Altcoin season? Still stuck in traffic.

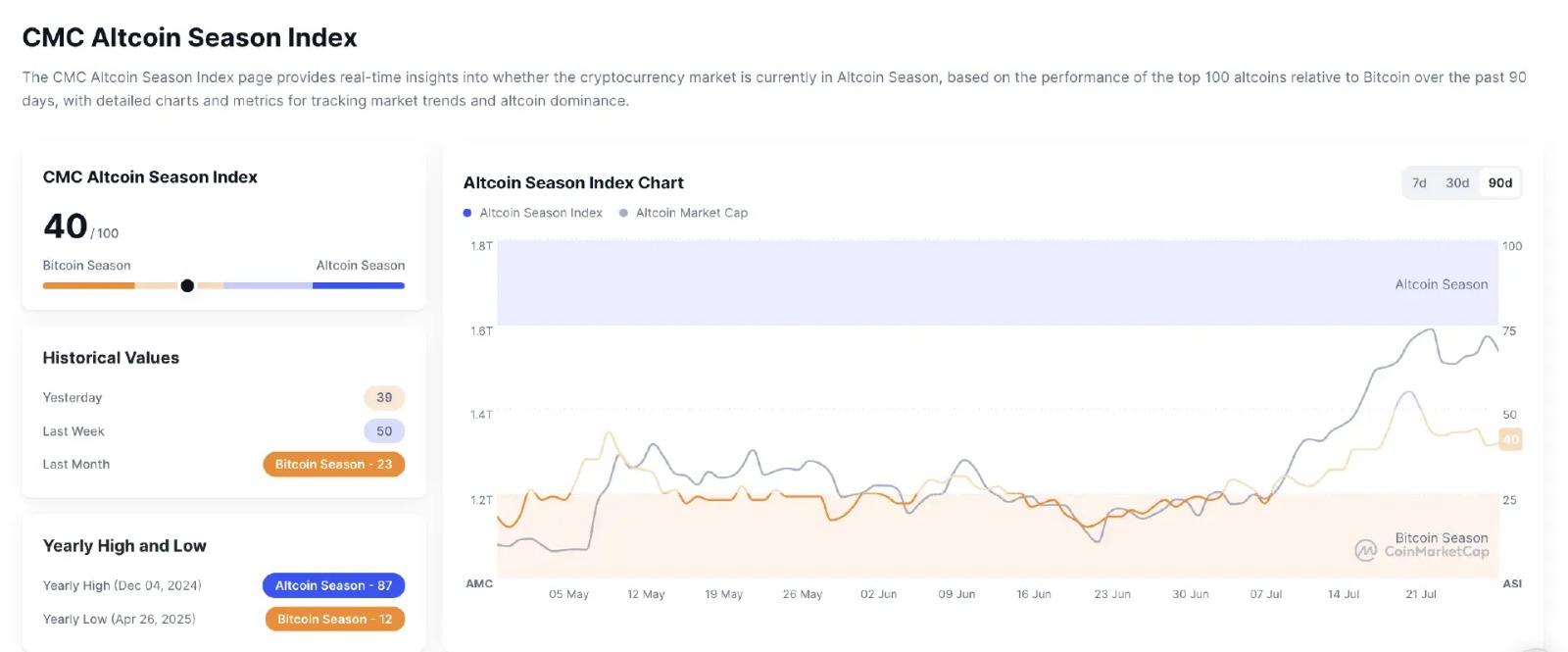

Bitcoin’s market dominance rose 0.60% to 61.40%, while the CMC Altcoin Index wobbled at 40.

It's not a collapse, but not much of a rebound either. It’s a market that’s waiting for something. And right now, that “something” might be Powell, a tariff update, or another KOL pump on a meme token.

But the big money? It’s already moving. And it's betting bullish.

DJT drops $300M on BTC exposure via options

According to Bloomberg, Trump Media Group (DJT) just lobbed $300M into call options tied to Bitcoin exposure likely spread across spot ETFs, MSTR shares, and possibly other BTC-adjacent plays. If true, the Trump family just leveraged up hard on crypto upside. And with Powell expected to announce rate decisions this week, the timing is spicy.

