Markets opened on a cautious note as sentiment remained deeply defensive.

The Fear and Greed Index printed 16 and stayed anchored in extreme fear, while the Altcoin Season Index sat at 25, signaling a tilt back toward majors. Bitcoin dominance edged up to 59.49%, gaining 0.12% from the day prior.

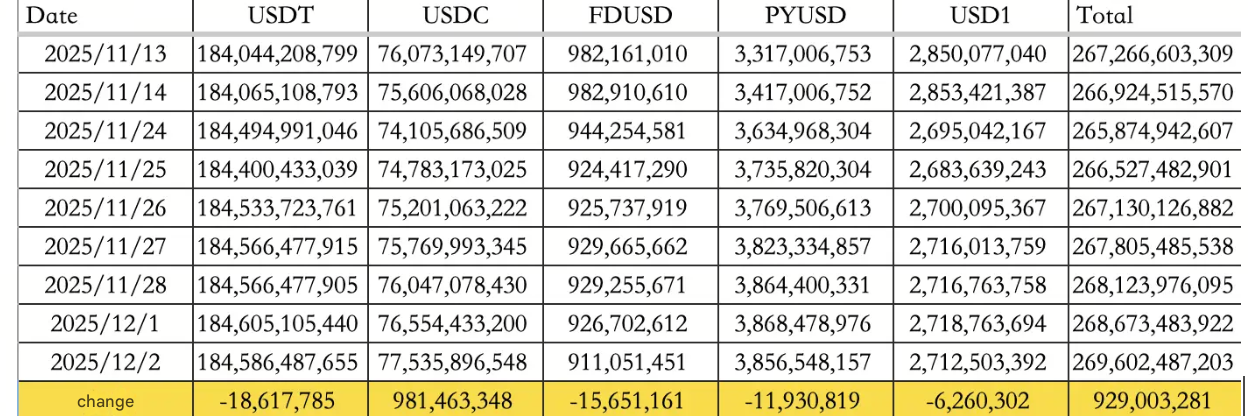

Stablecoin flows added clarity to positioning.

Total inflows on December 2 reached $929M, driven by a strong $981.46M surge in USDC supply, offsetting a $18.62M outflow from USDT. Circulating stablecoin supply now sits at $269.60B.

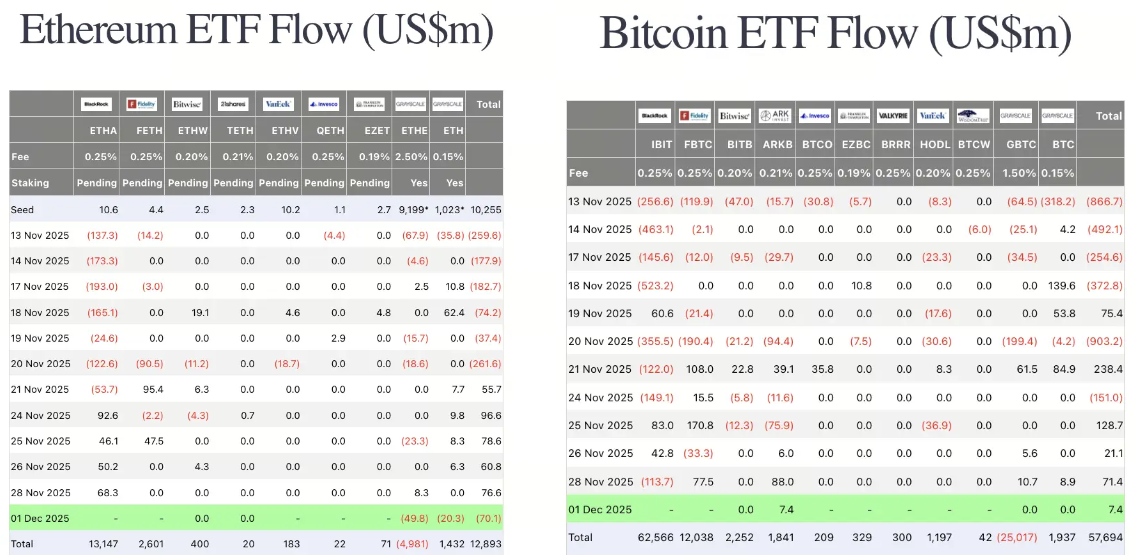

ETF flows were mixed. Ethereum ETFs saw uneven flows across issuers with notable redemptions at several large funds, while Bitcoin ETFs showed smaller directional moves but no significant inflow catalysts.

