On January 29, 2026, the United Arab Emirates (UAE) drew a clean line between "digital assets as speculation" and "digital assets as infrastructure."

The catalyst was USDU, a U.S. dollar stablecoin launched by Universal Digital Intl Limited and described as the first USD stablecoin sanctioned and registered by the Central Bank of the UAE (CBUAE), under UAE's Payment Token Services Regulation (PTSR).

This move by UAE signals a bigger move than a mere payment token launch. It shows how a regulated market can let tokenized dollars move fast, while keeping reserves, oversight, and compliance as strict as traditional finance.

How UAE institutionalized stablecoin, USDU

The UAE's PTSR is the backbone of this significant launch: It is the UAE Central Bank's rulebook that sets licensing and operating conditions for payment token services, including issuance, conversion, custody, and transfer.

The result is a new middle ground between fully private issuers and an unregulated free-for-all. Under a payment-token framework, a stablecoin is not just a product. It becomes a supervised payment instrument with defined obligations around reserves, operations, and conduct.

That is exactly why USDU's positioning is meaningful. A regulated USD stablecoin under a central bank framework can reduce friction in cross-border settlement because the rules are clearly laid out in the PTSR:

-

Who is allowed to issue and distribute it

-

How custody and safeguarding are handled

-

Which compliance standards apply to transfers and redemption

-

What happens when something breaks

S&P Global Ratings flagged that the PTSR establishes a framework for payment tokens and has implications for how banks engage with stablecoin activity in the UAE.

Image from Toobit; simplified diagram to explain how regulated stablecoin issuance and services are structured from issuer to end users.

The deeper shift is psychological. Stablecoins stop being a workaround for slow payments and start behaving like regulated financial rails that happen to run on-chain.

How bank custody turns stablecoins into institutional rails

If regulation is the rulebook, banks are the trust engine.

One of the most telling details in USDU's launch coverage is the reserve model. Multiple reports describe USDU reserves as being held on a 1:1 basis in safeguarded onshore accounts at UAE banking partners, including Emirates NBD, Mashreq, and Mbank.

This is what "bank-grade" looks like in practice:

-

Reserves are custody-held within domestic banks rather than floating in opaque offshore structures.

-

The stablecoin becomes easier for institutions to justify using, because reserve custody aligns with familiar banking controls.

-

The jurisdiction keeps monetary and supervisory visibility closer to home.

Emirates NBD has also signaled interest in digital asset custody infrastructure in earlier initiatives, which highlights how seriously major UAE institutions are treating this category.

The takeaway is simple: Banks bring custody discipline, oversight, and operational controls, while tokenization brings speed and programmability.

When that loop closes, stablecoins stop feeling like "outside money" and start behaving like regulated payment infrastructure that institutions can actually use with confidence.

Why the UAE is executing faster than the U.S.

Stablecoins are increasingly treated as an extension of sovereign currency influence in a digital format. That is why jurisdictions are racing to define what a compliant stablecoin is, who can issue it, and how it integrates with banking.

In the U.S., stablecoin policy has moved quickly, including the GENIUS Act becoming law in 2025. But key banking questions, like deposits, rewards, and bank integration, are still being negotiated. Reuters reported late January 2026 discussions involving banks and digital asset firms aimed at resolving legislative and policy conflicts, highlighting how contested the implementation details remain.

That contrast is what makes the UAE model stand out right now. The UAE is not just setting policy. It is operationalizing it through a central-bank payment token framework, plus a reserve model anchored inside domestic banks.

Forget "pro" or "anti" stablecoins debates. The real race is who turns regulation into bank-compatible rails first.

The pragmatism of PayFi

In practical terms, PayFi is the moment when stablecoins graduate from being a trading tool to being a settlement tool.

