Risk sentiment weakened further as the Fear and Greed Index fell to 21 and the Altcoin Index rose slightly to 22, signaling deep fear across the market.

Market structure continues to resemble early bear phase conditions, with low participation, thinning liquidity, and weak follow-through on rallies.

Capital flows continued to trend defensive, with stablecoins showing only marginal inflows while ETF demand deteriorated sharply.

On December 16, stablecoin inflows totaled $9.65M, reflecting subdued risk appetite. USDT saw $62.32M in inflows, while USDC recorded $44.96M in outflows.

Total stablecoin supply now stands at $271.28B, suggesting liquidity remains elevated but no longer accelerating.

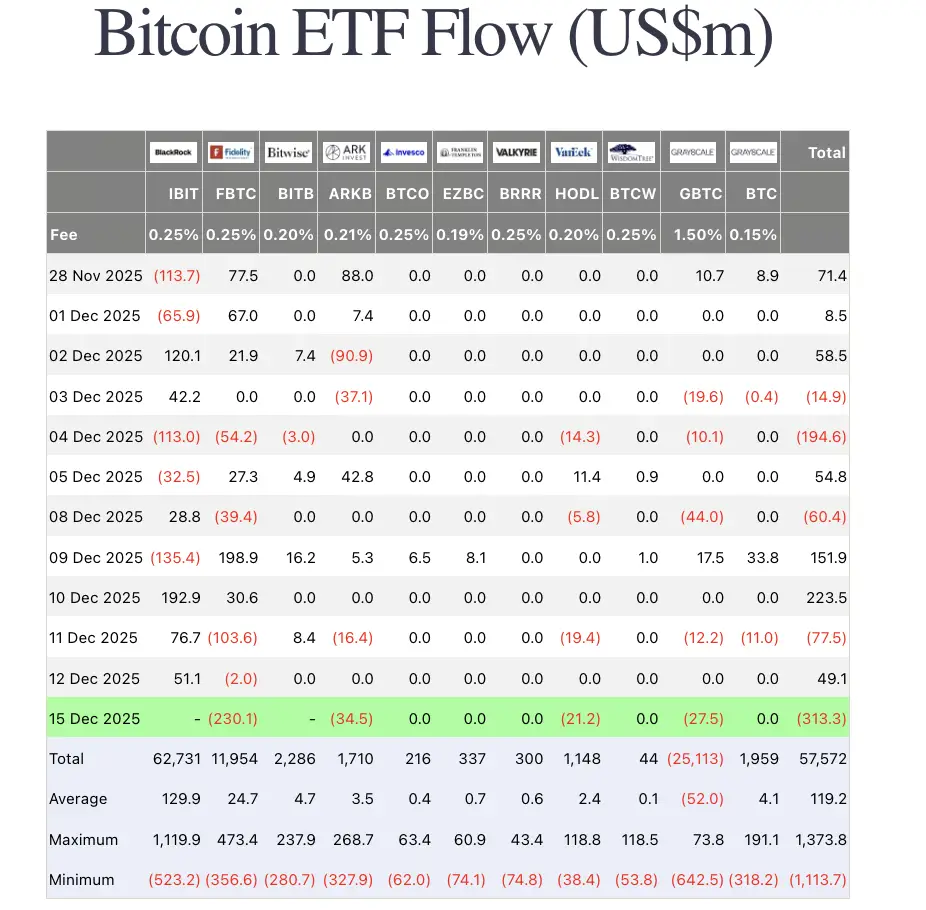

ETF demand deteriorated sharply on December 15. With no updated BlackRock data available:

