The Fed blinked—just not in the way markets wanted.

Instead of cutting, Powell gave us a shrug and a warning. September’s still a maybe. Inflation is sticky. And apparently, 30 to 40 percent of that stickiness is coming from tariffs, not interest rates.

So for now, we wait. But the market is already moving around him.

BTC dominance climbs again, altcoin index drags

Bitcoin dominance edged up to 61.55 percent, while the Altcoin Index slid to 37. The major caps are holding. The small caps? Still stuck in the mud.

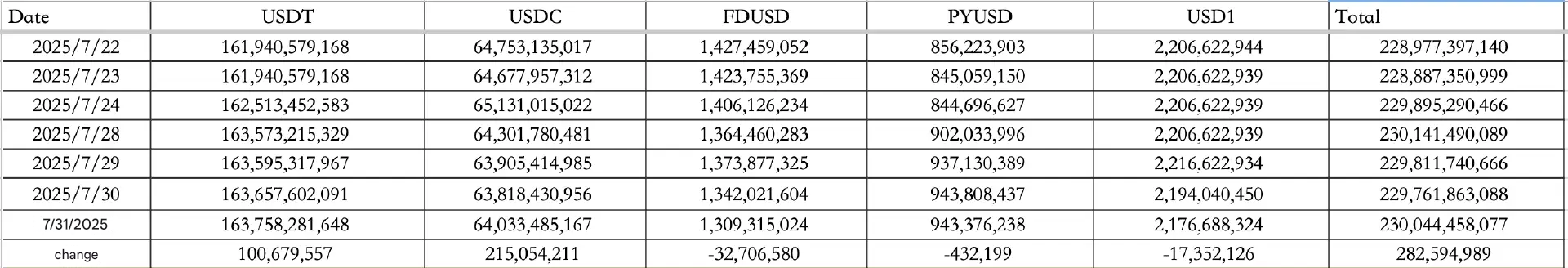

Stablecoins flowed in. USDT brought in $101M, USDC added $215M, for a total net inflow of $282M. That brings the stablecoin supply to $230B even.

ETF activity tells a similar story. On July 29, Bitcoin ETFs gained $80M, but Ethereum ETFs more than doubled that with $219M in inflows. The ETH thesis is still hot, despite the market’s hesitation.

SEC greenlights in-kind ETFs for BTC and ETH. Altcoin funds next?

Big news in ETF-land. The SEC just approved in-kind creation and redemption for Bitcoin and Ethereum ETFs—a long-awaited upgrade that brings crypto ETFs in line with how traditional commodity funds like gold operate.

What does this mean? Institutions can now swap actual BTC or ETH directly with ETF issuers, instead of settling in cash. That cuts down arbitrage friction, tightens spreads, and reduces tracking errors between the ETF and the spot price. Better execution. Higher liquidity. Fewer pricing gaps.

Even bigger? The SEC is now hinting at future in-kind approvals for altcoin ETFs. No timeline yet, but the message is clear: the framework is here, and the door is open. If Solana or other majors get the green light, expect a wave of new products and deeper institutional exposure.

How to start trading Ethereum

Ethereum’s more than just a coin, it’s an entire ecosystem. If you're ready to trade ETH like a pro (or at least fake it ‘til you make it), Toobit makes trading altcoins easy. From Spot to Futures, we’ve got the whole toolkit.

Oh, and if you start trading ETH now, you get 2.7% APR. Run, don't walk.

White House drops a report. Everyone nods.

The long-awaited White House digital asset strategy report finally dropped. It lays out a broad framework to make the U.S. a leader in crypto, tokenized finance, and blockchain development.

But in terms of actual substance? Not much. No follow-up on government Bitcoin reserves. Just a restatement of the executive order issued back in January. Still, a nod is better than a ban.

Crypto dips 3.8 percent as whales diverge

Markets pulled back 3.8 percent, reflecting a new wave of split sentiment across the majors. On one side, players like MicroStrategy and Anchorage are loading up billions. On the other, larger holders are cashing out, especially in ETH and midcap alts.

The result? A choppy, uncertain tape. Volatility is back, and positioning is everything.

Trump-backed WLFI goes deep into DeFi

Falcon Finance, a synthetic dollar protocol, just landed a $10M strategic investment from WLFI, the Trump-aligned crypto project. Falcon previously ran into trouble after a depeg scare, but has since re-pegged and now accepts USD1 as collateral. The WLFI backing gives it a fresh narrative, though some investors are still side-eyeing the volatility.

Trump crypto group offers proposals to boost digital finance https://t.co/peCqlHOUSh via @business

— Yahoo Finance (@YahooFinance) July 30, 2025

Meanwhile, Fundamental Global Inc., a Nasdaq-listed firm, is raising $200M through a stock sale to fund its Ethereum treasury strategy. Partners include Galaxy, Kraken, DCG, Kenetic, and others. Institutions are still stacking ETH even as prices consolidate.

CBOE eyes Solana ETF, Pendle expands cross-chain

The Chicago Board Options Exchange (CBOE) just filed for a universal listing standard for crypto ETPs. That would allow Solana to qualify for ETF status as early as September 17, based on its CME futures launch date. The SEC’s decision window closes October 10.

Pendle, meanwhile, is going multi-chain. It has now bridged over to HyperEVM, and its PT tokens can now be managed directly through VeloraDEX on Aave. Not headline material, but definitely something alpha traders are watching.

Alpha watch: traders pull back, ETH focus sharpens

Trader Eugene (aka 0xENAS) says he’s now mostly exited his long positions and is taking a defensive stance for August. He notes that this altcoin season might be the weakest in history, with ETH rallying but barely lifting other tokens.

His take? This rally is institutionally driven and retail still hasn't returned. As a result, there’s no trickle-down to small caps. His advice? Keep your eyes on ETH.

Elsewhere, Linea’s airdrop math continues to baffle users. Wallets with similar activity are getting drastically different LXP allocations. Seems like more than just raw numbers are at play.

Final word

The Fed held steady. Altcoins slipped. ETH is the narrative. WLFI is doubling down. And Washington is finally showing up, even if it’s just for the photo op.

August starts tomorrow. Volatility is coming. You can feel it.