Here's what's happening today:

If you’ve been waiting for TradFi and crypto to finally start fistfighting in the parking lot, congratulations—it’s happening.

On one end, the U.S. is throwing perjury charges at Jerome Powell like it’s courtroom drama night. On the other, the UK might be about to sell $7.1 billion worth of Bitcoin, which would be the most British way to crash the market since their last Prime Minister speedran a term in 45 days. And in the middle of it all? Ethereum just got a shiny legal green light.

Let’s unpack the chaos.

ETH is not a security. Let the games begin.

In a rare win for clarity, Paul Atkins, the new SEC chair, said on CNBC that Ethereum is not a security. That’s right—no vibes-based lawsuits, no regulatory limbo. It’s a clean “go” for ETH, and Wall Street heard it loud and clear.

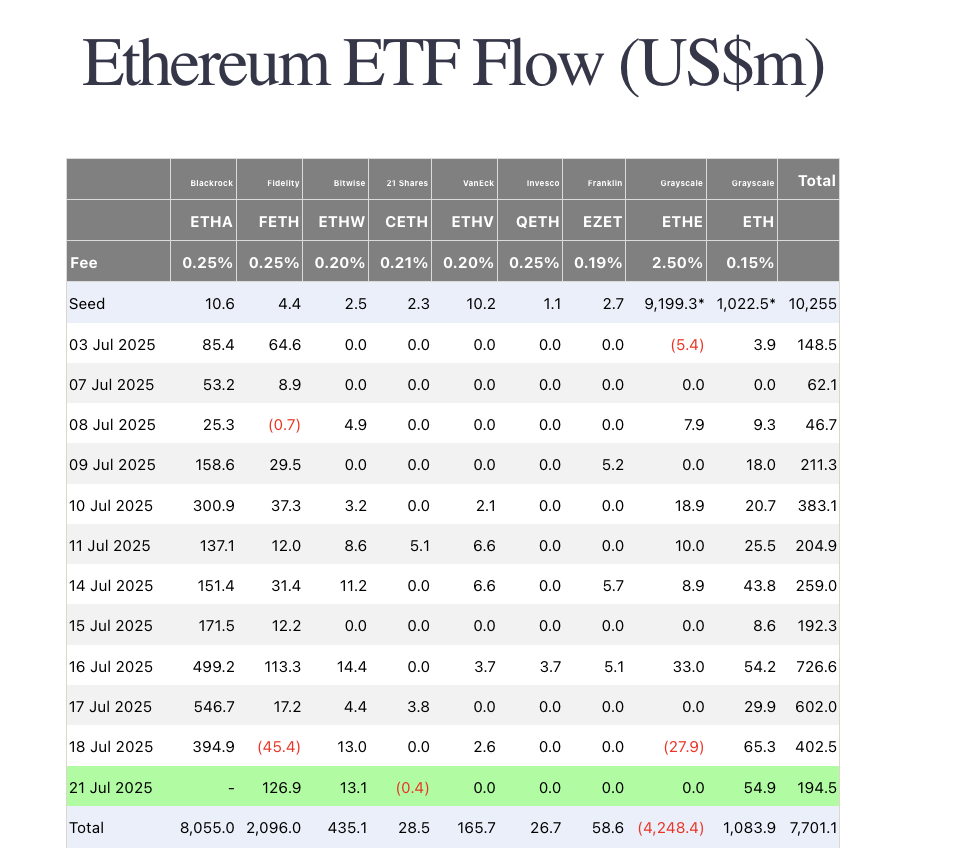

Ethereum ETF inflows didn’t just increase, they doubled. Last week saw $2.182 billion in inflows, a record high, and ETH perpetuals exploded from $18 billion to $28 billion in open interest in just seven days. If ETH were a person, it would’ve just walked into a courtroom, dropped the charges, and left with sunglasses on.

Atkins also said it’s “encouraging” to see companies using BTC and crypto as treasury assets, which is probably the closest thing to a love letter the SEC’s ever written.

How to start trading Ethereum

Ethereum’s more than just a coin, it’s an entire ecosystem. If you're ready to trade ETH like a pro (or at least fake it ‘til you make it), Toobit makes trading altcoins easy. From Spot to Futures, we’ve got the whole toolkit.

Meanwhile, the UK is selling the top (again)

Rumours are swirling that the UK government plans to offload $7.1 billion in Bitcoin to patch up a budget hole. With over 60,000 BTC in its bags, the UK is the third-largest official BTC holder—and if they start selling, expect price charts to go cliff-diving.

This wouldn’t be the first time a government-triggered fire sale tanked prices. Germany did it. Now the UK wants a turn. All eyes are on whether this dump actually happens, or if it’s just fiscal fear-mongering with extra steps.

Oh, and Powell might be in legal trouble

Because why not? U.S. Representative Anna Paulina Luna filed criminal charges against Fed Chair Jerome Powell, accusing him of perjury. The complaint stems from his June 25 testimony about the renovation of the Fed’s Eccles Building, which apparently didn’t pass the sniff test.

Perjury carries a five-year prison sentence. The White House, for its part, says Trump has “no plans” to fire Powell—though he still thinks Powell needs to cut rates ASAP. Just another day in macro hell.

