Bitcoin dominance increased by 0.13% to 58.03%, while the Altcoin Index fell to 70, signaling weaker risk appetite across non-BTC assets.

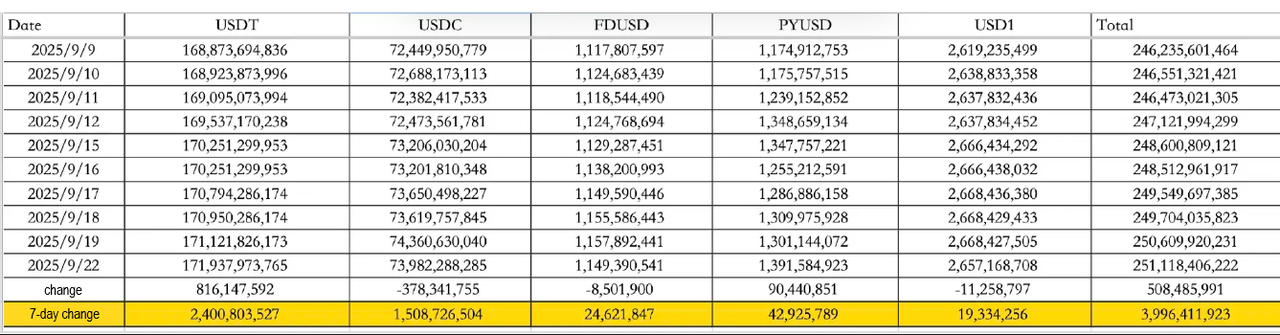

Stablecoin flows highlighted the mixed positioning: on September 20, total inflows reached $508.49M. USDT added $816.15M, offset by a $378.34M outflow from USDC, leaving overall stablecoin supply at $251.118B. For the week, inflows totaled $3.996B, marking strong demand for dollar-pegged liquidity.

Stablecoin flows highlighted the mixed positioning: on September 20, total inflows reached $508.49M. USDT added $816.15M, offset by a $378.34M outflow from USDC, leaving overall stablecoin supply at $251.118B. For the week, inflows totaled $3.996B, marking strong demand for dollar-pegged liquidity.

Institutional moves

Institutional headlines underscored the growing maturity of the crypto market. Nasdaq-listed Flora Growth Corp. raised $401M to launch its 0G treasury strategy.

Meanwhile, investment bank Jefferies compared the current stage of crypto development to the internet in 1996, noting wide growth potential still ahead.

Analysts cautioned that focusing too narrowly on Bitcoin’s price risks missing the disruptive value of blockchain technology across industries. Jefferies encouraged investors to adopt strategies similar to the early internet era, emphasizing durability and selectivity.

How to start trading Bitcoin

Bitcoin’s the OG—still king of the hill, still moving markets. Whether you're stacking sats or going full degen with leverage, Toobit gives you everything you need. Spot, Futures, and all the bells and whistles.

Industry highlights

The perpetuals market dominated attention over the weekend. Four-hour futures data from September 22 showed AVNT and Aster ranking third and fourth by trading volume, nearly matching Bitcoin contracts. Aster has already notched multiple milestones: best annualized returns, a tailwind for the perp industry, and the highest level of mentions in a short timeframe.

Arthur Hayes added to the noise, selling 96,600 HYPE tokens worth $5.1M. Just three weeks earlier, Hayes had projected HYPE could rally 126x in the coming years, highlighting the volatility of sentiment around emerging tokens.

Alpha Watch

Speculative signals continued to build:

-

One CDL presale entry of $6 now holds 1,543 tokens valued at $170.

-

Alpha players are being advised to edge up scores strategically. For example, a user at 205 points should push to 206 to secure tier upgrades.

-

The new alpha mode has proven profitable, with recent exchanges generating approximately $240 in sellable tokens.

-

River’s debut under BuildKey drew massive demand. Within two hours of launch on September 19, over $100M in BNB was deposited, setting a new record for IDO fundraising in Binance Wallet IDO history.

-

Plasma’s fixed-term finance airdrop has not yet been finalized. Support channels confirm timing is undecided, and no official update has been released. If initial public sales and airdrops align at TGE, the project could open with an estimated market cap of $950M.