-

Bitcoin ETFs recorded $313.3M in net outflows

-

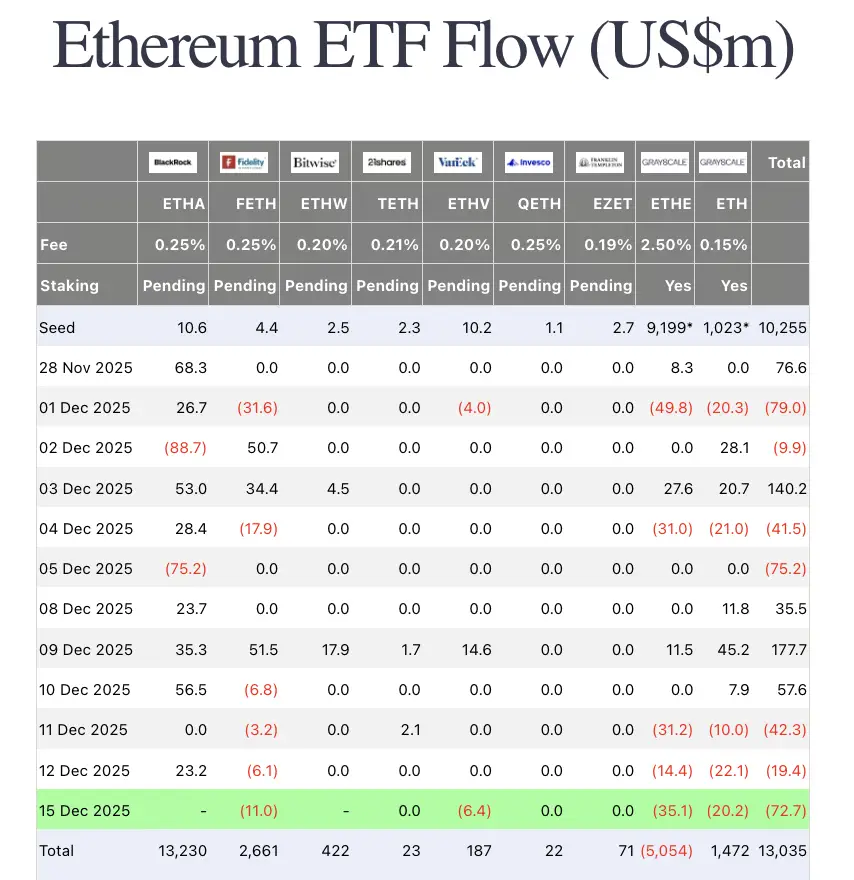

Ethereum ETFs recorded $72.7M in net outflows

The scale of outflows signals a clear slowdown in institutional demand and reinforces the broader bearish market structure.

Traditional markets

U.S. equities traded mixed as investors digested slowing liquidity conditions and fading ETF demand.

While specific index percentage changes were mixed, broader market tone leaned defensive as capital rotated away from risk assets.

The 10-year U.S. Treasury yield fell 0.24% to 4.17%, reflecting cautious positioning ahead of further macro clarity. The U.S. dollar index was unchanged at 98.25, indicating stable currency conditions despite rising uncertainty.

Gold rose 0.16% to $4,311.05, trading near historical highs and reinforcing its role as a preferred hedge amid declining risk appetite.

Macro policy updates

Hyperliquid ETF filing signals launch nearing

Bitwise submitted an amended filing for its Hyperliquid ETF, adding an 8(a) provision, a 0.67% fee, and the ticker BHYP. Historically, such amendments often indicate a product is nearing launch.

Cathie Wood's allocation framework

Cathie Wood's current positioning remains focused on three assets: Bitcoin as the institutional gateway, Ethereum as infrastructure, and Solana as the consumer application layer.

The framework reflects a layered view of crypto adoption rather than short term trading exposure.

Industry highlights

Ondo expands tokenized equities on Solana

Ondo Finance announced that its tokenized stock and ETF platform will launch on Solana in early 2026. Ondo stated that it currently operates the largest tokenized equities platform by scale and aims to bring Wall Street liquidity directly onto public blockchain infrastructure.

Circle secures U.S. banking license

Circle has officially secured a U.S. banking license, marking the first time in history that a stablecoin issuer has become a regulated bank.

This transition positions Circle as a core piece of U.S. financial infrastructure. USDC holdings are now treated as functionally equivalent to U.S. dollars for institutions, pensions, and interbank settlement.

The development represents a structural shift in how stablecoins integrate with traditional finance.

How to start trading Solana

Solana isn't just fast, it's lightning. From meme launches to serious DeFi, SOL is where the action lives. If you're ready to ride the high-speed rails, Toobit makes trading Solana simple. Spot, Futures, and the full pro toolkit are all at your fingertips.

Alpha watch

Stable project review

Analysts shared a post-mortem on recent stable-focused projects, emphasizing that returns have compressed significantly and execution risk remains high. Yield opportunities persist, but only with disciplined sizing and conservative assumptions.

Market psychology in bear phases

Veteran traders highlighted lessons learned from multiple bull and bear cycles. Key takeaways include fully exiting legacy altcoins during confirmed bear phases, avoiding emotional overtrading, and maintaining limited but consistent market awareness to prepare for the next cycle.

Grok 4.20 launch speculation

Elon Musk stated on December 7 that Grok 4.20 would launch within three to four weeks, then reaffirmed on December 10 that the release should occur within three weeks. Based on these statements, Grok 4.20 would likely launch before December 31.

However, prediction markets currently price only a 23% probability of release before year end. Traders cite holiday slowdowns and reduced engineering activity as key risks to a December launch.

Concluding note

Liquidity is thinning, ETF demand is weakening, and sentiment has shifted decisively into fear.

While long term conviction from institutions remains intact, current conditions favor capital preservation over aggressive positioning.

For now, patience matters more than prediction as the market waits for the next durable narrative to emerge.