Bitcoin dominance dips, stablecoins surge

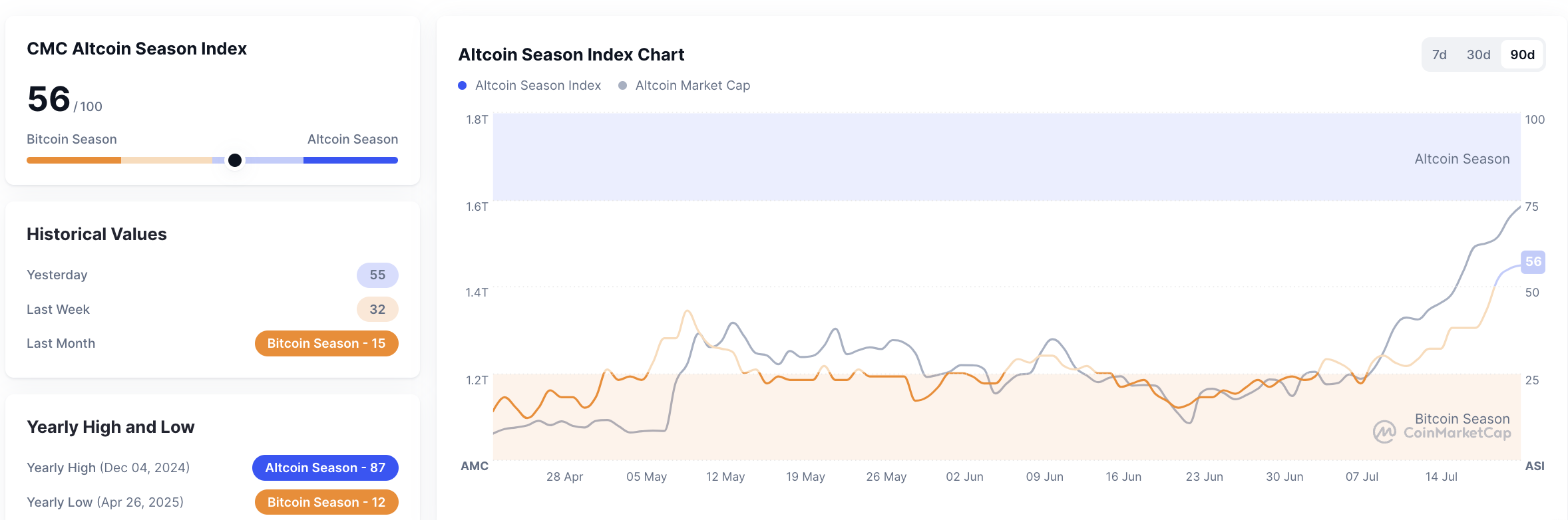

Altcoin season might actually be back. The Altcoin Seasonal Index just hit 56, its highest since last December, while Bitcoin dominance slipped to 60.57%.

At the same time, stablecoins are inflating. Over the past seven days, the total supply grew by $3.09 billion, bringing the stablecoin market cap to $228.667 billion. That’s not just spare change sloshing around—it’s dry powder waiting for a reason.

TradFi still pretending it’s chill

In traditional markets, the Nasdaq ticked up 0.38%, the S&P 500 edged 0.14% higher, and the Dow pretended to care by dropping 0.04%. Gold got a nice boost, jumping 1.41% to $3,394.77—probably because everyone’s starting to sweat about the fiscal circus.

Meanwhile, 10-year U.S. Treasury yields fell 0.90% to 4.37%, dipping below the 200-day moving average. The dollar index dropped to 97.90. Inflation's taking a breather, but the macro theatre is very much alive.

Alpha watch: Solana whales, ETH surges, and a DEX with actual vibes

Solana's having a main character moment. DeFi Development Corp scooped up 141,383 SOL, bringing their total to a crisp 999,999 SOL. No, really. That’s their number. Somewhere, a dev is crying tears of symmetry.

Upexi also got in on the fun, adding 100,000 SOL for $17.7 million. Their total holdings now sit at 1.818 million SOL, worth $331 million, with $58 million in floating gains. The Solana treasury narrative? It’s real, and it’s snowballing.

MFH threw down too, securing a $200 million equity credit deal with Solana Ventures to roll out their own treasury strategy. MicroStrategy walked so Solana could sprint.

Back on the Ethereum side, ETF inflows are breaking records, and ETH’s open interest is soaring. If you’re not long, you're probably late.

On the DeFi frontier, Etherex just launched. A collaboration between Linea, Consensys, and Nile, it's a fully on-chain DEX built on Ramses v3. They’re rolling out “x33 tokenomics” (because naming conventions are dead) and rewarding LPs with REX tokens. Convert those into xREX to vote on your favourite pools and pretend you’re part of governance. It’s nerdy, but profitable.

And in spicy CEO takes: Kraken’s chief just called Bitcoin a meme. We’re not sure if he meant it as a compliment or a roast, but runes bags definitely felt that.

Final word

Altcoin season is stirring. Ethereum just got its hall pass. Bitcoin might get dumped by an entire nation-state. And whales are playing musical chairs with treasuries.

If this is just Tuesday, we can’t wait for Friday.