Here's what's happening today:

Just when you thought crypto couldn’t get more bipolar, Tuesday arrives with tariffs, ETFs, and whale transfers.

Bitcoin’s dominance is back above 60%. Ethereum is swimming in institutional love. And somehow, BNB decided to break its all-time high while nobody was looking.

Let’s unpack this rollercoaster of a market day.

Bitcoin claws back dominance as altcoin heat simmers

After a week of alts stealing the spotlight, Bitcoin isn’t done fighting. BTC dominance rebounded 0.58% to 60.94%, while the Altcoin Season Index cooled slightly to 52, still above that magical 50 line that screams “copycat coins are running wild.”

Stablecoin inflows were solid: $310M added on July 22 alone, with USDT pulling $280M and USDC soaking up $57M. That’s fresh liquidity, and you can bet it’s looking for somewhere to park.

ETF limbo: Bitwise gets a nod… then a ‘maybe not’

The SEC approved Bitwise’s 10-token crypto index fund for conversion into an ETF, covering everything from BTC and ETH to XRP, SOL, and SUI. Sounds great...until you get to the fine print.

The approval is provisional. The SEC is already walking it back, citing the need for unified ETF standards—especially for “problem children” like XRP and ADA. In short: it’s a win with an asterisk the size of a bear market.

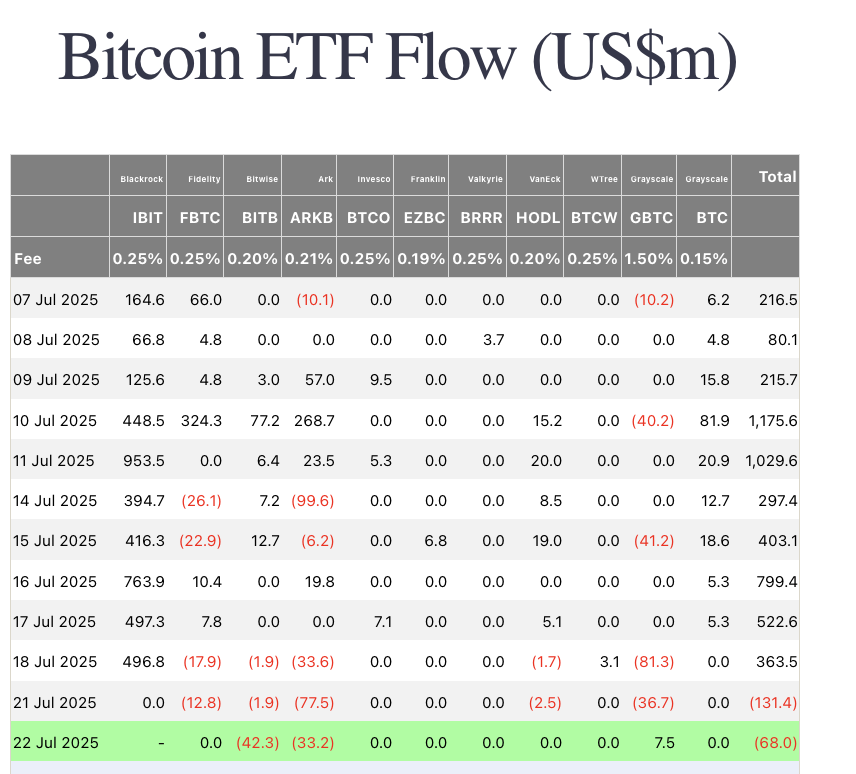

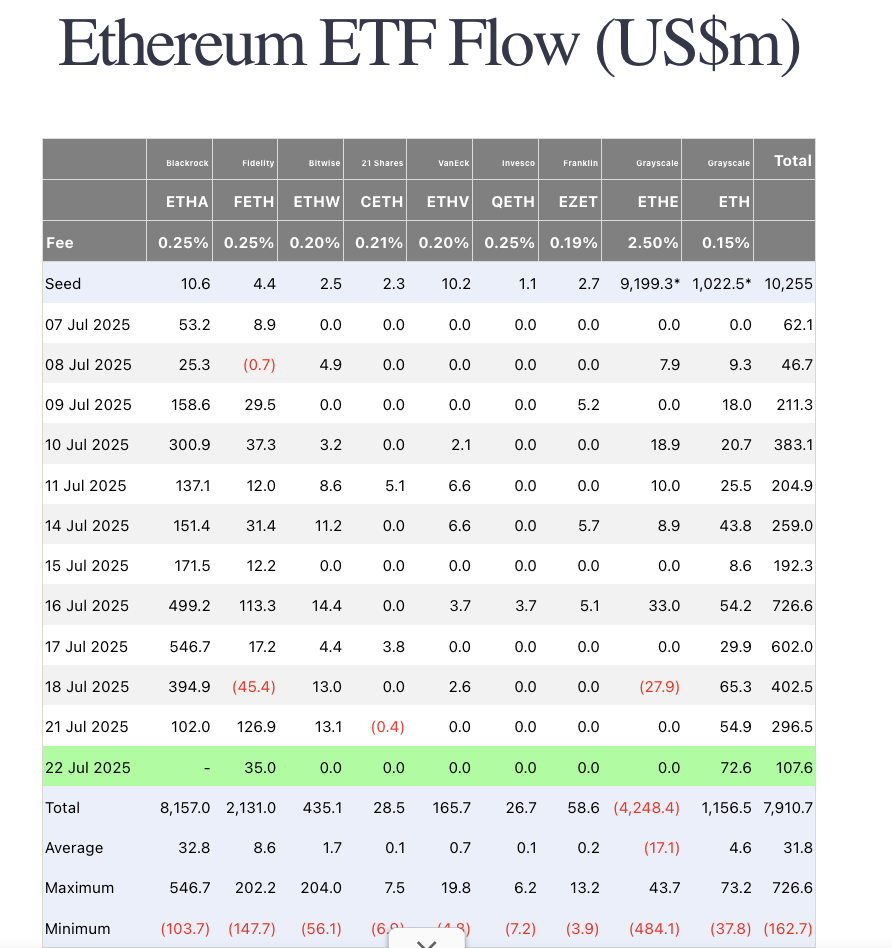

Also in ETFland: ETH products pulled $108M in inflows (again, no BlackRock data), while BTC ETFs saw $68M in outflows. Not catastrophic, but it does raise a brow or two.

How to start trading Ethereum

Ethereum’s more than just a coin, it’s an entire ecosystem. If you're ready to trade ETH like a pro (or at least fake it ‘til you make it), Toobit makes trading altcoins easy. From Spot to Futures, we’ve got the whole toolkit.

Macro madness: gold climbs, tariffs tighten, and Powell drama simmers

Gold jumped 1.03% to $3,427, inching toward all-time highs as investors hedge against the macro mess.

The U.S., Japan, and the Philippines are all playing tariff Twister. Japan’s now agreed to invest $550 billion in the U.S., and pay a reduced 15% reciprocal tariff (down from 25%).

Trump said the US and Japan have struck a deal that will lower the hefty tariffs Trump had threatened to impose on goods from its Asian ally while extracting commitments for Japan to invest $550 billion in the US and open its markets to American goods https://t.co/WvRmt7s9gl

