Bitcoin and total crypto market cap just set fresh records, but the loudest cheer is for Ethereum, now only 2.7 percent away from breaking its all-time high.

ETH’s rally has dragged the entire alt market into green territory, pushing the Altcoin Index up to 41. With BTC dominance slipping to 59.76 percent, the rotation whispers are getting harder to ignore.

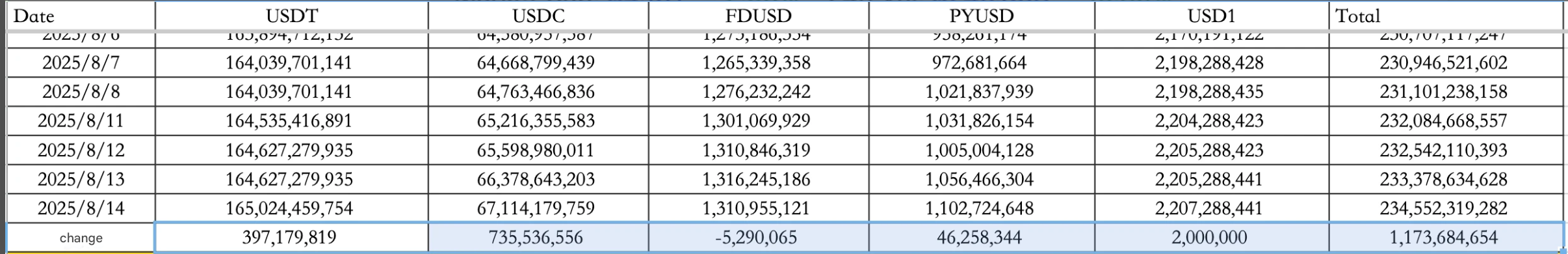

Stablecoins are flying in. On August 14 alone, net inflows hit $1.174B, with USDT adding $397M and USDC adding $735M, lifting total supply to $234.552B.

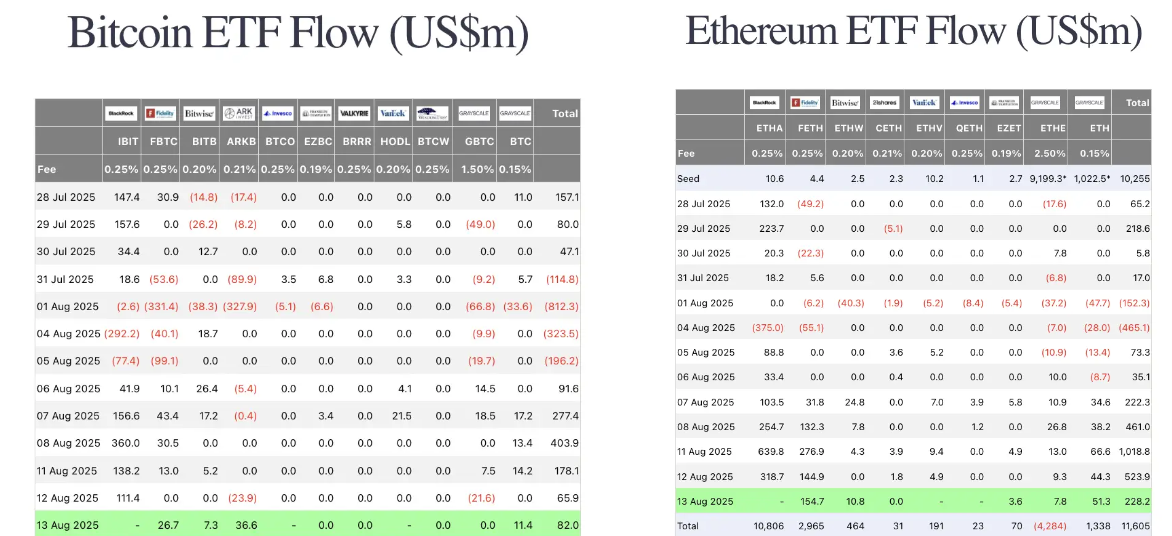

ETFs kept pace without BlackRock numbers, BTC ETFs added $82M and ETH ETFs pulled $228M on August 13.

