Markets opened steadily as BTC dominance climbed to 59.34, signaling a mild rotation back into majors.

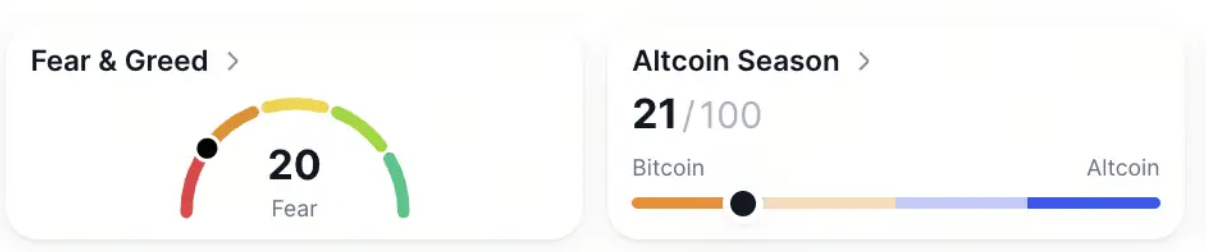

Sentiment was lifted, yet caution persists; the Fear and Greed Index moved up to 20 and the Altcoin Index sliding down slightly to 21.

Stablecoin activity continued to strengthen the near term backdrop. On November 28, total inflows reached $318.49M, led by USDC's $277.09M, which increased the circulating supply to $268.12B.

ETF flows painted a divided picture, with ETH ETFs adding $60.8M and BTC ETFs pulling in $21.1M, while SOL ETFs recorded their first outflow of the month at $8.2M, breaking their prior multi-day inflow streak on November 26.

Traditional markets

With Wall Street shut for Thanksgiving, traditional market activity was muted and major benchmarks saw a temporary pause.

-

US 10Y Treasury yield rose 0.38% to 4.01%

-

DXY edged up 0.07% to 99.60

-

Gold climbed 0.47% to $4182.21

Macro policy updates

President Trump reiterated that equity markets are positioned to continue reaching new highs. He added that expanding tariff revenue could eventually support a reduction or near removal of income taxes, sparking fresh debate around the longer term path of United States' fiscal policy.

In regulatory developments, the United Kingdom published new guidance on the tax treatment of DeFi lending and staking. Depositing assets into protocols such as Aave is not classified as a taxable disposal, which offers a clearer structure for those using digital assets as collateral to borrow stablecoins.

Industry highlights

Security concerns resurfaced after a leading Korean platform suffered a $30M breach, prompting renewed attention to operational safeguards across the sector.

A malicious Chrome extension named Crypto Copilot was found intercepting and siphoning funds from Solana transactions, according to security researchers.

HashKey's donation of HKD 10M (around $1.28M USD) to fire relief efforts in Hong Kong triggered strong backlash from HSK holders. Criticism centered on the platform’s earlier statement about operating losses, which delayed its pledged 20% profit based buyback and burn commitment, while the HSK token remains down more than 90% since listing.

Alpha watch

A prominent fund manager noted that the market bottom had already formed, and projected BTC to climb above $100K before 2025 closes, hinting at the potential for new highs. He added that artificial intelligence has become a larger economic focus, which may limit how strongly BTC can outperform wider financial markets going forward.

Concluding note

November's final stretch continues to highlight a cautious but improving landscape.

Strong stablecoin inflows and selective ETF strength provide a firmer base, even as security threats and policy shifts shape short term sentiment. Market attention now turns to whether this liquidity can build enough momentum to carry BTC out of consolidation into December.