Here's what's happening today:

If you were hoping for a Friday breather, too bad! Markets came out swinging.

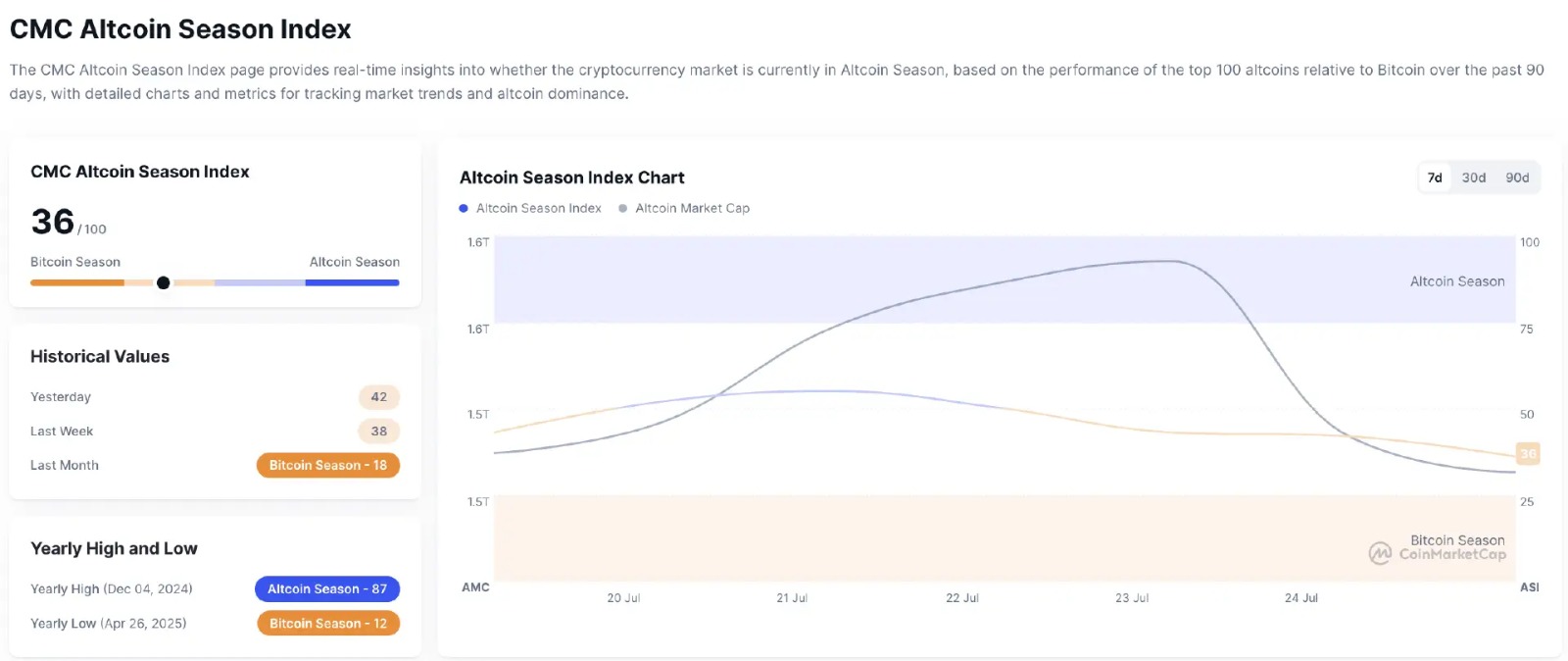

The Altcoin Index plummeted to 36, BTC dominance barely budged, and stablecoin whales just poured in $1B+.

Ethereum is once again in the spotlight, thanks to ETF demand and a surprise shout-out from the Trump dynasty.

Meanwhile, Solana’s pitching itself as the future of internet finance, and Elon wants to resurrect Vine with AI. You can’t make this up.

BTC steady, alts fall further, but stables flood in

Bitcoin’s market dominance dipped just slightly to 61.84%, while the CMC Altcoin Index dropped hard to 36, deep into risk-off territory.

That confirms the post-altseason cooling phase. Alts are still bleeding, and the easy rotations are done...for now.

But check this: stablecoins saw a net inflow of $1.007B, with USDT adding $573M and USDC gaining $453M. Total stablecoin supply is now back to $229.9B. That’s serious firepower re-entering the system; quiet, steady, and ready to pounce.