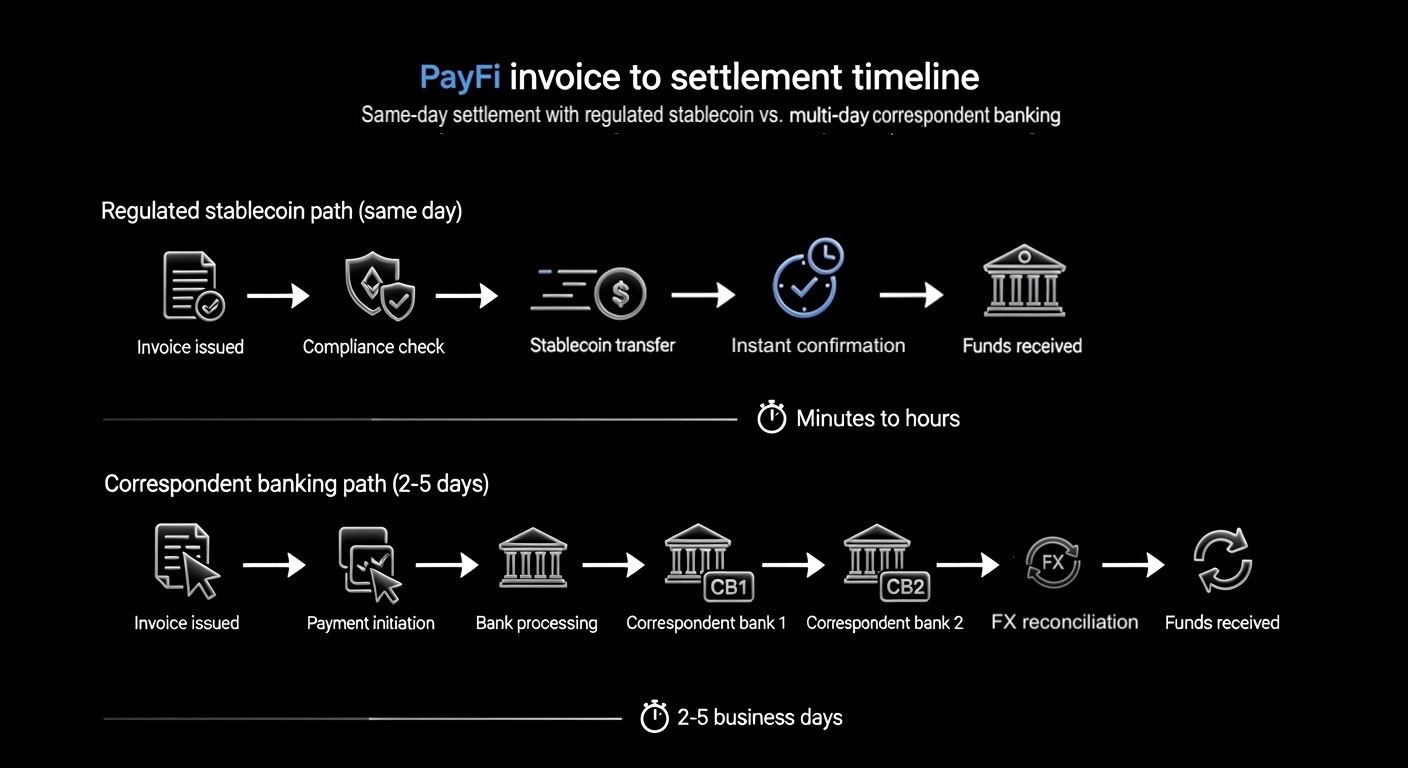

According to PwC, corporate treasury teams can use stablecoins to shorten cross-border settlement windows and move liquidity faster.

The Bank of International Settlement (BIS)'s 2025 Annual Report further elaborates that tokenized payment rails can reduce reliance on correspondent-banking chains, cutting friction for cross-border merchants. And because transfers can be programmable, compliance checks and policy limits can be validated at the moment of execution, creating a cleaner audit trail by design.

Image by Toobit; PayFi settlement timeline using regulated stablecoins vs. Multi-day correspondent banking

PayFi is a fundamental shift toward settlement that runs closer to real time, stays auditable by default, and can plug into everyday banking workflows without waiting for legacy cutoffs. In a region that already sits at the center of global trade and remittance flows, that shift can ripple outward, reshaping how banks clear and settle payments well beyond Dubai.

What this means for banks and everyday users (like you)

For institutions, a regulated stablecoin with bank-custodied reserves can lower internal resistance. The checklist becomes simpler:

-

Is the framework recognized by the central bank?

-

Are reserves clearly segregated and protected?

-

Are service providers licensed for custody and transfer?

-

Are redemption and reporting expectations defined?

For everyday users, the impact can be indirect but real. Faster settlement can mean faster access, fewer intermediaries, and lower operational costs that can eventually show up as better payment experiences.

None of this removes risk, but this move by the UAE proves that settlements with stablecoins are definitely operationalizable and auditable, through strong workflows and defined regulations.

The bottom line

USDU is not the headline. The headline is that the UAE is treating regulated stablecoins like an operating system upgrade for money, not a new asset class to debate on panels.

Over the next 12 to 24 months, the differentiator will be who turns settlement into a repeatable product. Think standardized mint and redeem cycles, predictable cutoffs that are basically always on, and compliance that runs at the transaction layer instead of as a messy afterthought.

By then, stablecoins would be seamlessly plugged into an on-chain settlement API, and everything around it, from reconciliation to reporting, gets simpler and harder to game.

In 2026, the lead story is not about whether stablecoins exist. It is about which countries turn them into safe, programmable, and scalable financial rails first.