A key highlight emerged from MicroStrategy's updated liquidity framework, where the firm established a new $1.44B reserve fund designed to cover dividends and interest over the next 21 months, even under a severe Bitcoin drawdown. The company now holds 650,000 BTC at an average cost of $74,436.

Traditional markets

U.S. equities traded lower across major benchmarks:

-

The Dow Jones fell 0.90%

-

The Nasdaq slipped 0.38%

-

The S&P 500 declined 0.53%.

The 10-year Treasury yield rose 1.77% to 4.09%, while the U.S. Dollar Index moved marginally down 0.01% to 99.47.

Gold lost 0.30% to close near $4,210.03.

Macro policy updates

A major macro pivot came from the Bank of Japan.

Governor Kazuo Ueda reiterated that policymakers are evaluating the timing and tradeoffs of raising interest rates based on inflation and financial conditions. This will be the first time Japan's two year yield touches 1% since 2008, alongside the 30 year yield briefly hitting 3.395%.

The significance runs deeper than a simple rate shift. If Japan exits its long running easing era, global liquidity dynamics may turn more restrictive, weighing on risk assets into year end.

Industry highlights

Institutional activity remained lively, beginning with developments around FDUSD.

FDUSD's issuer is preparing to go public through a SPAC transaction with CSLM Digital Asset Acquisition Corp III, marking a rare move toward the public markets for a stablecoin operator.

At the same time, the whale cluster active during the post flash crash unwind has intensified positioning. The three linked addresses have now borrowed $220M USDT from Aave and transferred the funds to a major exchange, while still maintaining more than $500M in on chain assets.

Meanwhile, momentum is building in Hong Kong as HashKey Holdings completed its listing hearing, positioning it to become the first publicly traded virtual asset exchange operator in the region. Disclosures show more than HKD 1.3T in cumulative spot trading volume and HKD 29B in staked assets, underscoring the scale of its footprint.

Simultaneously, Vanguard will open access to digital asset ETFs and related funds starting tomorrow, broadening the traditional finance linkages into the sector.

Another storyline came from the GiggleFund update, which noted that the first round of GIGGLE trading fee donations and burns came in smaller than expected. Between November 1 and 29, roughly 6,837.99 GIGGLE in fees were generated, equivalent to $975,733.54. Half of the tokens were donated to Giggle Academy while the remaining half were permanently burned, tightening the available supply base.

Alpha watch

Prediction market platform Kalshi confirmed a major migration to Solana, choosing to tokenize thousands of prediction markets and enable permissionless monetization via a global liquidity pool. The move creates a direct competitive escalation with Polymarket, natively deployed on Polygon.

Beyond institutional flows, several themes continued to circulate within market discussions.

-

Assets such as ASTER, HYPE, BNB, and ONDO have emerged as potential accumulation candidates during broader downturn conditions.

-

Community commentary highlights ASTER's upcoming airdrop effects as a near term catalyst, while ONDO carries a longer term narrative around potential linkage between U.S. IPO pathways and blockchain based fundraising cycles.

Tooling also advanced, particularly across prediction markets.

-

A new automated scanner for Opinion and Polymarket allows participants to compare identical events across both venues, surfacing probability deviations, depth disparities, and potential arbitrage size in real time.

-

By setting minimum acceptable spreads and profit thresholds, the tool identifies event pairs that match the participant's preferred capital range, streamlining two sided arbitrage strategies across the sector.

Concluding note

Markets continue to grapple with tightening global liquidity signals and cautious positioning ahead of mid December policy events.

With stablecoin inflows firm and majors seeing rotational strength, price action may remain range bound until macro clarity improves. Broader flows from Japan and ETF channels will likely set the tone for the next directional push.