ETH ETF flows, validator stacks, and a wild Trump moment

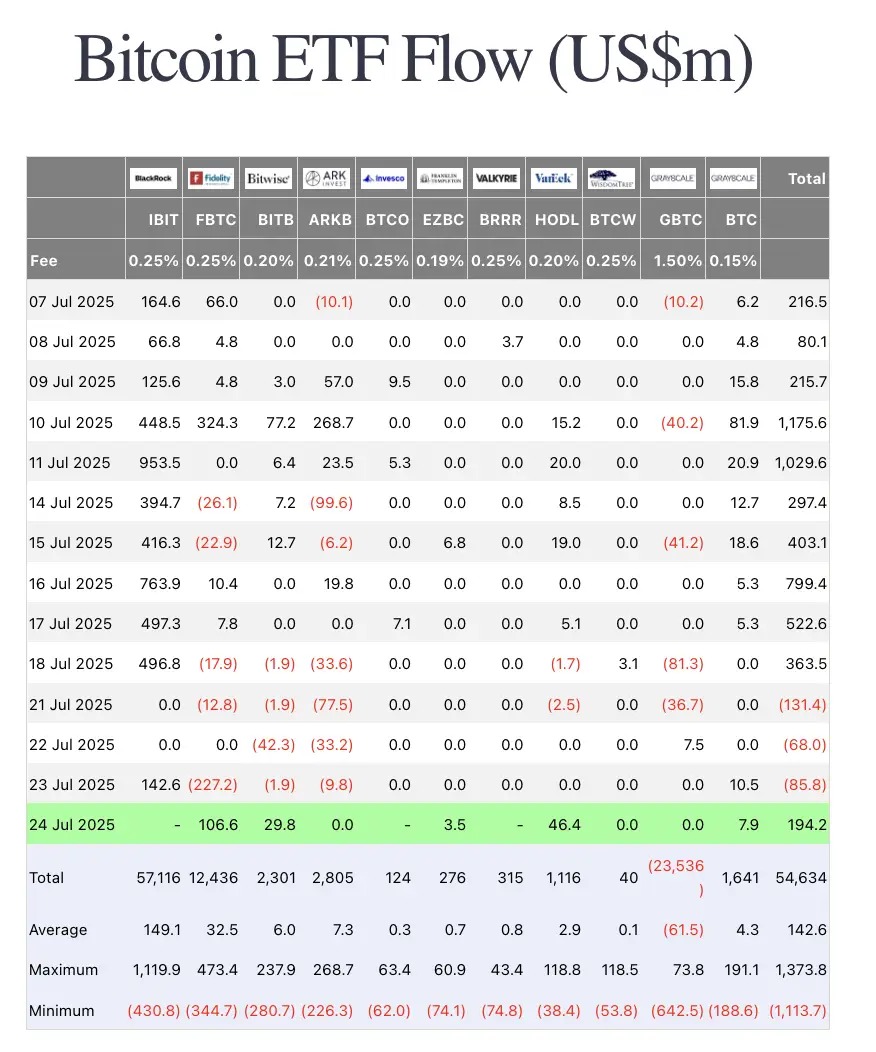

Ethereum pulled in $231M in ETF inflows on the 24th, outpacing BTC’s $194M. That kind of institutional appetite usually signals one thing: accumulation season.

And accumulate they did.

Bitmine (BMNR) now holds 566,800 ETH, worth over $2.1B, with a +247% increase in 30 days. SharpLink Gaming (SBET) holds 360,800 ETH, worth $1.35B, up 91% in the same period. Even ETPs and listed companies have added 2.83M ETH since mid-May.

Adding to the hype, Eric Trump just endorsed Ethereum on social media. He reposted a chart claiming ETH is chasing global liquidity and should be valued above $8,000, calling it “the most undervalued trade opportunity” and adding: “I completely agree.”

So now ETH has Powell, ETFs, and Trump’s second-born backing it. Sure, why not.

How to start trading Ethereum

Ethereum’s more than just a coin, it’s an entire ecosystem. If you're ready to trade ETH like a pro (or at least fake it ‘til you make it), Toobit makes trading altcoins easy. From Spot to Futures, we’ve got the whole toolkit.

Trump slaps Powell’s back and smiles

In a rare appearance, President Trump visited the Federal Reserve HQ and shared the stage with Jerome Powell. When asked about their history, Trump smiled, patted Powell’s back, and said, “I want him to cut rates.” Powell smiled. Awkwardly.

Markets shrugged, but the message is clear: pressure is mounting. Especially with Tesla missing earnings and falling 8.2%, dragging tech with it.

Meanwhile, Trump went on to dismiss rumours he’d cut Musk’s subsidies, saying: “The better they do, the better America does.” Not exactly policy, but it’s bullish for anyone riding the AI bubble.

Pump fumbles, Solana moon-plans, and Vine makes a comeback?

PumpFun’s fully diluted valuation dropped below $2.6B, down from a $4B fundraising cost. That’s a reality check. Meanwhile, BonkFun remains quiet after reclaiming top market share earlier this week.

On the big-chain end, Solana dropped a roadmap dubbed the “Internet Capital Market.” It focuses on app-level execution, low latency, and privacy-preserving trades, designed to bring high-frequency trading (HFT) to DeFi. The community's already frothing over Jito BAM, a new MEV component launching end of July.

Solana devs are also proposing a 66% increase to block capacity, boosting compute units per block from 60M to 100M. If approved, this could attract quant firms, MM strategies, and even challenge CEX liquidity dominance. The mid-term goal? 150ms finality and CLOB-powered DEX domination.

Vine’s also back...apparently. Elon Musk says he’ll revive it using AI, which caused an immediate spike in Vine-related tokens. Because of course it did.

Alpha watch: Solana pump fuel, Circle’s new stablecoin, and GPT-5 looming

The Solana alpha narrative is gaining steam. JitoSOL was just added to REX-Osprey’s SSK ETF, which tracks Solana staking derivatives, adding more credibility to DeFi-native yield assets.

At the same time, Circle is launching USYC, a yield-bearing stablecoin backed by U.S. treasuries, natively on BNB Chain. That’s a direct shot at DeFi money markets and could become a serious player for passive income chasers.

Also worth noting: OpenAI is preparing to release GPT-5 in August, which may kickstart a new AI token frenzy. You’ve been warned.

Final word

ETH is getting bullish. BTC is holding court. And alts? They’re still sliding.

But stablecoins are flowing, Solana’s building like it’s 2021, and even Vine is apparently having a Lazarus moment. Welcome to Friday. Everything’s broken and somehow, that’s bullish.