— Reuters (@Reuters) July 23, 2025

The Philippines? They’ll cough up 19%. And yes, the hard deadline for new tariffs kicks in August 1, unless the U.S. and China manage to delay it during next week’s Stockholm showdown.

Circle also took a beating in equities, dropping 8.23%, because why not?

Ethereum whales make moves—and the numbers don’t lie

ETH is being hoarded like it’s post-apocalyptic rations.

Bitmine Immersion Tech (BMNR) is now the largest ETH-holding entity, with 300,700 ETH worth over $1.1B, having grown their stack 84.29% in 30 days. SharpLink Gaming isn’t far behind with 280,600 ETH worth $1.03B, while the Ethereum Foundation itself is slowly backing out, reducing its holdings by 8.06%.

Meanwhile, ARK Invest just threw $182M at BMNR stock—nearly all of it earmarked for ETH buys. ETH isn’t just trending. It’s institutional bait now.

Telegram just became a crypto wallet

Yep, it’s finally happened. U.S. users can now send, receive, and manage crypto directly inside Telegram, no extensions, plugins, or third-party browsers required. The TON Wallet is integrated and rolling out, letting you control your keys like a proper degen.

Welcome to 2025. The chat app just became a fintech suite.

BNB makes history and Kaito’s Launchpad goes live

BNB just broke its all-time high, surpassing its December 2024 record of $793.35. For a coin that rarely makes noise anymore, that’s a big statement. Quiet strength is still strength.

And Kaito’s first Launchpad project went live on July 23. The $ESP token is capped at a $400M FDV, with up to $100K in allocations per person. Unlocking starts after one year, because delayed gratification is still in fashion.

Just don’t be Chinese KYC, or you’re out of luck.

Alpha watch: Whales dumping PUMP, and Nasdaq altcoin fever?

On the darker side, the top $PUMP wallet, who bought 25B tokens at $0.004, just deposited 17B of them to exchanges via FalconX, worth a tidy $89.5M. They’ve still got 8B left, so if you’re holding PUMP… maybe stop.

Finally, DWF Labs’ Andrei Grachev is calling it: “Altcoin season has just begun.” He says Nasdaq-listed companies are next in line. Is it hopium? Probably. Is it working? Also yes.

Final word

Bitcoin’s back in charge (barely). Ethereum is the new whale playground. And somewhere between Telegram wallets and ETF waffling, altcoin season might’ve already started.

Time’s ticking. So are the bags.