The tide is turning, and it smells like freshly printed fiat.

The SEC just approved physical redemption for Bitcoin and Ethereum ETFs, giving institutions a direct path to swap shares for coins. At the same time, ETH whales are hoarding like it’s 2021, with 648,000 ETH quietly scooped since July 10 across multiple wallets. That’s about 2.44 billion dollars at a blended $3,445 entry.

Bitcoin dominance climbed back to 61.57 percent, while the Altcoin Index slid to 38. This week clearly belongs to the majors.

The Fed is coming

Set your clocks. On July 31 at 2 AM Beijing time, the Fed will unveil its next rate move. Markets are tense, volumes are light, and everyone’s squinting at Powell like he’s holding the cheat codes.

Investors parsing Jerome Powell’s remarks Wednesday for any hint that the Federal Reserve is moving closer to an interest-rate cut might be left wanting https://t.co/4TRamFWzST

— Bloomberg (@business) July 29, 2025

The dollar index hovers around 98.7. Ten-year yields dipped slightly to 4.328 percent. Gold is crawling back toward safety at 3,330.30 dollars. The macro fog is thick. Buckle in.

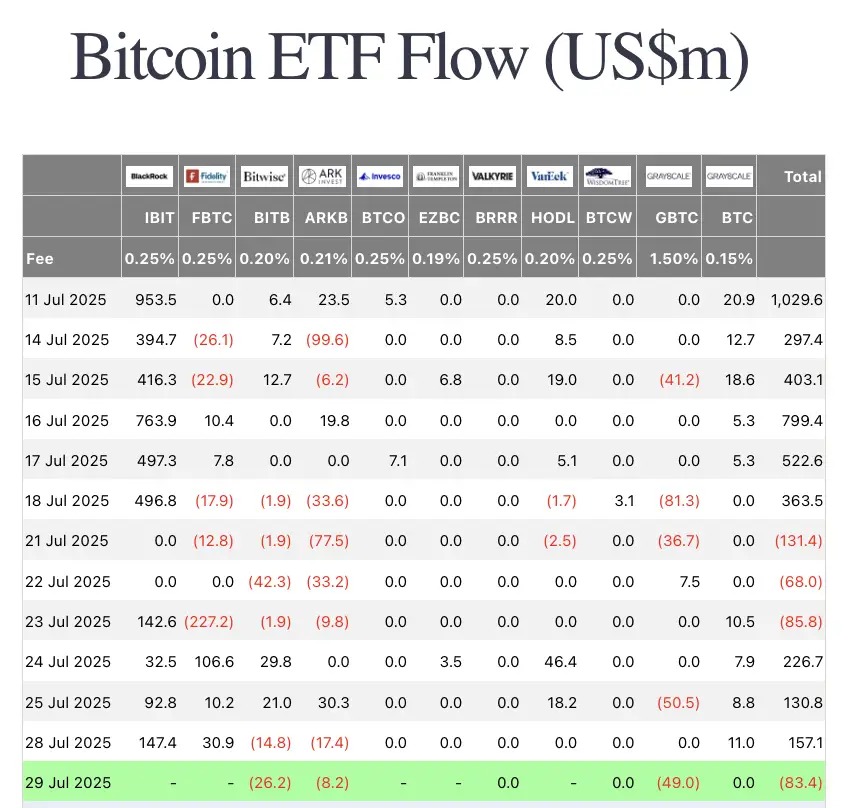

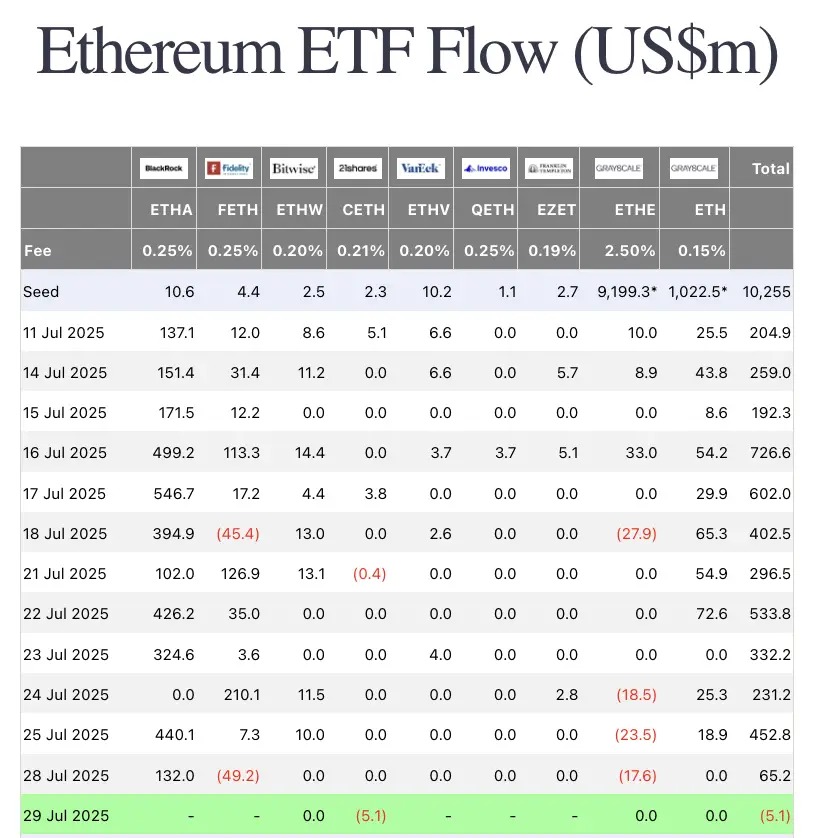

ETF flows steady, ETH stocks take a hit

On July 28, Bitcoin ETFs added 157 million dollars, while Ethereum ETFs gained 65 million. Meanwhile, USDC saw a 87 million dollar outflow, dragging stablecoin supply to 229.76 billion dollars. The rotation is cooling, but it’s not reversing.

Still, ETH stock proxies are feeling it. Bitmine Immersion and SharpLink Gaming, the two leading public ETH treasury firms, both dropped more than 8.8 percent in U.S. trading. Investors might be taking profits or hedging ahead of the Fed.

In response, Bitmine just announced a 1 billion dollar stock buyback program. It’s open-ended and ready to deploy whenever. The ETH treasury arms race is far from over.