Bitcoin-related options trading may be the Trump family's latest path to profit https://t.co/9BqyJwNACr

— Bloomberg (@business) July 26, 2025

Meanwhile, Trump himself told reporters the Fed must cut rates. No room for ambiguity there.

How to start trading Bitcoin

Bitcoin’s the OG—still king of the hill, still moving markets. Whether you're stacking sats or going full degen with leverage, Toobit gives you everything you need. Spot, Futures, and all the bells and whistles.

Stablecoins dip, ETFs leak, and volatility whispers

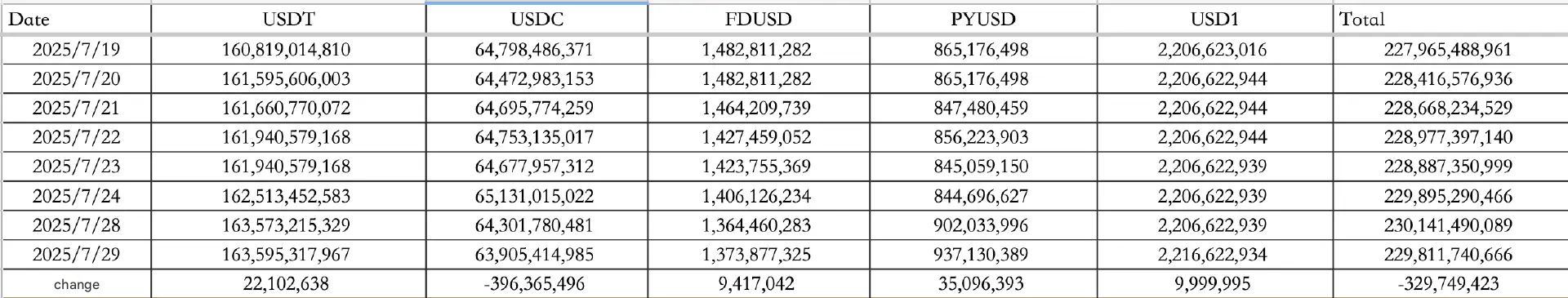

It wasn’t a strong day for liquidity. Stablecoins saw $330M in net outflows, with USDC dropping $396M and USDT barely holding the line with a $22M inflow. Total stablecoin supply sits at $229.81B, ticking down again after last week’s surge.

ETF flows followed suit. On July 28, Bitcoin ETFs (excluding BlackRock) lost $21M, while ETH ETFs shed a heftier $67M. A bit of a reversal from the previous inflow cycle. Traders might be de-risking ahead of this week’s GDP print and Fed presser.

The dollar index spiked 1.01% to 98.699, and 10Y yields ticked up to 4.408%, suggesting macro stress is back on the table. Gold? Down again. BTC? Holding steady.

Solana and BNB treasury plays go corporate

Let’s talk big plays.

ARK Invest announced it's migrating validator operations to SOL Strategies, officially leaning into its Solana infrastructure bet. Meanwhile, Upexi plans to sell up to $500M in equity to bulk up its SOL treasury a full-blown “Solana as reserve asset” push.

But the real jaw-dropper: CEA Industries (VAPE) and 10X Capital are raising $500M with an optional kicker of $750M in warrants to launch the world’s largest public BNB treasury company. They claim over 140 institutional backers including Pantera, GSR, Blockchain.com, Kenetic, and more.

And SUI? Mill City Ventures III is raising $450M to build out a SUI-focused treasury platform. Apparently, L1 treasuries are the new holding companies.

Alpha watch: Plasma FOMO, Linea cross-chain, and bounce gets real

Plasma just closed public fundraising with $373M raised, 7x oversubscribed. The mainnet beta is now going live with a wild $1B in total value locked, making it the fastest protocol in history to hit that figure. Expect every VC tweet this week to name-drop it.

Linea is hyping a “critical week” and calling for cross-chain bridging to their network. If you did earlier tasks, this is your moment to double down.

Meanwhile, Bounce Finance launched a perpetual contract platform with bounty rewards for testers and early traders. Tasks are live. Rewards are live.

So yeah, go click buttons.

Final word

Bitcoin dominance is creeping back up. ETF flows are going cold. And the Trump family just made a $300M leveraged bet on crypto upside.

The market might look quiet but beneath the surface, whales are loading, treasuries are forming, and altcoins are just biding their time.