Markets opened the day steadily as BTC market dominance inched up 0.1% to 58.56%, signaling a mild rotation back into majors even as sentiment stayed deep in extreme fear.

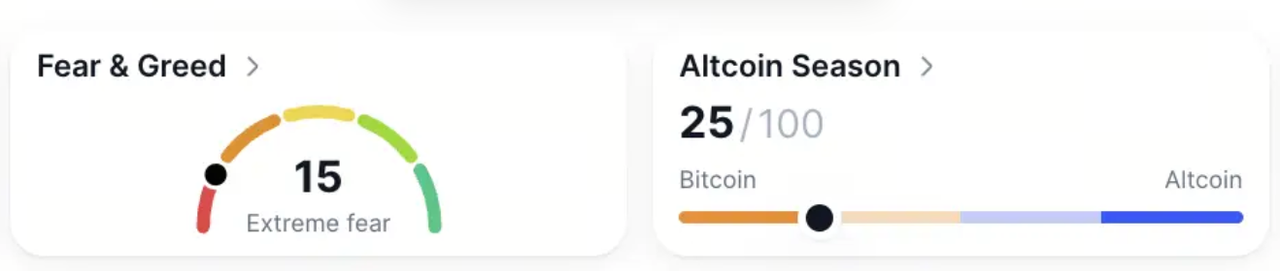

The Fear and Greed Index held at 15, unchanged from yesterday, while the Altcoin Season Index shifted slightly to 25, showing early signs of rotation beginning to build under the surface.

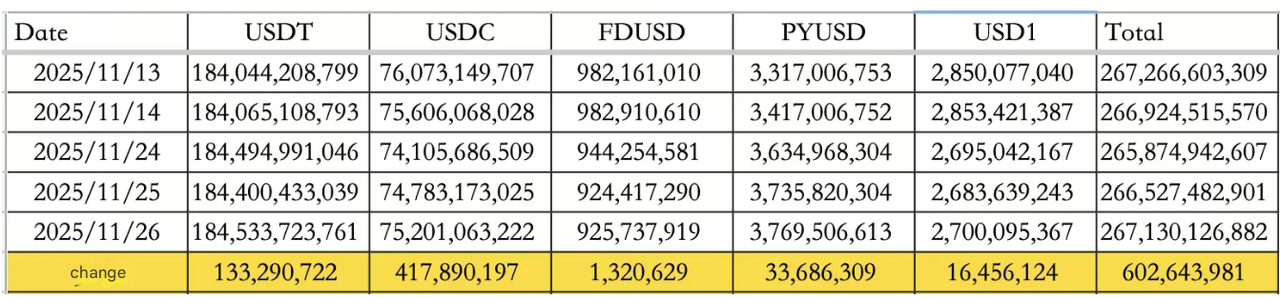

Stablecoin flows strengthened for a second session. Total inflows on November 26 reached $602.64M, with $133.29M into USDT and $417.89M into USDC, bringing circulating supply to $267.13B.