How to start trading Ethereum

Ethereum’s more than just a coin, it’s an entire ecosystem. If you're ready to trade ETH like a pro (or at least fake it ‘til you make it), Toobit makes trading altcoins easy. From Spot to Futures, we’ve got the whole toolkit.

MetaMask enters DeFi income game

MetaMask Wallet now offers native yield on stablecoins via Aave, directly in the app. Passive income without needing a centralized exchange. That’s a DeFi UX glow-up.

Pump cranks buybacks, Treehouse drops tokens, and Linea opens the vault

Pump.fun quietly doubled its daily token buyback rate. It went from 25 percent to 100 percent of platform income, and they didn’t even issue a formal announcement. If you’ve been farming, now’s a good time to check your wallet.

Treehouse’s ETH staking program handed out 40 to 60 dollars worth of tokens for a 0.01 ETH stake. That is roughly 0.5 to 0.6 percent daily yield if you caught it early.

And Linea has published its full TGE breakdown. Twenty-two percent of tokens will unlock at launch, including 9 percent for LXP holders. A separate LXP-L drop will come later. Strategic builders and market makers also get early liquidity.

Alpha watch: ETH birthday mint, Ray Dalio flips, BNB discount event

Ethereum’s 10-year anniversary NFT is now free to mint on ethereum.org. It may be nostalgic, but onchain bragging rights never get old.

Ray Dalio, founder of Bridgewater, just said investors should put 15 percent of their portfolio in Bitcoin or gold. He cited the U.S. debt spiral and the long-term risk of currency debasement.

Final word

Physical ETF redemption is live. ETH whales are loading up. MetaMask is paying yield. Ray Dalio is hedging with Bitcoin. All just ahead of the Fed.

This week is already charged. If Powell flinches, we might just get fireworks.