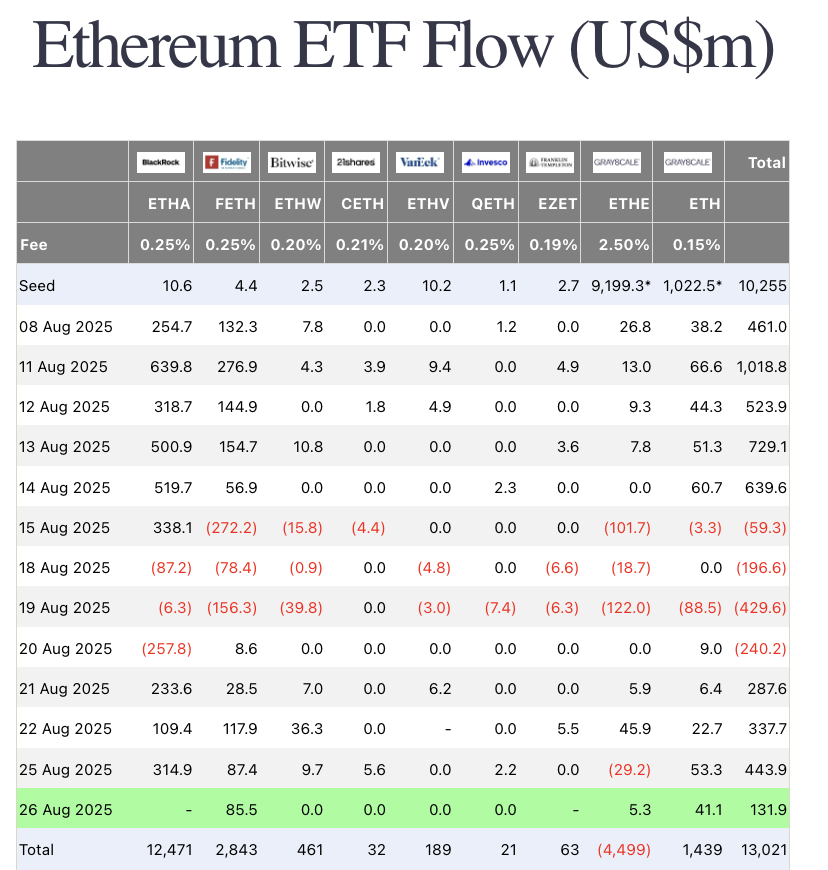

ETF flows were balanced. On August 26, excluding BlackRock data, BTC ETFs brought in $43M, while ETH ETFs added $132M.

How to start trading Ethereum

Ethereum’s more than just a coin, it’s an entire ecosystem. If you're ready to trade ETH like a pro (or at least fake it till you make it), Toobit makes trading altcoins easy. From Spot to Futures, we’ve got the whole toolkit.

Macro and policy

U.S. equities pushed higher, with the Dow up 0.30%, Nasdaq up 0.44%, and S&P 500 up 0.41%. Nvidia rose 1.09% ahead of its Q2 earnings release later in the day.

Treasuries and the dollar eased, with the 10-year yield down 0.28% to 4.27% and the DXY off 0.23% to 98.27. Gold climbed 0.82% to $3,387.08, inching toward all-time highs.

The fallout from President Trump’s firing of Fed Governor Lisa Cook continues. Legal analysts expect the case to run up to the Supreme Court, given the lack of precedent and the vagueness of the “for cause” dismissal clause.

Treasury Secretary Bessent added that the Fed’s independence “derives entirely from political consensus,” warning that public trust is its only real credibility.

In another first, the U.S. Commerce Secretary confirmed that official GDP data will begin publishing on blockchain rails, with technical details being finalized.

Market movers and industry

The highlight of the day was a whale-driven short squeeze on Hyperliquid’s XPL, where a single trader loaded hundreds of millions in long orders, swept the book, and forced cascading short liquidations.

Prices spiked over 200% in two minutes, peaking at $1.80 before retracing. The whale reportedly booked $16M profit in under a minute.

Meanwhile, Truth Media & Technology Group signed a $155M strategic deal, involving token custody, staking, and equity swaps to upgrade its app-based rewards system.

Alpha watch

The alpha board was dominated by Solana news. Multiple microstrategy-style firms are preparing to launch, with single-firm raise sizes expected to exceed the current combined size of Solana treasuries.

Pantera is reportedly lining up a $1.25B Solana coin-equity hybrid fund, while other asset managers are exploring $1B acquisitions of SOL reserves.

On the consumer side, Play Solana confirmed its first handheld gaming device (PSG1) will ship October 6, preloaded with a Solana wallet.

ETF watchers note that spot ETF applications for Solana close in October, a key milestone for mainstream access.

Circle also disclosed that it minted $24.75B USDC on Solana this year, underscoring its role as one of the chain’s biggest drivers of liquidity.

Elsewhere, meme pre-sales are heating up again, with fourmeme’s upcoming drop drawing attention as a possible repeat of earlier cycle patterns.

Meteora finalized its Q1 and Q2 points distributions, logging over 565B points across 287,687 wallets for 2025.

And in prediction markets, 1789 Capital confirmed a multi-million dollar investment in Polymarket, with Donald Trump Jr. joining as an advisor. Insiders see it as positioning the platform for a potential IPO.