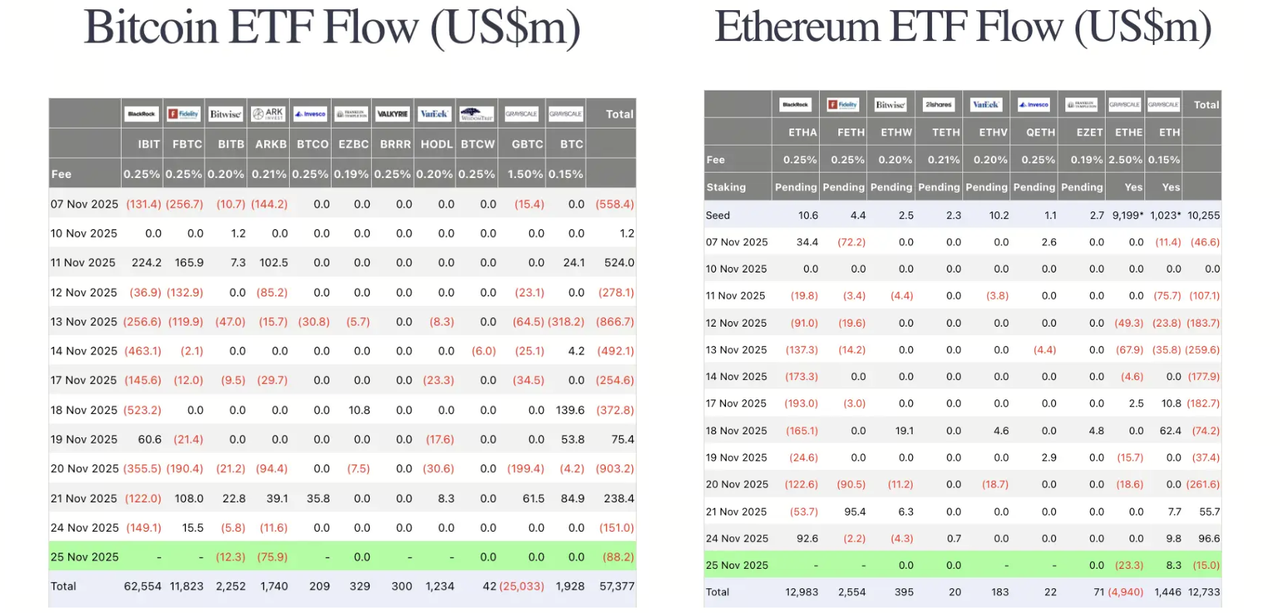

ETF flows diverged again. Based on November 24 data, BTC ETFs recorded $151M in net outflows, while ETH ETFs gained $96.6M in net inflows. SOL ETF demand remained concentrated in Bitwise's BSOL, rather than other issuers.

U.S. listed BTC spot ETFs have now recorded $3.7B in outflows for November, surpassing the previous monthly record of $3.6B set in February.

Traditional markets

Wall Street saw broad gains as risk appetite improved.

U.S. equities:

-

The Dow Jones rose 1.43%

-

The Nasdaq gained 0.67%

-

The S&P 500 added 0.91%.

Bonds and dollar: The 10 year Treasury yield fell 0.52% to 4.01%, while the U.S. Dollar Index slipped 0.36% to 99.82.

Gold: Spot gold increased 0.35% to $4145.60.

A notable mover was Nvidia, which dropped 2.59% after plunging more than 6% intraday, marking its steepest single day swing in more than seven months.

Macro policy updates

Geopolitical and policy developments shaped the broader risk backdrop.

-

Russia and Ukraine: President Zelensky noted that talks with the United States on a peace framework continue, even after reports emerged on provisional agreement terms.

-

Federal Reserve: U.S. Treasury Secretary Bessent confirmed that the Federal Reserve chair selection has moved into its second and final interview round, with five strong candidates under consideration.

-

U.S. political landscape: President Trump, despite not appearing on the midterm ballot, has taken unprecedented, early control of the Republican strategy for the 2026 elections. His heavy involvement includes making an unusually large number of early endorsements and personally urging candidates to run for or stay in specific races to minimize primary fights. The campaign is focused on the economy, centered on promoting recent tax cuts and addressing persistent voter frustration over inflation and the high cost of living.

AI investment and development:

-

Alibaba stated it will increase AI investments beyond its previously committed 380B RMB, citing overwhelming demand and tightening supply. The company does not expect an AI bubble within the next three years.

-

Meanwhile, xAI revealed details of Grok 5, a 60 trillion parameter multimodal model targeting a 2026 release, which aims to compete against top human League of Legends teams using human level reaction constraints.

Industry highlights

Sector specific catalysts shaped the day's narrative.

MON jumped above $0.047 on a major exchange, sparking debate on whether large scale projects may increasingly choose alternative launch venues instead of traditional listing paths. The development revived two concerns among:

-

Whether high profile projects may bypass conventional exchange listings.

-

Whether poor airdrop design could push future teams to abandon interactive community airdrops in favor of allocations to key opinion leaders.

A prominent whale withdrew 25.99M WLFI worth $4.18M, lifting its total holdings to 73.16M WLFI valued at roughly $11.70M.

New derivatives listings continued as another exchange confirmed ASTER perpetuals would launch on November 26, 2025.

MegaETH saw strong demand again as its $500M USDM deposit allocation sold out rapidly after a contract fix. Once reopened, the round completed in under three minutes, reinforcing the current abundance of liquidity chasing new ecosystem opportunities.

Alpha watch

Speculative flows and emerging trends accelerated across ecosystems.

Renaiss Protocol released its Da Vinci 3.0 Pokémon card pack during Closed Beta, containing PSA graded TCG cards. The pack sold out in under 90 minutes, including a PSA 10 M2 Mega Charizard worth nearly $1000.

Prediction markets recorded $2.45B in weekly notional volume, broken down as:

-

Polymarket: $986.58M

-

Opinion Labs: $818.30M

-

Kalshi: $607.97M

-

Others: $35.83M

Opinion Labs is now the second largest prediction market by volume.

On a side note, Galaxy Digital is in talks with major prediction market platforms to provide liquidity as retail participation expands and institutional interest grows.

WLFI buys SPSC: WLFI announced its purchase of Solana ecosystem meme token SPSC, which surged 43% intraday and 139.80% over 24 hours, lifting its market cap to $7.71M.

Polymarket secured approval from the U.S. Commodity Futures Trading Commission (CFTC) to offer regulated services to U.S. retail users.

Concluding note

Despite persistent fear reading, underlying flows show steady positioning.

Stablecoin inflows continue to support liquidity, ETF divergences reveal where capital is rotating, and ecosystem specific catalysts remain strong across prediction markets, meme segments, and new infrastructure launches. As macro and AI policy cues grow louder, markets appear to be setting up for another decisive shift in direction.