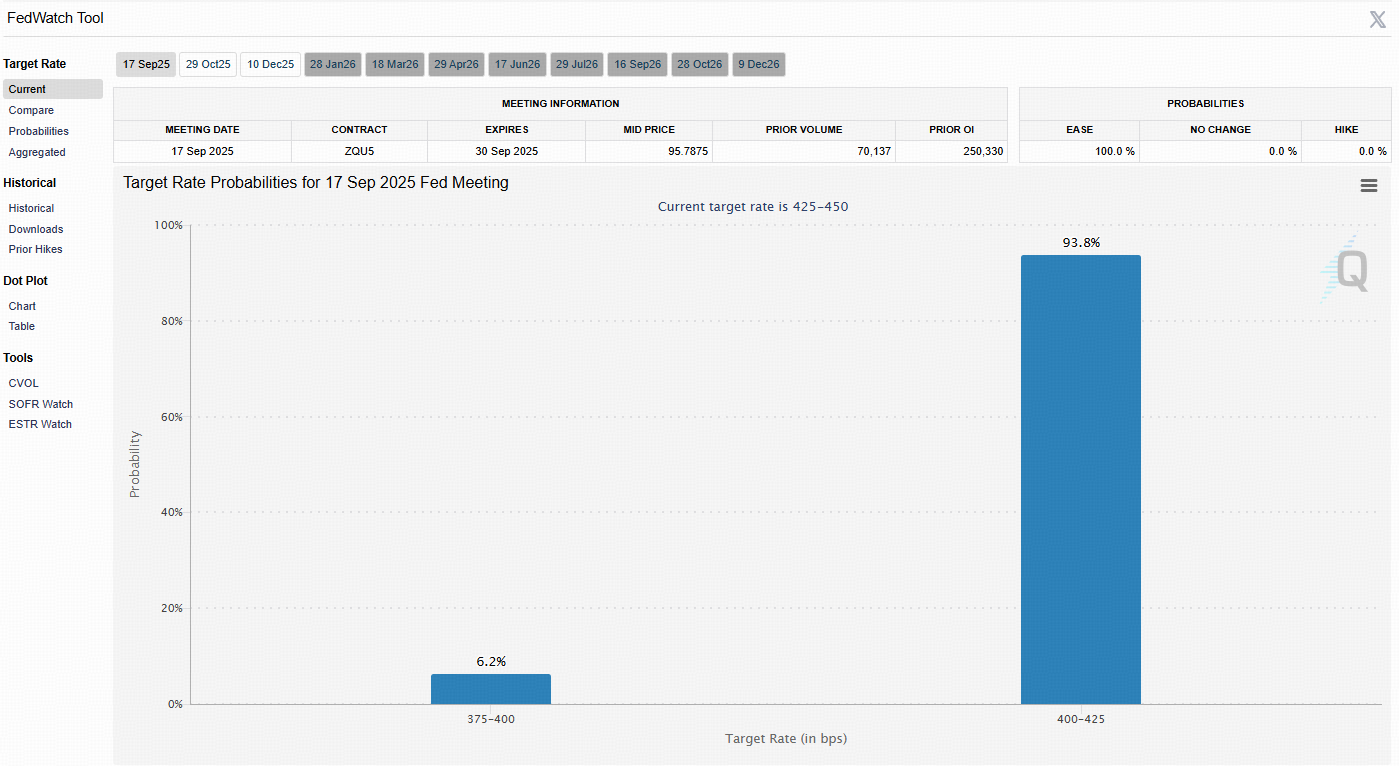

Policy heat: rate cut odds hit 100%

Treasury Secretary Bessent told media that U.S. rates should be 150–175 bps lower and hinted at a 50 bps cut in September.

CME data now prices a 100 percent chance of a September cut, with traders split on whether it’s 25 or 50 bps.

How to start trading Bitcoin

Bitcoin’s the OG—still king of the hill, still moving markets. Whether you're stacking sats or going full degen with leverage, Toobit gives you everything you need. Spot, Futures, and all the bells and whistles.

DeFi moves: a16z pushes safe harbor, BMNR and Sharplink plan $20–40B ETH grab

After halting Uniswap’s fee-switch push earlier this year, a16z and the DeFi Education Fund are now petitioning the SEC for a regulatory “safe harbor” to protect DeFi frontends from broker-dealer rules. If approved, this could be the greenlight for Uniswap’s long-awaited protocol fee switch.

I see SBET/BMNR combined buying $20-40bn of ETH in 25', most of which will be placed into onchain borrow markets, drawing stables to loop or farm

— Vance Spencer (@pythianism) August 12, 2025

This will be the most meaningful active capital injection in DeFi ever

Future of france

Elsewhere, Framework Ventures’ Vance Spencer says Bitmine and Sharplink are preparing to jointly purchase $20–40B in ETH, most of it going into on-chain lending markets to attract stables and loop yield — which would be the largest active capital injection in DeFi history.

Solana treasuries and WLFI’s power play

Solana “microstrategies” are stacking big: Upexi holds 2M SOL, DFDV holds 1.29M SOL, and Canada’s HODL has over 400K SOL (and is raising $500M via convertible notes). The Solana Foundation itself has stepped in, teaming up with MFH for a $200M credit line plus a $500M DeFi fund, for a total $700M war chest.

Meanwhile, WLFI just made one of the boldest moves of the year, swapping 7.5B WLFI tokens worth $1.5B at $0.20 each for 50 percent of ALT5 Sigma.

Co-founders Zach Witkoff and Zak Folkman told CNBC the $1.5B stake is only the opening shot. ALT5 plans to copy the MicroStrategy model by issuing preferred stock to buy more, effectively giving WLFI “infinite bullets” for expansion.

🚨 BREAKING: Trump brothers join Zach Witkoff LIVE on Fox & Friends — major announcement incoming? 👀🇺🇸 pic.twitter.com/oUDxRfeazx

— The Crypto Times (@CryptoTimes_io) August 13, 2025

Industry heat: MetaMask stablecoin, OKB overhaul

MetaMask is set to launch mUSD stablecoin this month, backed by Stripe bridges and BlackRock treasury support. OKB is ditching buyback burns, upgrading to Polygon’s latest CDK, and trying to reboot X Layer’s ecosystem — though history says their L2 traction will be an uphill climb.

Alpha watch: hedged ETH, sparks, and TGE

KOL 0xSun’s long-ETH, short-alt hedge is up 16 percent — less than ETH, but with lower drawdowns. Spark YT is offering a 4x farm. Linea is about to TGE, and Mystonks is stuck in a PR nightmare over withdrawal issues.